Region:Asia

Author(s):Shubham

Product Code:KRAD5444

Pages:88

Published On:December 2025

Market.png)

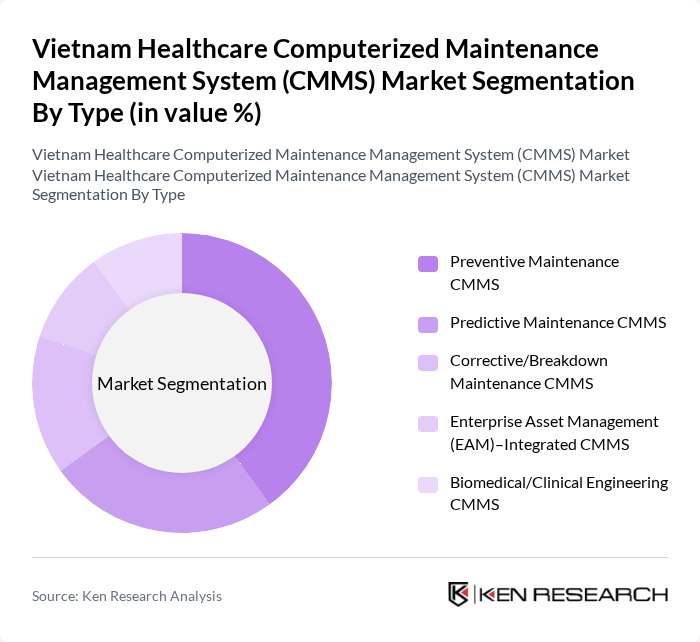

By Type:The market is segmented into various types of CMMS solutions, including Preventive Maintenance CMMS, Predictive Maintenance CMMS, Corrective/Breakdown Maintenance CMMS, Enterprise Asset Management (EAM)–Integrated CMMS, and Biomedical/Clinical Engineering CMMS. Among these, Preventive Maintenance CMMS is the most widely adopted due to its ability to reduce downtime and extend the lifespan of medical equipment. The increasing focus on proactive maintenance strategies in healthcare facilities drives the demand for this sub-segment.

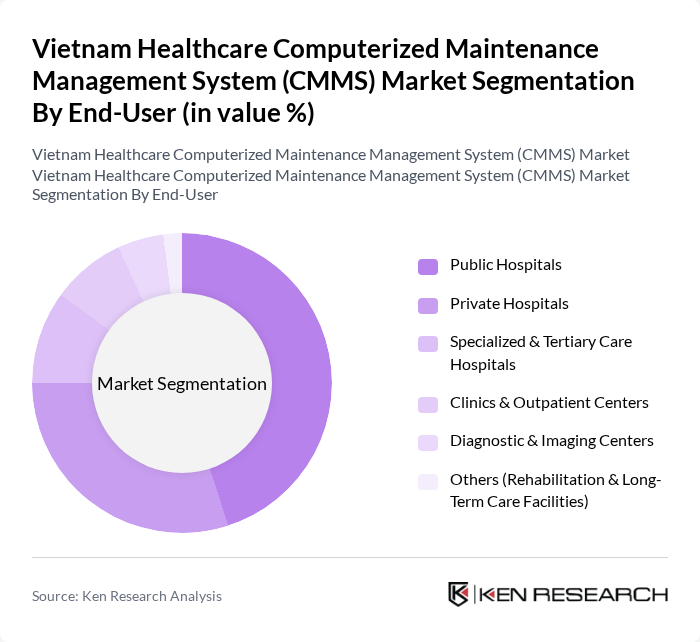

By End-User:The end-user segmentation includes Public Hospitals, Private Hospitals, Specialized & Tertiary Care Hospitals, Clinics & Outpatient Centers, Diagnostic & Imaging Centers, and Others (Rehabilitation & Long-Term Care Facilities). Public Hospitals are the leading end-users of CMMS solutions, driven by government regulations and the need for efficient management of public healthcare resources. The increasing patient load and the necessity for compliance with safety standards further enhance the demand for CMMS in this segment.

The Vietnam Healthcare Computerized Maintenance Management System (CMMS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Maximo Application Suite, SAP EAM (SAP SE), Oracle Enterprise Asset Management (Oracle Corporation), Infor EAM (Infor, Inc.), Siemens Healthineers AG, GE HealthCare Technologies Inc., FPT Information System (FPT IS), Viettel Solutions (Viettel Group), Vingroup JSC – VinBrain / VinMec Digital Health, BMS Vietnam Co., Ltd. (BMS Vietnam Healthcare), eMaint CMMS (Fluke Corporation), Maintenance Connection (Accruent, LLC), UpKeep Technologies, Inc., Dude Solutions (Brightly Software, Inc.), Fiix Software (Rockwell Automation, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam healthcare CMMS market appears promising, driven by ongoing investments in digital health solutions and a growing emphasis on operational efficiency. As healthcare facilities increasingly adopt cloud-based systems, the integration of IoT devices will enhance predictive maintenance capabilities. Furthermore, the government's support for healthcare digitization will likely foster a more conducive environment for CMMS adoption, ultimately improving service delivery and patient outcomes across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Preventive Maintenance CMMS Predictive Maintenance CMMS Corrective/Breakdown Maintenance CMMS Enterprise Asset Management (EAM)–Integrated CMMS Biomedical/Clinical Engineering CMMS |

| By End-User | Public Hospitals Private Hospitals Specialized & Tertiary Care Hospitals Clinics & Outpatient Centers Diagnostic & Imaging Centers Others (Rehabilitation & Long?Term Care Facilities) |

| By Deployment Model | On-Premise Cloud-Based (SaaS) Hybrid Hosted/Managed Service |

| By Functionality | Work Order & Task Management Asset & Equipment Lifecycle Management Spare Parts & Inventory Management Maintenance Planning & Scheduling Compliance, Documentation & Audit Trails Analytics, Dashboards & Reporting |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Mekong Delta & Other Regions |

| By Customer Size | Large Hospital Networks & Health Systems Single Hospitals & Medium-Sized Providers Small Clinics & Diagnostic Centers Others (NGOs, Military & University Hospitals) |

| By Pricing Model | Subscription-Based (Per User / Per Facility) One-Time Perpetual License Pay-Per-Use / Transaction-Based Enterprise/Custom Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospitals | 100 | IT Managers, Facility Administrators |

| Private Clinics | 80 | Healthcare Practitioners, Office Managers |

| Healthcare IT Vendors | 60 | Sales Directors, Product Managers |

| Healthcare Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Healthcare Consultants | 70 | Consultants, Market Analysts |

The Vietnam Healthcare Computerized Maintenance Management System (CMMS) market is valued at approximately USD 12 million, reflecting a growing demand for efficient asset management in healthcare facilities and the adoption of digital solutions to enhance operational efficiency.