Region:Asia

Author(s):Geetanshi

Product Code:KRAA8016

Pages:99

Published On:September 2025

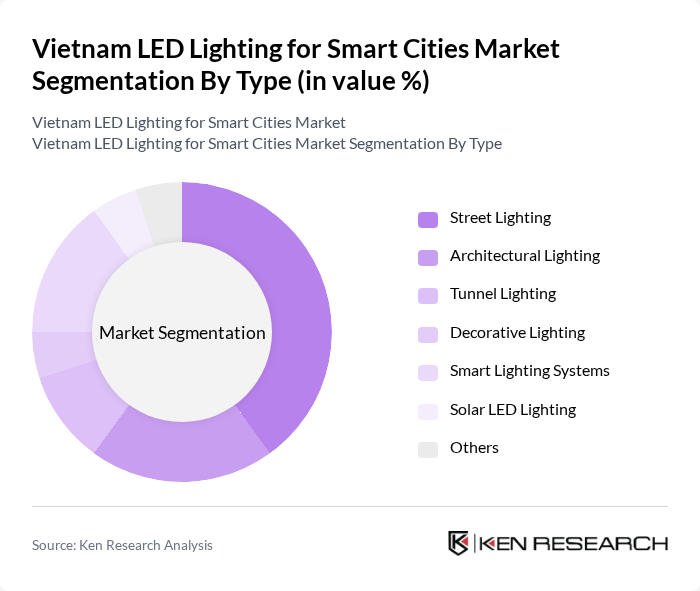

By Type:The market is segmented into various types of LED lighting solutions, including street lighting, architectural lighting, tunnel lighting, decorative lighting, smart lighting systems, solar LED lighting, and others. Each sub-segment caters to specific needs and applications within smart city frameworks, with street lighting being the most prominent due to its essential role in urban safety and energy efficiency.

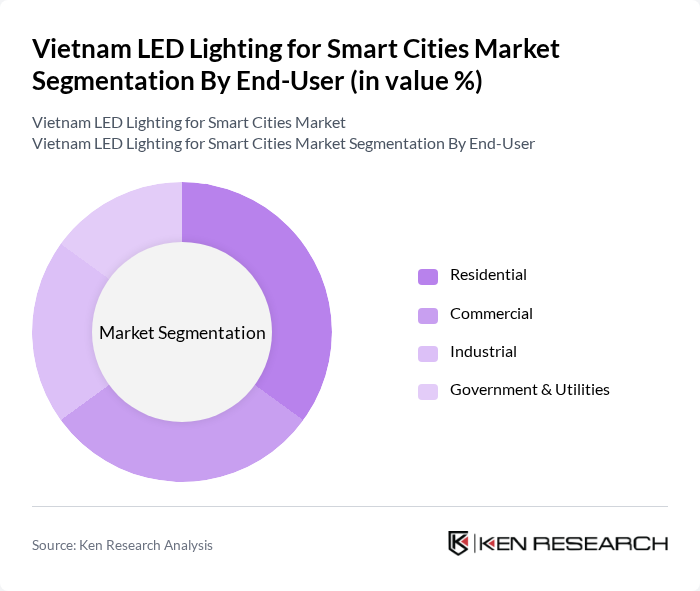

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential segment is witnessing significant growth as consumers increasingly adopt energy-efficient lighting solutions for their homes, driven by rising awareness of sustainability and energy savings.

The Vietnam LED Lighting for Smart Cities Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting, Osram Licht AG, Cree, Inc., General Electric Company, Signify N.V., Eaton Corporation, Zumtobel Group AG, Acuity Brands, Inc., Panasonic Corporation, Toshiba Corporation, Samsung Electronics, LG Electronics, Dialight plc, Hubbell Lighting, Nichia Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam LED lighting market for smart cities appears promising, driven by ongoing urbanization and government initiatives. As cities continue to evolve, the integration of smart technologies will become increasingly vital. The focus on sustainability and energy efficiency will likely lead to greater investments in LED solutions, particularly as public awareness grows. Additionally, partnerships between public and private sectors may enhance innovation and funding, further accelerating the adoption of advanced lighting systems in urban environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Street Lighting Architectural Lighting Tunnel Lighting Decorative Lighting Smart Lighting Systems Solar LED Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Urban Infrastructure Public Spaces Transportation Systems Smart Buildings |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Smart City Projects | 100 | City Planners, Urban Development Officials |

| Commercial LED Lighting Adoption | 80 | Facility Managers, Business Owners |

| Residential LED Lighting Preferences | 75 | Homeowners, Property Managers |

| Public Space Lighting Initiatives | 60 | Public Works Directors, Community Leaders |

| Energy Efficiency Policy Impact | 90 | Energy Policy Analysts, Environmental Consultants |

The Vietnam LED Lighting for Smart Cities Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, energy efficiency demands, and government initiatives aimed at enhancing smart city infrastructure.