Region:Asia

Author(s):Geetanshi

Product Code:KRAD0011

Pages:88

Published On:August 2025

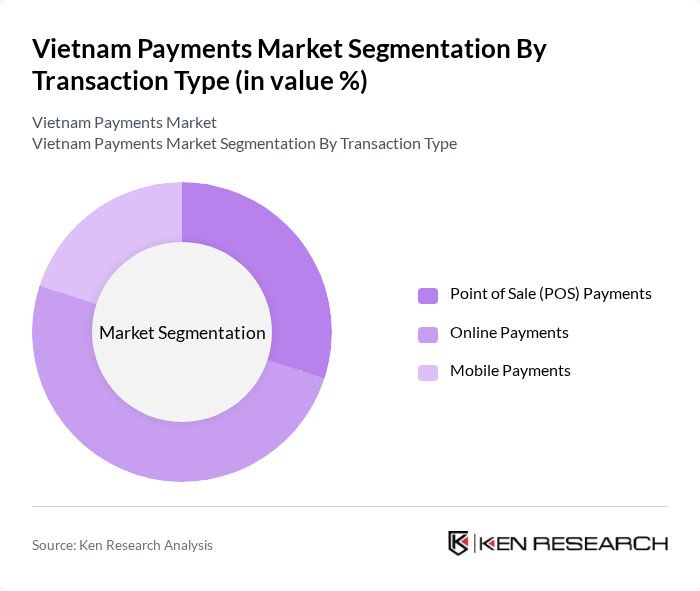

By Transaction Type:The transaction types in the Vietnam Payments Market include Point of Sale (POS) Payments, Online Payments, and Mobile Payments. Among these, Online Payments have emerged as the leading segment, driven by the surge in e-commerce activities and the convenience of digital transactions. Consumers increasingly prefer online shopping, which has led to a significant rise in online payment methods. POS Payments are also growing, particularly in urban areas, as businesses upgrade their payment systems to accommodate cashless transactions. Mobile Payments are gaining traction, especially among younger consumers who favor the convenience of mobile wallets .

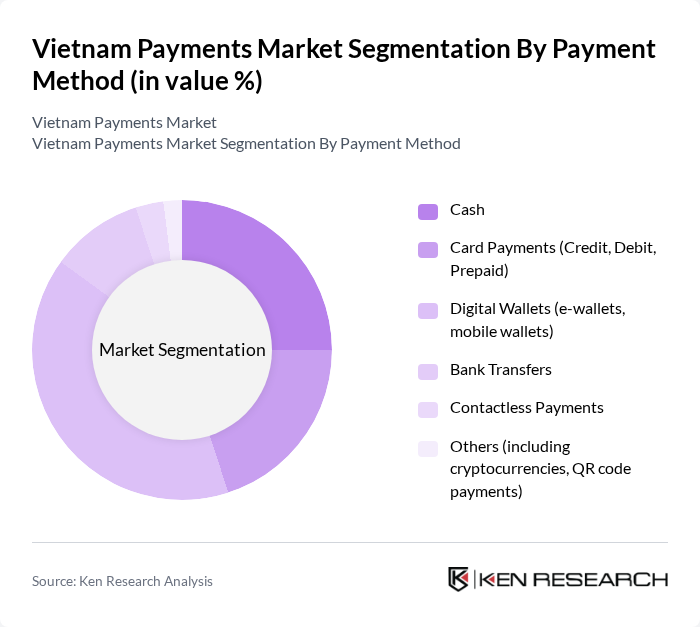

By Payment Method:The payment methods in the Vietnam Payments Market encompass Cash, Card Payments (Credit, Debit, Prepaid), Digital Wallets (e-wallets, mobile wallets), Bank Transfers, Contactless Payments, and Others (including cryptocurrencies, QR code payments). Digital Wallets have become the dominant payment method, reflecting the growing consumer preference for convenience and speed in transactions. Card Payments are also significant, particularly among urban consumers, while Cash remains prevalent in rural areas. Bank Transfers are widely used for larger transactions, and Contactless Payments are gaining popularity due to their ease of use .

The Vietnam Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo (M_Service JSC), ZaloPay (VNG Corporation), ViettelPay (Viettel Group), Payoo (VietUnion Online Services Corporation), VNPay (Vietnam Payment Solution JSC), Timo (Global Online Financial Solution JSC), GrabPay (Grab Holdings Inc.), ShopeePay (Sea Group), BIDV Smart Banking (Bank for Investment and Development of Vietnam), Techcombank eBanking (Vietnam Technological and Commercial Joint Stock Bank), Sacombank eBanking (Saigon Thuong Tin Commercial Joint Stock Bank), Agribank Online (Vietnam Bank for Agriculture and Rural Development), ACB Online (Asia Commercial Bank), Vietcombank Online (Joint Stock Commercial Bank for Foreign Trade of Vietnam), VPBank Online (Vietnam Prosperity Joint Stock Commercial Bank) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam payments market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The increasing adoption of contactless payments and the integration of artificial intelligence in fraud detection are expected to enhance transaction security and efficiency. Additionally, the emergence of open banking will facilitate greater competition and innovation, allowing consumers to access a wider range of financial services. These trends indicate a dynamic future for the payments landscape, fostering a more inclusive and efficient financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Transaction Type | Point of Sale (POS) Payments Online Payments Mobile Payments |

| By Payment Method | Cash Card Payments (Credit, Debit, Prepaid) Digital Wallets (e-wallets, mobile wallets) Bank Transfers Contactless Payments Others (including cryptocurrencies, QR code payments) |

| By End-User Industry | Retail E-commerce Hospitality Healthcare Entertainment Transportation Government Others |

| By Transaction Size | Micro Transactions Small Transactions Medium Transactions Large Transactions |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government Entities |

| By Geographic Distribution | Urban Areas Rural Areas Suburban Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 120 | General Consumers, Young Professionals |

| Small Business Payment Acceptance | 90 | Small Business Owners, Retail Managers |

| Fintech Adoption Trends | 60 | Tech-savvy Consumers, Early Adopters |

| Corporate Payment Solutions | 50 | Finance Managers, CFOs of SMEs |

| Regulatory Impact on Payments | 40 | Policy Makers, Compliance Officers |

The Vietnam Payments Market is valued at approximately USD 22 billion, driven by the rapid adoption of digital payment solutions, increased smartphone penetration, and a growing e-commerce sector, particularly accelerated by the COVID-19 pandemic.