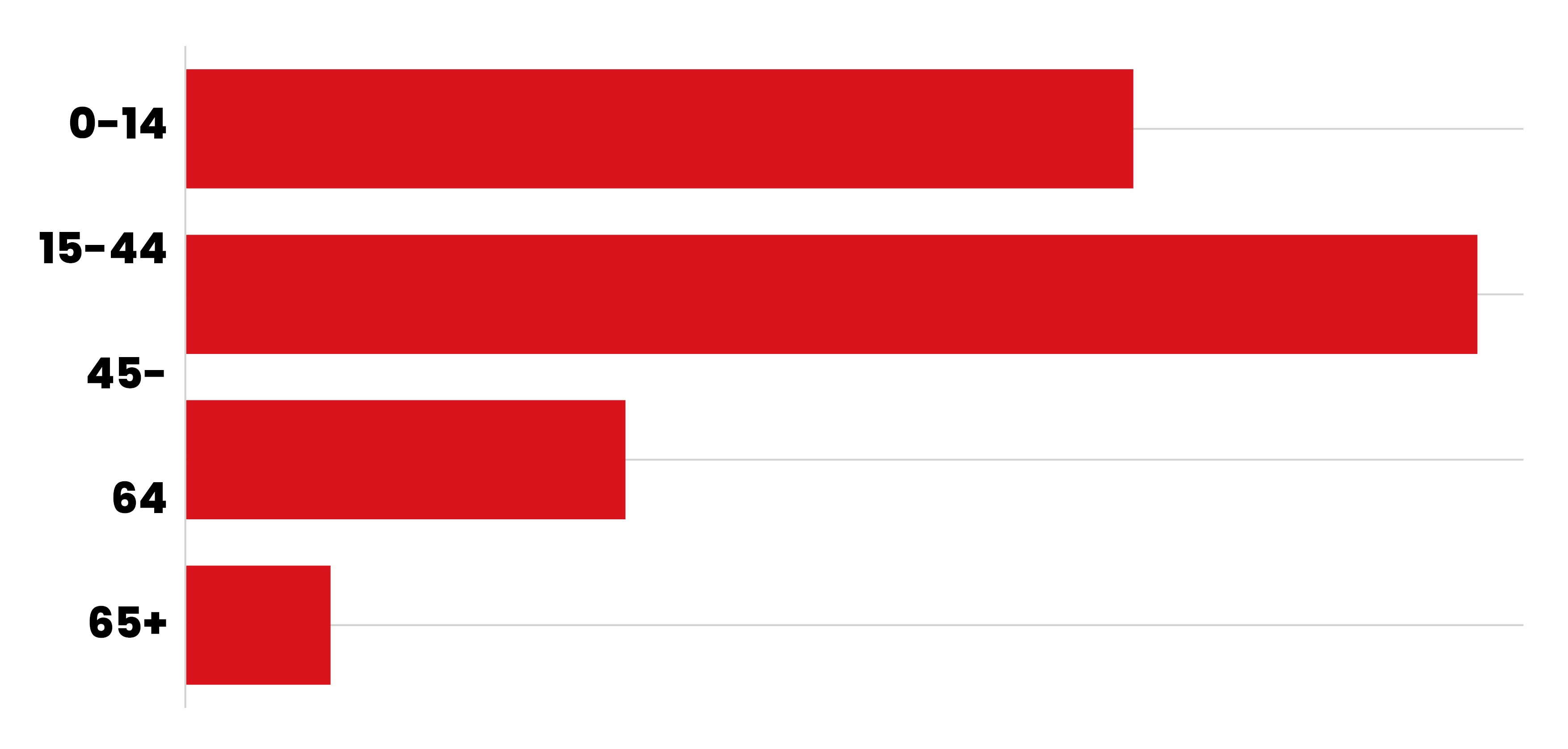

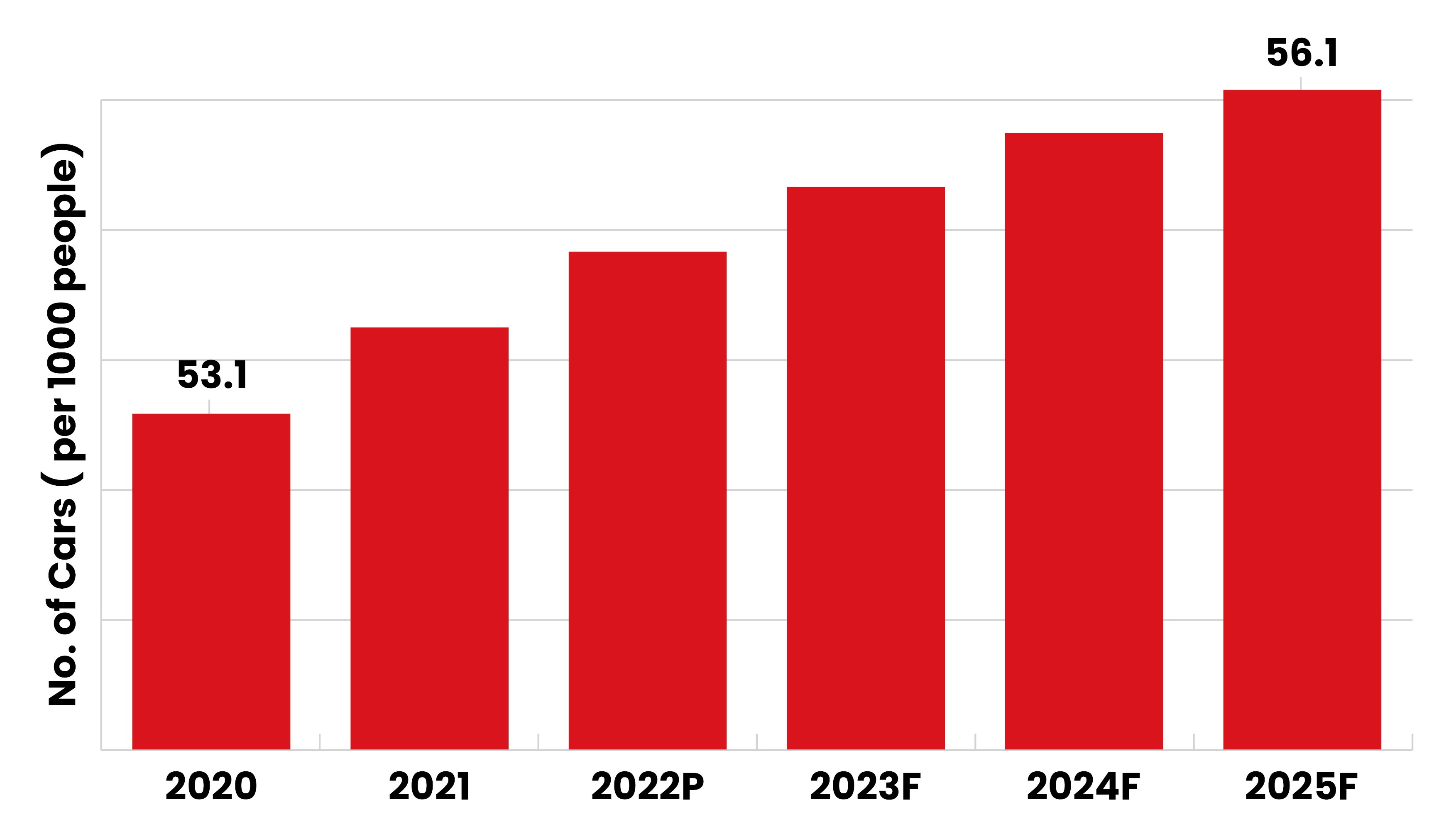

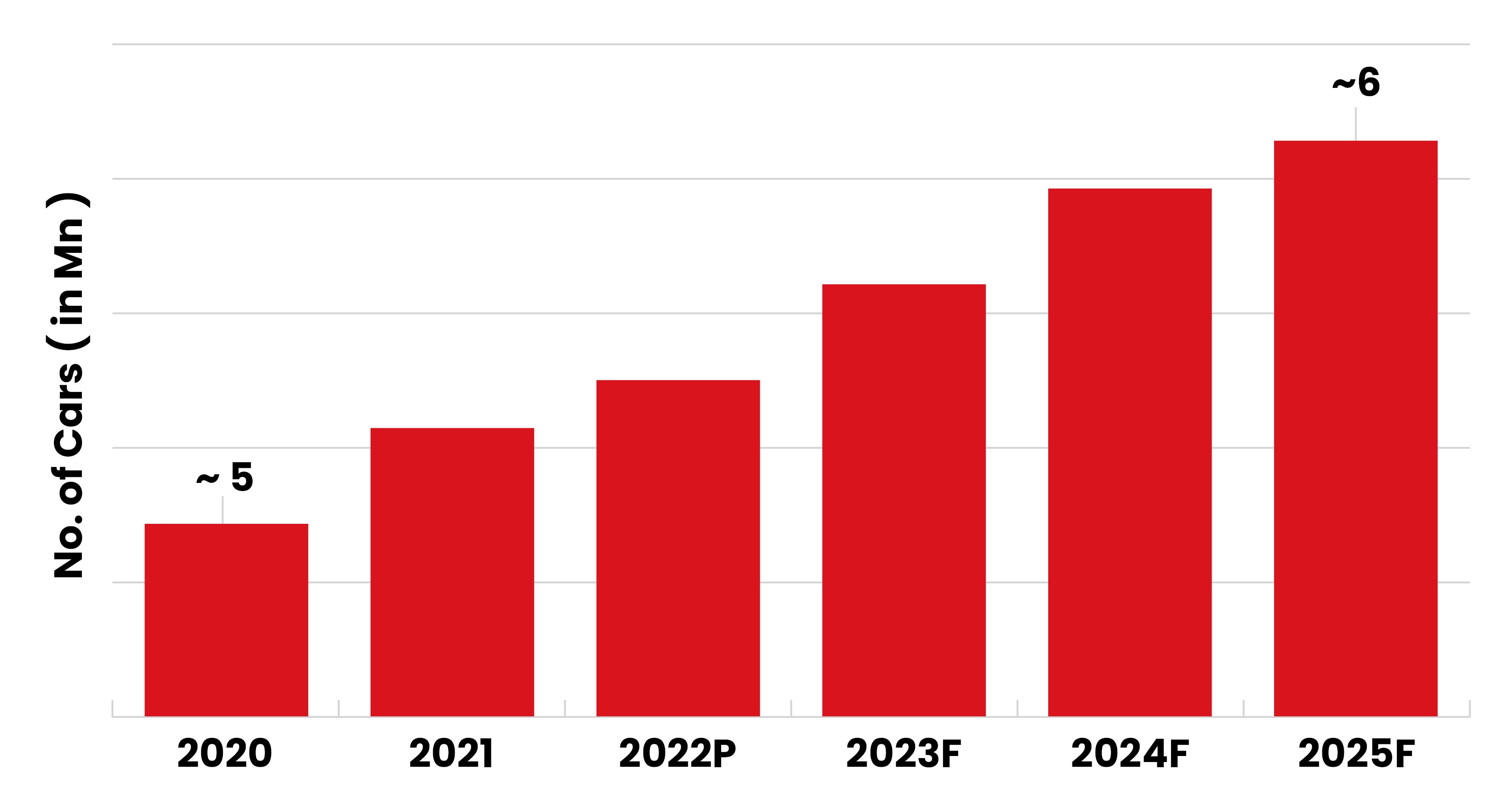

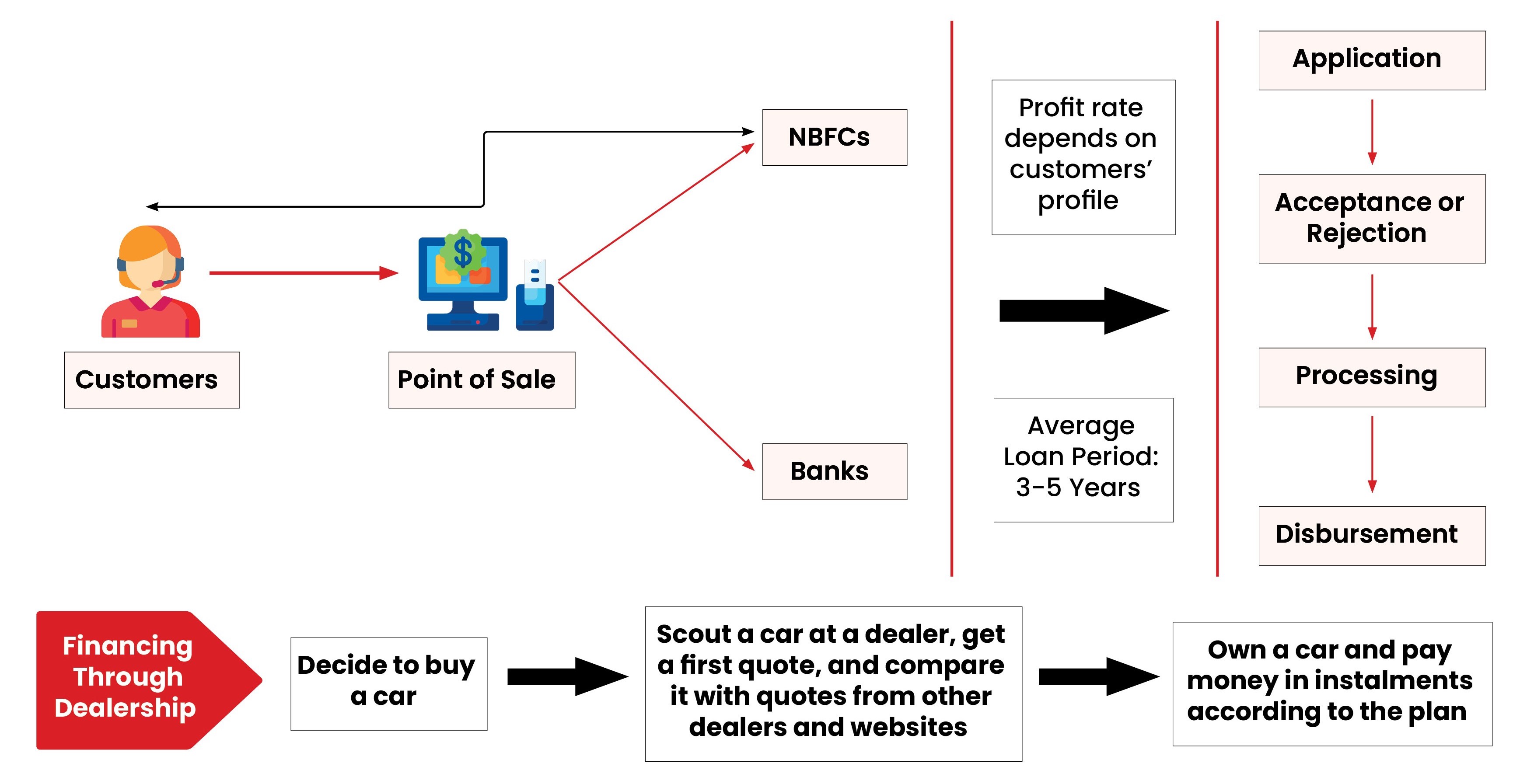

Auto finance industry has seen substantial growth in credit disbursement backed by accelerated population growth, vehicle sales, and a surge in financial penetration. Presently, Egypt Auto Finance Market is growing at a CAGR of 18%, 2016-2022. The sector is driven by Purchasing power of individuals and the risk appetite of the financial service provider. Also, the entry of women drivers has led to an increase in total cars sold, and hence the credit disbursed.

However, digital disruption will act as a major catalyst behind the development of the auto finance market in the coming years. Here, we have outlined the key reasons on how digital disruption will help Egypt’s Auto Finance Market to reach double-digit growth by 2027.

| Governorate | Population in Mn |

|---|---|

| Cairo | 10.0 |

| Giza | 9.2 |

| Sharkia | 7.6 |

| Dakahlia | 6.8 |

| Others | 67.8 |

.png)

Responsive regulation, robust infrastructure, effective supervision and customer centricity will focus on 5 C’s coverage, cost, convenience, convergence and confidence which will help in building a financial ecosystem to benefit the auto finance sector.