Region:Asia

Author(s):Rebecca

Product Code:KRAC2600

Pages:84

Published On:October 2025

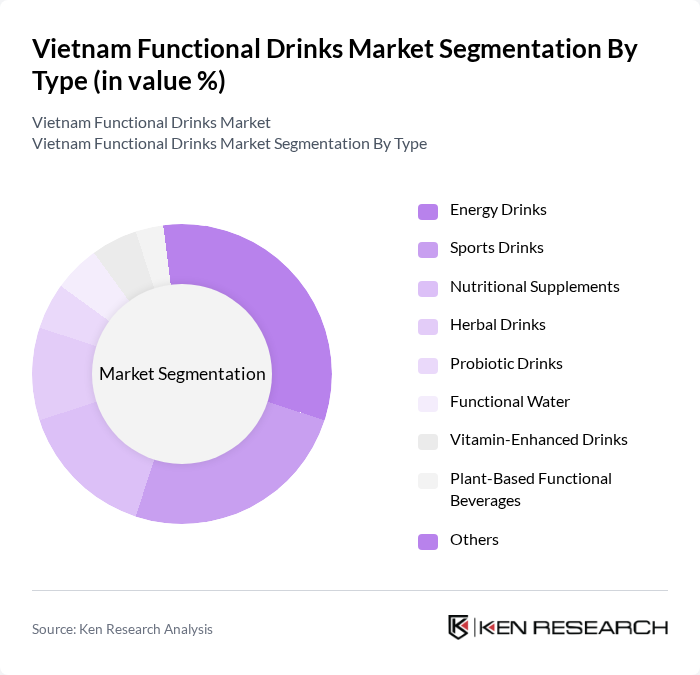

By Type:The functional drinks market can be segmented into various types, including energy drinks, sports drinks, nutritional supplements, herbal drinks, probiotic drinks, functional water, vitamin-enhanced drinks, plant-based functional beverages, and others. Among these, energy drinks and sports drinks are particularly popular due to the increasing demand for products that enhance physical performance and provide quick energy boosts. The trend towards healthier lifestyles has also led to a rise in the consumption of herbal and probiotic drinks, which are perceived as beneficial for overall health. Manufacturers are innovating with new flavors, functional ingredients, and packaging to meet evolving consumer preferences .

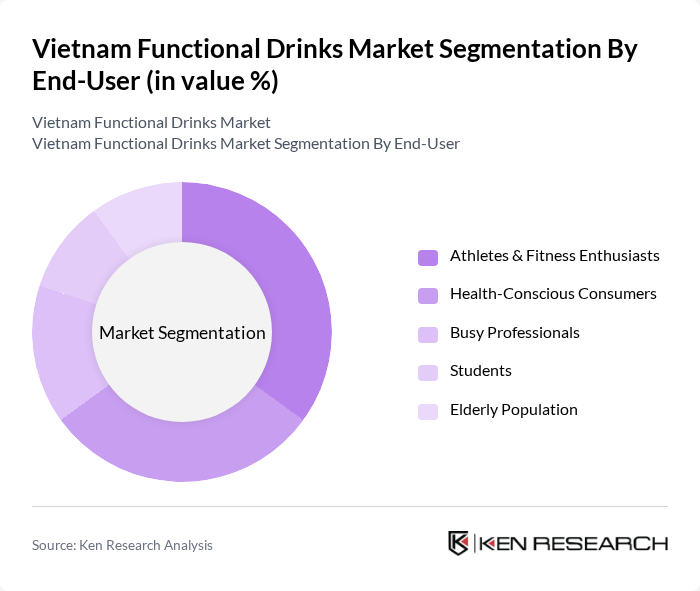

By End-User:The end-user segmentation includes athletes and fitness enthusiasts, health-conscious consumers, busy professionals, students, and the elderly population. Athletes and fitness enthusiasts represent a significant portion of the market, driven by their need for hydration and energy replenishment. Health-conscious consumers are increasingly opting for functional drinks that offer health benefits, while busy professionals seek convenient options that fit their fast-paced lifestyles. The elderly population is also becoming more aware of the health benefits of functional drinks, contributing to market growth. Urban millennials and Gen Z consumers are especially responsive to product claims around reduced sugar, herbal extracts, and cognitive support .

The Vietnam Functional Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as TH True Milk, Nutifood Nutrition Food Joint Stock Company, Red Bull Vietnam Co., Ltd., PepsiCo Vietnam Beverage Co., Ltd., Coca-Cola Beverages Vietnam Ltd., Universal Robina Corporation (URC) Vietnam Co., Ltd., FrieslandCampina Vietnam, Suntory PepsiCo Vietnam Beverage Co., Ltd., Herbalife Vietnam Co., Ltd., Ovaltine Vietnam (Mondelez Kinh Do Vietnam), Nestlé Vietnam Ltd., Vinasoy (Vietnam Soya Products Company), La Vie Vietnam (Nestlé Waters Vietnam Ltd.), Nutricare Vietnam, FPT Food Processing Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam functional drinks market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, brands are likely to innovate with new formulations and ingredients. Additionally, the integration of digital marketing strategies will enhance consumer engagement, allowing brands to reach a broader audience. The focus on sustainability will also shape product development, as consumers increasingly favor eco-friendly packaging and natural ingredients, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Energy Drinks Sports Drinks Nutritional Supplements Herbal Drinks Probiotic Drinks Functional Water Vitamin-Enhanced Drinks Plant-Based Functional Beverages Others |

| By End-User | Athletes & Fitness Enthusiasts Health-Conscious Consumers Busy Professionals Students Elderly Population |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Health & Specialty Stores Pharmacies/Drugstores |

| By Packaging Type | Bottles Cans Tetra Packs Sachets |

| By Price Range | Economy Mid-Range Premium |

| By Ingredient Type | Natural Ingredients Artificial Ingredients Organic Ingredients |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Functional Drinks | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Functional Beverage Sales | 80 | Store Managers, Beverage Category Buyers |

| Distribution Channels for Functional Drinks | 60 | Distributors, Wholesalers, Retail Chain Executives |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Health and Wellness Influencer Perspectives | 40 | Nutritionists, Fitness Trainers, Wellness Coaches |

The Vietnam Functional Drinks Market is valued at approximately USD 575 million, reflecting significant growth driven by increasing health consciousness, urbanization, and diverse product offerings that cater to consumer demands for health benefits beyond basic nutrition.