Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0565

Pages:99

Published On:December 2025

By Type:The market is segmented into various types of recycled plastics, including PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), PVC (Polyvinyl Chloride), LDPE (Low-Density Polyethylene), PP (Polypropylene), PS (Polystyrene), and others. Among these, PET is the most dominant type due to its extensive use in beverage bottles and packaging materials. The increasing consumer preference for sustainable products drives the demand for PET recycling, making it a key player in the market.

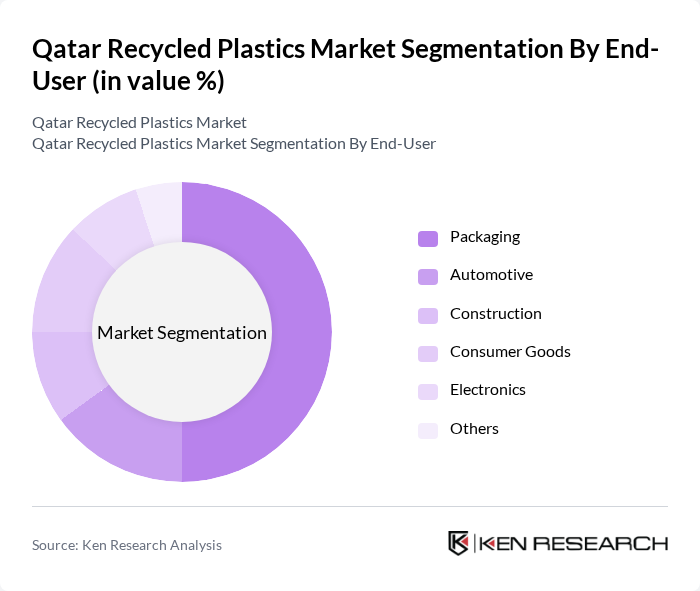

By End-User:The end-user segmentation includes packaging, automotive, construction, consumer goods, electronics, and others. The packaging sector is the largest consumer of recycled plastics, driven by the growing demand for eco-friendly packaging solutions. As companies increasingly adopt sustainable practices, the use of recycled materials in packaging is expected to rise significantly, making it the leading end-user segment in the market.

The Qatar Recycled Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatari Plastic Products Company, Qatar Recycling Company, Gulf Plastic Industries, Qatar Petrochemical Company, Qatar National Plastic Company, Al Jazeera Plastic Products, Doha Plastic Company, Qatar Green Building Council, Qatar Industrial Manufacturing Company, Qatar Waste Management Company, Qatar Plastic Recycling Company, Qatar Environmental Management Company, Qatar Chemical Company, Qatar Green Recycling, Qatar Sustainable Plastics Initiative contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar recycled plastics market appears promising, driven by increasing environmental awareness and supportive government policies. As the nation continues to invest in recycling infrastructure, the market is expected to witness significant growth. Innovations in recycling technologies and the development of biodegradable alternatives will further enhance sustainability efforts. Additionally, collaboration between businesses and government entities will likely create a more robust ecosystem for recycled plastics, fostering a circular economy that benefits both the environment and the economy.

| Segment | Sub-Segments |

|---|---|

| By Type | PET (Polyethylene Terephthalate) HDPE (High-Density Polyethylene) PVC (Polyvinyl Chloride) LDPE (Low-Density Polyethylene) PP (Polypropylene) PS (Polystyrene) Others |

| By End-User | Packaging Automotive Construction Consumer Goods Electronics Others |

| By Application | Bottles Containers Films and Sheets Fibers Others |

| By Collection Method | Curbside Collection Drop-off Centers Deposit Return Schemes Others |

| By Processing Method | Mechanical Recycling Chemical Recycling Energy Recovery Others |

| By Source of Material | Post-Consumer Waste Post-Industrial Waste Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Waste Management Companies | 100 | Operations Managers, Environmental Compliance Officers |

| Manufacturers Using Recycled Plastics | 80 | Procurement Managers, Product Development Leads |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Consumer Awareness and Behavior Studies | 120 | General Public, Community Leaders |

| Research Institutions Focused on Sustainability | 70 | Research Scientists, Academic Professors |

The Qatar Recycled Plastics Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting recycling and sustainable packaging solutions.