Region:Asia

Author(s):Rebecca

Product Code:KRAC2560

Pages:81

Published On:October 2025

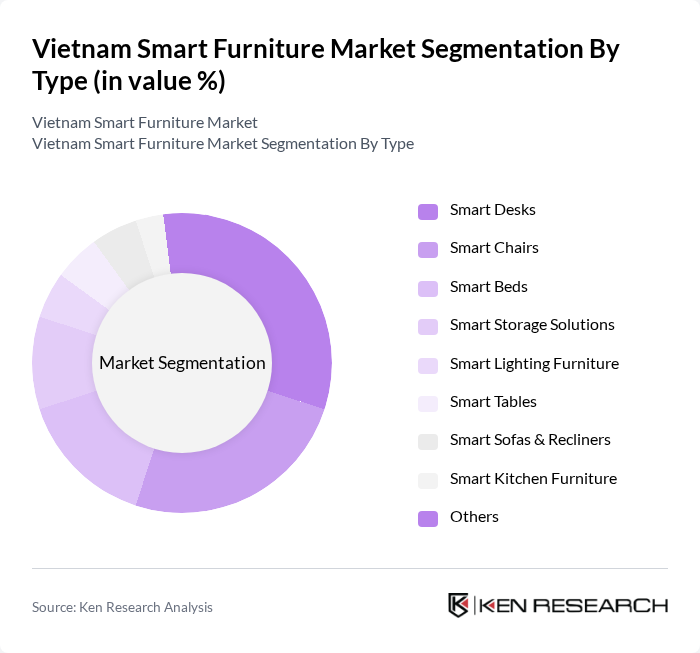

By Type:The smart furniture market is segmented into various types, including Smart Desks, Smart Chairs, Smart Beds, Smart Storage Solutions, Smart Lighting Furniture, Smart Tables, Smart Sofas & Recliners, Smart Kitchen Furniture, and Others. Among these, Smart Desks and Smart Chairs continue to lead the market, driven by the increasing trend of remote work, the need for ergonomic solutions, and the demand for technology-integrated furniture that enhances productivity and comfort. Consumers are prioritizing furniture with features such as wireless charging, automated adjustments, and connectivity with smart home devices.

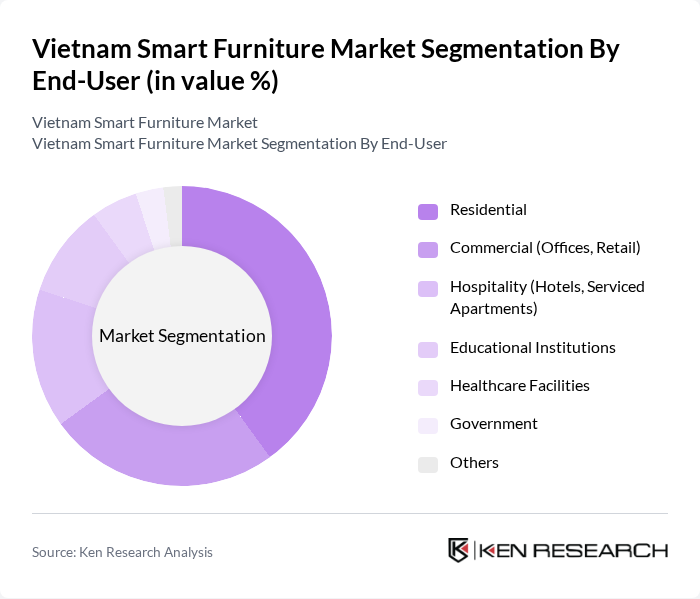

By End-User:The market is segmented by end-user into Residential, Commercial (Offices, Retail), Hospitality (Hotels, Serviced Apartments), Educational Institutions, Healthcare Facilities, Government, and Others. The Residential segment remains the largest, reflecting the growing trend of smart homes and the increasing number of urban households seeking modern furniture solutions that enhance their living spaces. Commercial and hospitality sectors are also adopting smart furniture to improve space utilization and offer enhanced experiences to occupants and guests.

The Vietnam Smart Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Muji, Hòa Phát Furniture, Fami, Xuân Hòa, N?i Th?t Hòa Phát, Lixil Group, TOTO Vietnam, VIXFURNITURE COMPANY CO., LTD, Duy Tân Plastics, Th?ng Long Furniture, An C??ng Wood Working, Hòa Bình Furniture, Ngh?a S?n Furniture, SMARTFURNITURE VIETNAM, SMHome Smart Furniture, Vietnam Smart Electronic Production Co., Ltd, XHOME VIETNAM CORPORATION, Jager Furniture Manufacturer, Trimble Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam smart furniture market is poised for significant growth as urbanization accelerates and disposable incomes rise. With a projected increase in smart home adoption, manufacturers are likely to focus on integrating advanced technologies into furniture designs. Additionally, sustainability trends will drive innovation, as consumers increasingly seek eco-friendly options. As awareness of smart furniture benefits grows, the market is expected to attract new players, enhancing competition and product diversity, ultimately benefiting consumers and the industry alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Desks Smart Chairs Smart Beds Smart Storage Solutions Smart Lighting Furniture Smart Tables Smart Sofas & Recliners Smart Kitchen Furniture Others |

| By End-User | Residential Commercial (Offices, Retail) Hospitality (Hotels, Serviced Apartments) Educational Institutions Healthcare Facilities Government Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Offline Retail (Showrooms, Dealers) Direct Sales (B2B, Projects) Wholesale Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Material | Wood Metal Plastic Composite Materials Smart Textiles Others |

| By Functionality | Adjustable Multi-functional Space-saving Smart Integration (IoT, Sensors, Connectivity) Energy-efficient Others |

| By Brand Positioning | Luxury Brands Mid-tier Brands Budget Brands Emerging Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Furniture Adoption | 100 | Homeowners, Interior Designers |

| Commercial Smart Furniture Solutions | 80 | Office Managers, Facility Managers |

| Retail Smart Furniture Trends | 60 | Retail Buyers, Merchandising Managers |

| Smart Furniture Technology Integration | 50 | IT Managers, Product Development Specialists |

| Consumer Preferences in Smart Furniture | 90 | General Consumers, Tech Enthusiasts |

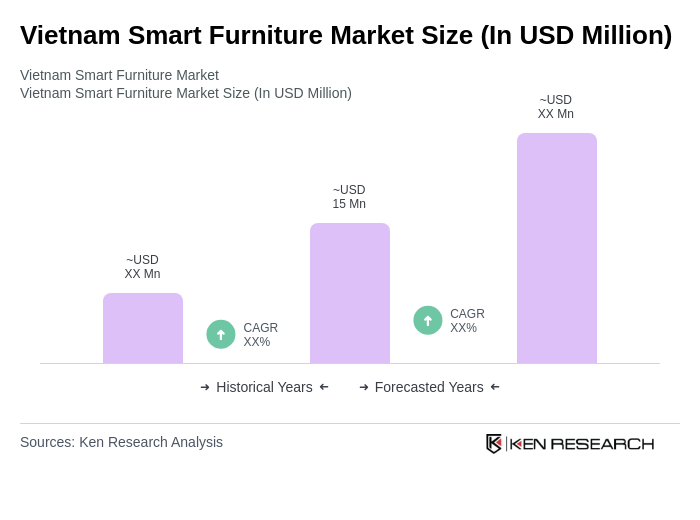

The Vietnam Smart Furniture Market is valued at approximately USD 15 million, driven by increasing demand for innovative and multifunctional furniture solutions, particularly in urban areas where space optimization is essential.