Region:Asia

Author(s):Rebecca

Product Code:KRAB2888

Pages:84

Published On:October 2025

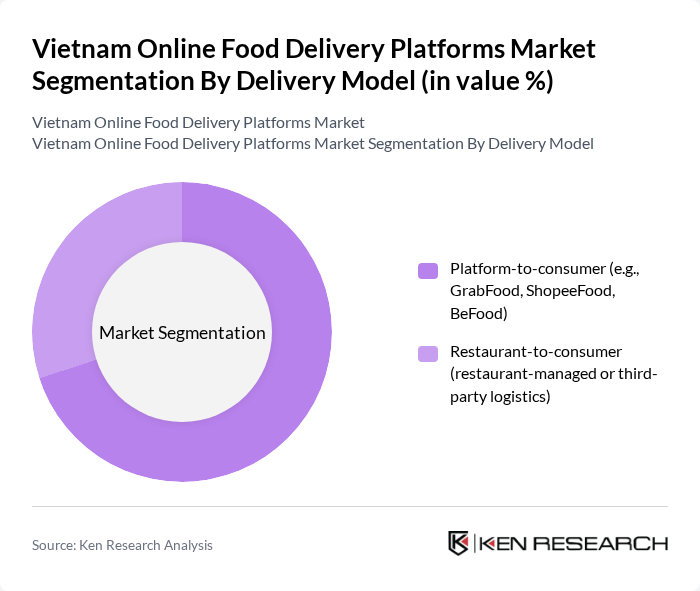

By Delivery Model:

The delivery model segmentation includes two primary subsegments: Platform-to-consumer and Restaurant-to-consumer. The Platform-to-consumer model, exemplified by services like GrabFood, ShopeeFood, and BeFood (formerly Baemin), has gained significant traction due to its convenience and user-friendly interfaces. This model allows consumers to order from a wide variety of restaurants through a single platform, enhancing customer experience. Following Gojek's exit from Vietnam in September 2024, three major platforms remain, with ShopeeFood and GrabFood dominating over 90% combined market share. On the other hand, the Restaurant-to-consumer model, which can be managed by the restaurant itself or through third-party logistics, is also growing as restaurants seek to establish direct relationships with their customers. However, the Platform-to-consumer model currently dominates the market due to its extensive reach and marketing strategies that appeal to tech-savvy consumers.

By Order Type:

This segmentation includes Individual orders and Group orders. Individual orders are the most common type of transaction in the online food delivery market, driven by the increasing number of single-person households and busy lifestyles that favor quick meal solutions. The widespread availability of diverse food options including Vietnamese cuisines, western cuisines, and South Asian cuisines caters to unique food preferences of different consumers across the country. Group orders, while less frequent, are gaining popularity, especially among corporate clients and during social gatherings. The convenience of ordering for multiple people through a single platform is appealing, but the Individual orders segment remains the leader due to its volume and frequency of transactions.

The Vietnam Online Food Delivery Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as GrabFood, ShopeeFood, BeFood, Now.vn, Loship, Viettel Post, Foody.vn, Chopp.vn, Ahamove, FastGo, VinID, TikiNOW, DeliveryNow, Momo contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's online food delivery market appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt AI and machine learning, personalized services will enhance user experiences. Additionally, the integration of sustainable practices will resonate with health-conscious consumers. The market is likely to see further expansion into rural areas, tapping into previously underserved demographics. Overall, the combination of innovation and strategic partnerships will shape the competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Delivery Model | Platform-to-consumer Restaurant-to-consumer |

| By Order Type | Individual orders Group orders |

| By Cuisine Type | Vietnamese cuisine Asian cuisine Western cuisine Fast food Vegetarian/vegan options Desserts & beverages |

| By Payment Method | Cash on delivery Online payment Digital wallets |

| By Customer Type | Individual consumers Corporate clients Event catering |

| By Order Method | Mobile application Website |

| By Region | Southern Vietnam Northern Vietnam Central Vietnam |

| By Subscription Model | Monthly subscriptions Pay-per-order Annual subscriptions |

| By Customer Demographics | Age group Income level Urban vs rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Food Delivery | 120 | Frequent Users, Occasional Users, Non-Users |

| Restaurant Partnerships and Collaborations | 85 | Restaurant Owners, Managers, Franchise Operators |

| Delivery Personnel Insights | 75 | Delivery Drivers, Logistics Coordinators |

| Market Trends and Innovations | 65 | Industry Analysts, Technology Providers |

| Regulatory Impact Assessment | 55 | Policy Makers, Regulatory Affairs Specialists |

The Vietnam Online Food Delivery Platforms Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by smartphone adoption, urbanization, and changing consumer preferences towards convenience and online shopping.