Region:Asia

Author(s):Rebecca

Product Code:KRAE2896

Pages:95

Published On:February 2026

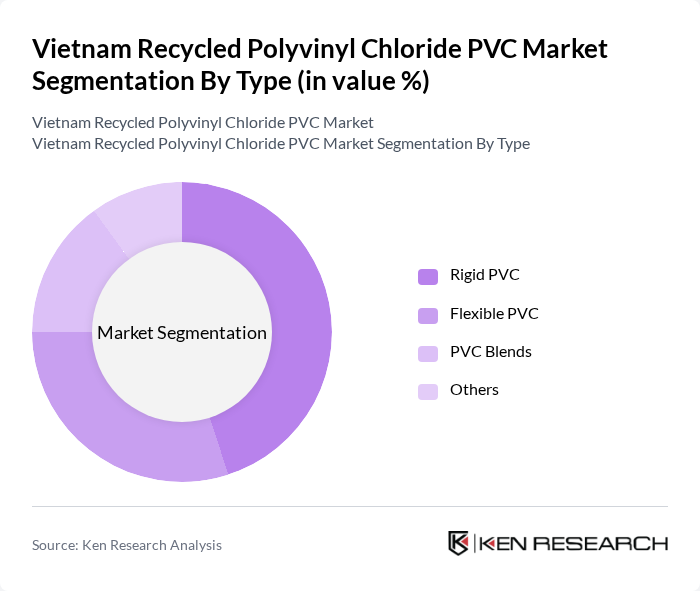

By Type:The market is segmented into Rigid PVC, Flexible PVC, PVC Blends, and Others. Rigid PVC is widely used in construction and plumbing applications due to its durability and strength. Flexible PVC is favored in applications requiring flexibility, such as electrical cables and flooring. PVC Blends combine properties of both rigid and flexible PVC, making them suitable for various applications. The "Others" category includes niche products that do not fit into the primary classifications.

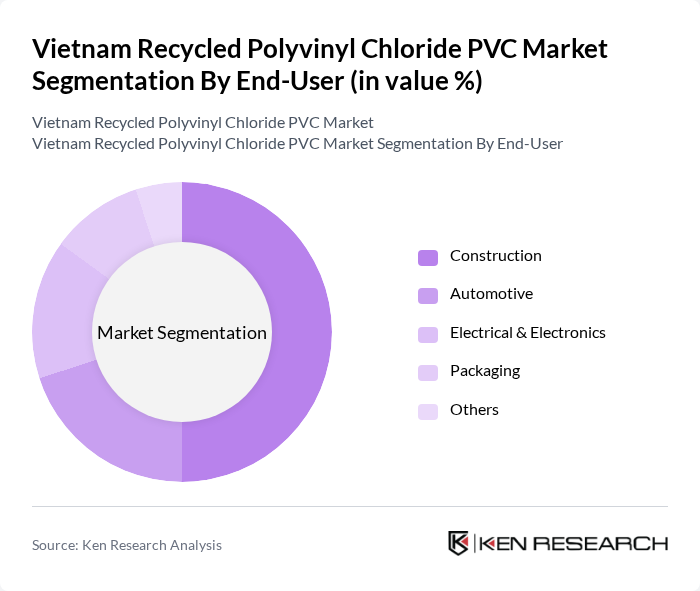

By End-User:The end-user segments include Construction, Automotive, Electrical & Electronics, Packaging, and Others. The construction sector is the largest consumer of recycled PVC, utilizing it for pipes, fittings, and flooring. The automotive industry also increasingly adopts recycled materials for interior components. Electrical & Electronics use recycled PVC for insulation and wiring, while the packaging sector benefits from its lightweight and durable properties. The "Others" category encompasses various smaller industries utilizing recycled PVC.

The Vietnam Recycled Polyvinyl Chloride PVC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Plastic Association, Binh Minh Plastic Joint Stock Company, Tien Phong Plastic Joint Stock Company, An Phat Holdings, Long Thanh Plastic Company, Southern Plastic Industry Corporation, Hoa Sen Group, Vietstar Joint Stock Company, Duy Tan Plastics Manufacturing Corporation, Nam Kim Steel Joint Stock Company, Tan Phat Plastic Company, Phu Cuong Plastic Company, Minh Tam Plastic Company, Dai Dong Tien Plastic Company, Viet Nam National Chemical Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam recycled PVC market appears promising, driven by increasing government support and consumer demand for sustainable products. As the country enhances its recycling infrastructure and technology, the market is expected to expand significantly. Innovations in recycling processes and product applications will likely emerge, further integrating recycled PVC into various industries. Additionally, the shift towards a circular economy will encourage businesses to adopt sustainable practices, fostering a more resilient and environmentally friendly market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid PVC Flexible PVC PVC Blends Others |

| By End-User | Construction Automotive Electrical & Electronics Packaging Others |

| By Application | Pipes and Fittings Flooring and Wall Coverings Window Profiles Others |

| By Source of Recycling | Post-Consumer Waste Post-Industrial Waste Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Policy Support | Subsidies for recycling initiatives Tax incentives for manufacturers Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| PVC Recycling Facilities | 100 | Facility Managers, Operations Directors |

| Construction Industry Stakeholders | 80 | Project Managers, Procurement Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Inspectors |

| Environmental NGOs | 60 | Sustainability Advocates, Program Coordinators |

| End-users of Recycled PVC Products | 70 | Product Managers, Supply Chain Analysts |

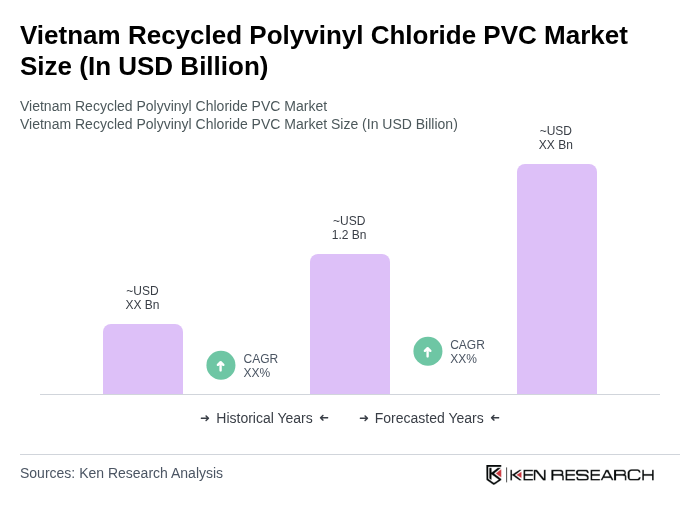

The Vietnam Recycled Polyvinyl Chloride (PVC) Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing environmental awareness and demand for sustainable materials across various industries.