Region:Europe

Author(s):Geetanshi

Product Code:KRAA7909

Pages:97

Published On:September 2025

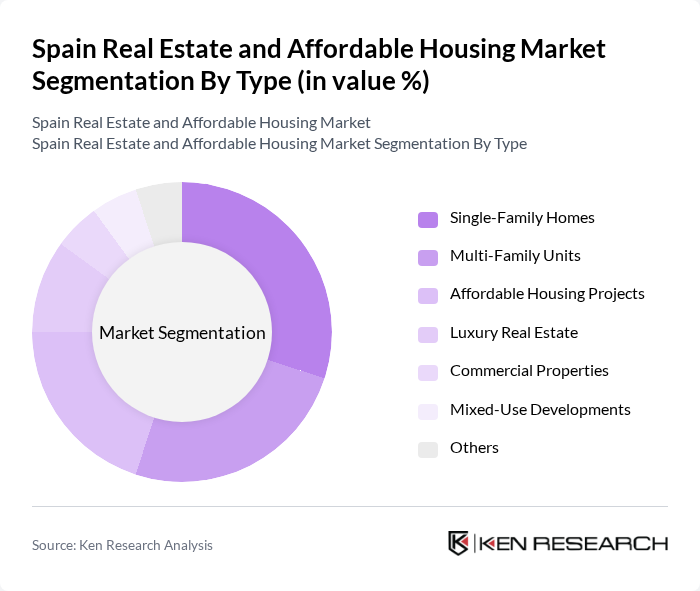

By Type:The market can be segmented into various types, including Single-Family Homes, Multi-Family Units, Affordable Housing Projects, Luxury Real Estate, Commercial Properties, Mixed-Use Developments, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of the real estate market in Spain.

By End-User:The end-user segmentation includes First-Time Homebuyers, Investors, Renters, and Government Agencies. Each group has distinct motivations and requirements, influencing their participation in the real estate market.

The Spain Real Estate and Affordable Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Lar, Metrovacesa, Neinor Homes, Aedas Homes, Habitat Inmobiliaria, Acciona, Ferrovial, Sacyr, Inmobiliaria Colonial, Renta Corporación, Grupo San José, Urbania International, Quabit Inmobiliaria, Vía Célere, Tinsa contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's real estate and affordable housing market appears promising, driven by ongoing urbanization and government support. As the population continues to migrate towards urban centers, the demand for affordable housing will likely increase. Additionally, the focus on sustainable and smart housing solutions is expected to shape the market landscape. With the government’s commitment to enhancing housing affordability, the sector is poised for growth, attracting both domestic and foreign investments in innovative housing projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Affordable Housing Projects Luxury Real Estate Commercial Properties Mixed-Use Developments Others |

| By End-User | First-Time Homebuyers Investors Renters Government Agencies |

| By Price Range | Low-Income Housing Mid-Range Housing High-End Housing |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Financing Type | Government-Funded Projects Private Investments Public-Private Partnerships |

| By Construction Type | New Constructions Renovations Green Building Initiatives |

| By Development Stage | Planning Stage Under Construction Completed Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Affordable Housing Projects | 150 | Real Estate Developers, Urban Planners |

| Rural Housing Initiatives | 100 | Local Government Officials, Community Leaders |

| Rental Market Analysis | 120 | Property Managers, Tenants |

| First-time Homebuyer Insights | 80 | Potential Homebuyers, Financial Advisors |

| Impact of Economic Policies on Housing | 90 | Economists, Policy Analysts |

The Spain Real Estate and Affordable Housing Market is valued at approximately USD 300 billion, reflecting significant growth driven by urbanization, increased housing demand, and government initiatives promoting affordable housing solutions.