Region:Asia

Author(s):Dev

Product Code:KRAB5459

Pages:95

Published On:October 2025

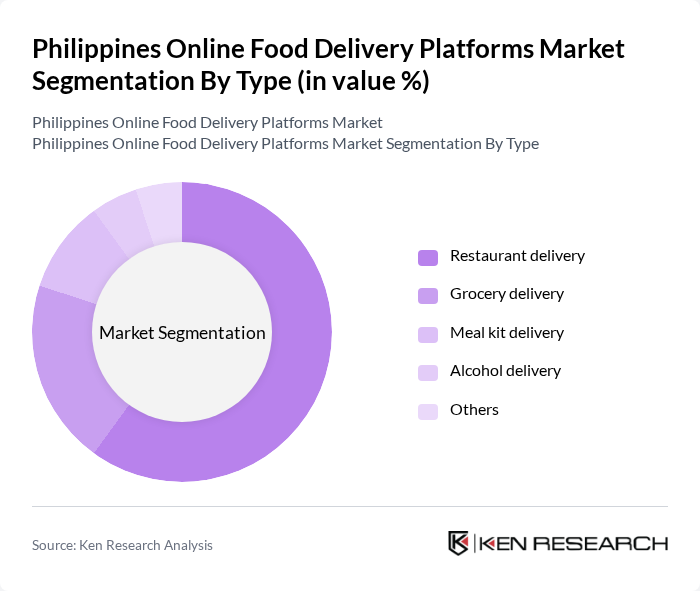

By Type:

The market is segmented into various types, including restaurant delivery, grocery delivery, meal kit delivery, alcohol delivery, and others. Among these, restaurant delivery is the most dominant segment, driven by the increasing number of food establishments partnering with delivery platforms. The convenience of ordering meals from a wide variety of restaurants has made this segment particularly appealing to consumers, especially in urban areas where dining out may not always be feasible. Grocery delivery is also gaining traction, particularly among busy households looking for convenience in their shopping experience.

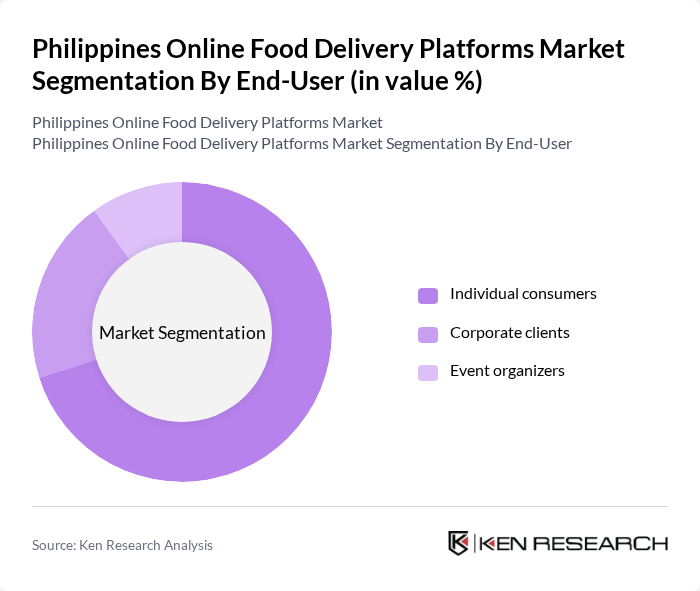

By End-User:

The end-user segmentation includes individual consumers, corporate clients, and event organizers. Individual consumers dominate the market, driven by the growing trend of online food ordering for convenience and variety. The rise of remote work has also led to an increase in corporate clients utilizing food delivery services for meetings and events. Event organizers are increasingly turning to food delivery platforms to cater to various occasions, further diversifying the market.

The Philippines Online Food Delivery Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as GrabFood, Foodpanda, LalaFood, Zomato, Jollibee Foods Corporation, McDonald's Philippines, Chowking, Bonchon Chicken, Red Ribbon, Mang Inasal, The Coffee Bean & Tea Leaf, Starbucks Philippines, KFC Philippines, Shakey's Pizza, Yellow Cab Pizza contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online food delivery market in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt AI and machine learning for personalized experiences, customer engagement is expected to improve significantly. Moreover, the integration of sustainable practices, such as eco-friendly packaging, will likely resonate with the growing environmentally conscious consumer base, further enhancing market growth and brand loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Restaurant delivery Grocery delivery Meal kit delivery Alcohol delivery Others |

| By End-User | Individual consumers Corporate clients Event organizers |

| By Delivery Mode | Standard delivery Express delivery Scheduled delivery |

| By Payment Method | Credit/debit cards E-wallets Cash on delivery |

| By Cuisine Type | Local Filipino cuisine Asian cuisine Western cuisine Fast food |

| By Subscription Model | Monthly subscriptions Pay-per-order Loyalty programs |

| By Region | Metro Manila Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage Patterns | 150 | Regular users of online food delivery services |

| Restaurant Partnerships | 100 | Restaurant owners and managers affiliated with delivery platforms |

| Delivery Personnel Insights | 80 | Delivery riders and logistics coordinators |

| Market Trends Analysis | 70 | Industry analysts and market researchers |

| Consumer Satisfaction Surveys | 120 | Users who have recently ordered food online |

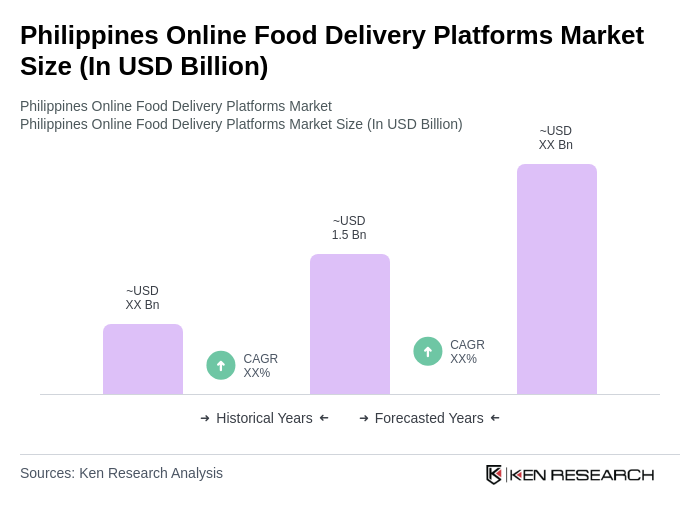

The Philippines Online Food Delivery Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased smartphone adoption, e-commerce expansion, and changing consumer preferences for convenience and variety in food options.