Region:Middle East

Author(s):Rebecca

Product Code:KRAE2893

Pages:85

Published On:February 2026

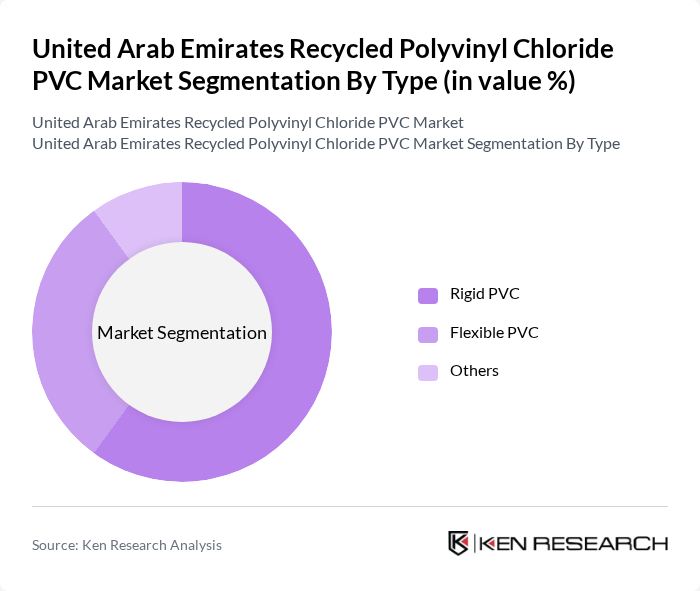

By Type:The market is segmented into Rigid PVC, Flexible PVC, and Others. Rigid PVC is widely used in construction and plumbing applications due to its durability and strength. Flexible PVC, on the other hand, is preferred in applications requiring flexibility and softness, such as in electrical cables and flooring. The "Others" category includes various niche applications that contribute to the overall market.

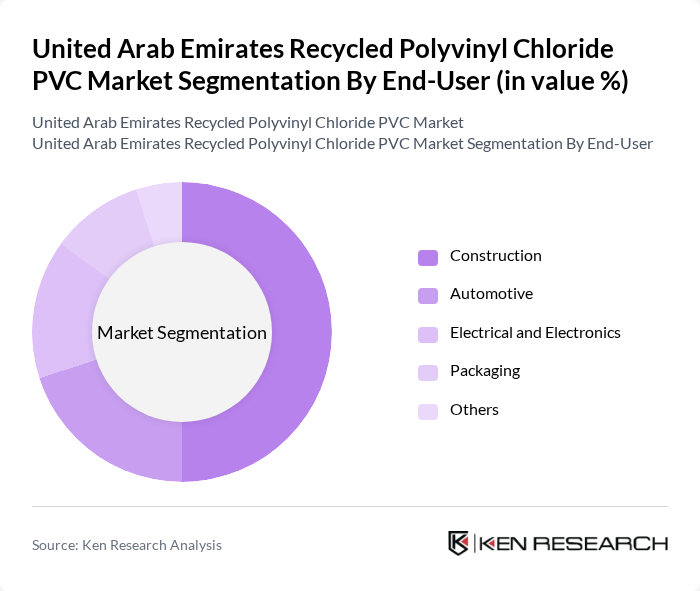

By End-User:The end-user segmentation includes Construction, Automotive, Electrical and Electronics, Packaging, and Others. The construction sector is the largest consumer of recycled PVC, driven by the increasing demand for sustainable building materials. The automotive industry is also a significant user, utilizing recycled PVC in various components. The "Others" category encompasses diverse industries that utilize recycled PVC in specialized applications.

The United Arab Emirates Recycled Polyvinyl Chloride PVC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Recycling, Dubai Investments, Gulf Plastic Industries, National Plastic Factory, Al Dhafra Recycling Industries, Abu Dhabi National Oil Company (ADNOC), Polyvinyl Chloride Recycling Company, Emirates Plastics, Al Ain Plastic Factory, Sharjah Plastic Industries, Gulf Coast Recycling, United Plastics, Green Planet Recycling, Eco-Friendly PVC Solutions, Future PVC Recycling contribute to innovation, geographic expansion, and service delivery in this space.

The future of the recycled PVC market in the UAE appears promising, driven by increasing regulatory support and a growing emphasis on sustainability. As the government continues to implement recycling mandates and incentives, the market is expected to see a rise in the adoption of recycled materials across various sectors. Furthermore, the expansion of recycling facilities and technological innovations will likely enhance the quality and availability of recycled PVC, positioning it as a viable alternative to virgin products in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid PVC Flexible PVC Others |

| By End-User | Construction Automotive Electrical and Electronics Packaging Others |

| By Application | Pipes and Fittings Flooring and Wall Coverings Profiles and Sheets Others |

| By Source of Recycling | Post-Consumer Waste Post-Industrial Waste Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry PVC Recycling | 100 | Project Managers, Sustainability Coordinators |

| Automotive Sector PVC Waste Management | 80 | Operations Managers, Environmental Compliance Officers |

| Consumer Goods Packaging Recycling | 75 | Product Managers, Supply Chain Analysts |

| Government Policy Impact on Recycling | 50 | Policy Makers, Environmental Consultants |

| Recycling Technology Providers | 60 | Technical Directors, R&D Managers |

The United Arab Emirates Recycled Polyvinyl Chloride PVC Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by environmental awareness and government initiatives promoting recycling and sustainable materials.