Region:Asia

Author(s):Geetanshi

Product Code:KRAA7932

Pages:100

Published On:September 2025

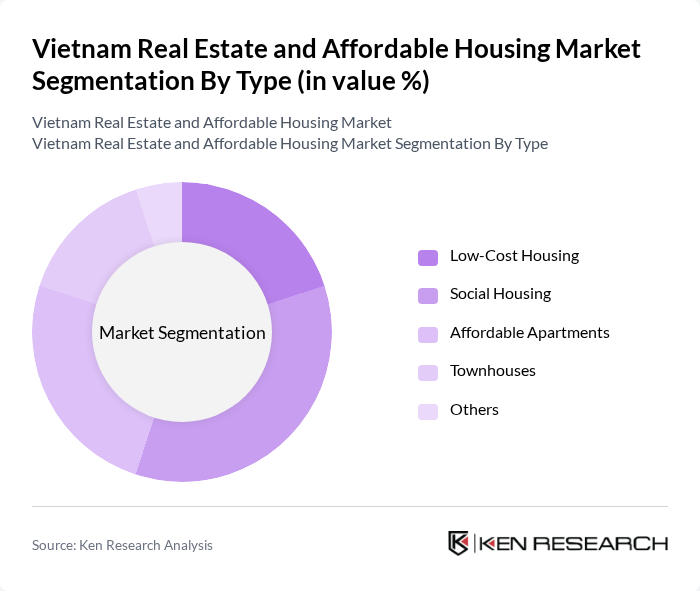

By Type:The market is segmented into various types, including Low-Cost Housing, Social Housing, Affordable Apartments, Townhouses, and Others. Among these, Social Housing is currently the leading subsegment, driven by government policies and initiatives aimed at providing affordable living options for low-income families. The increasing urban population and the need for affordable living spaces have made this segment particularly attractive to both developers and buyers.

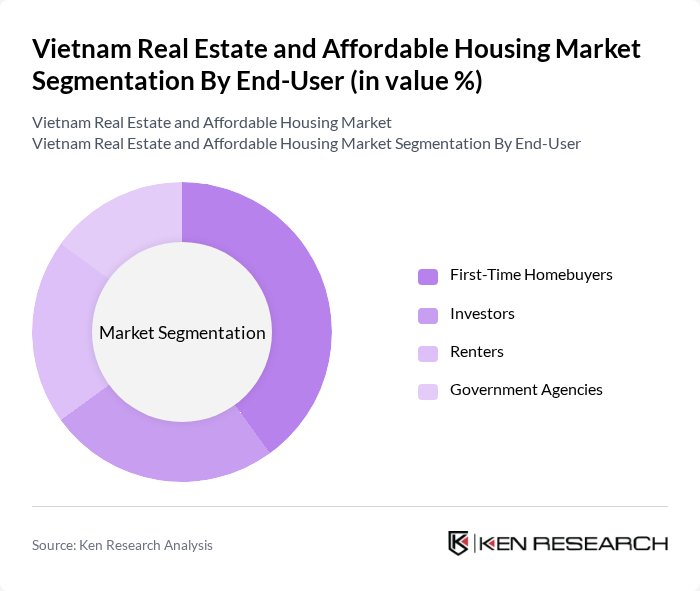

By End-User:The end-user segmentation includes First-Time Homebuyers, Investors, Renters, and Government Agencies. First-Time Homebuyers dominate the market, driven by favorable financing options and government support programs aimed at making homeownership more accessible. This demographic is increasingly seeking affordable housing solutions, contributing significantly to the overall market growth.

The Vietnam Real Estate and Affordable Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vingroup JSC, Novaland Investment Group, FLC Group, Phu My Hung Development Corporation, Dat Xanh Group, Nam Long Investment Corporation, Becamex IDC Corporation, Kinh Bac City Development Holding Corporation, Saigon Newport Corporation, Hoang Anh Gia Lai Group, An Phuoc Investment and Development, Tan Hoang Minh Group, Him Lam Land, SSG Group, Hòa Bình Construction Group contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam real estate market is poised for significant transformation as urbanization accelerates and government initiatives gain momentum. In the future, the focus on sustainable and affordable housing will likely intensify, driven by rising middle-class incomes and increased foreign investment. The integration of technology in real estate processes will enhance efficiency and transparency, while public-private partnerships will play a crucial role in addressing housing shortages. Overall, the market is expected to adapt to evolving consumer preferences and regulatory landscapes, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-Cost Housing Social Housing Affordable Apartments Townhouses Others |

| By End-User | First-Time Homebuyers Investors Renters Government Agencies |

| By Price Range | Below 500 Million VND Million to 1 Billion VND Billion to 2 Billion VND Above 2 Billion VND |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Residential Use Commercial Use Mixed-Use Developments Others |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Policy Support | Subsidies Tax Exemptions Housing Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Affordable Housing Demand | 150 | Potential Homebuyers, Renters |

| Real Estate Developer Insights | 100 | Project Managers, Business Development Heads |

| Government Housing Policy Impact | 80 | Policy Makers, Urban Planners |

| Community Housing Needs Assessment | 70 | Community Leaders, Housing Advocates |

| Market Trends in Rental Properties | 90 | Property Managers, Real Estate Agents |

The Vietnam Real Estate and Affordable Housing Market is valued at approximately USD 25 billion, driven by rapid urbanization, population growth, and government initiatives aimed at improving housing accessibility for low- and middle-income families.