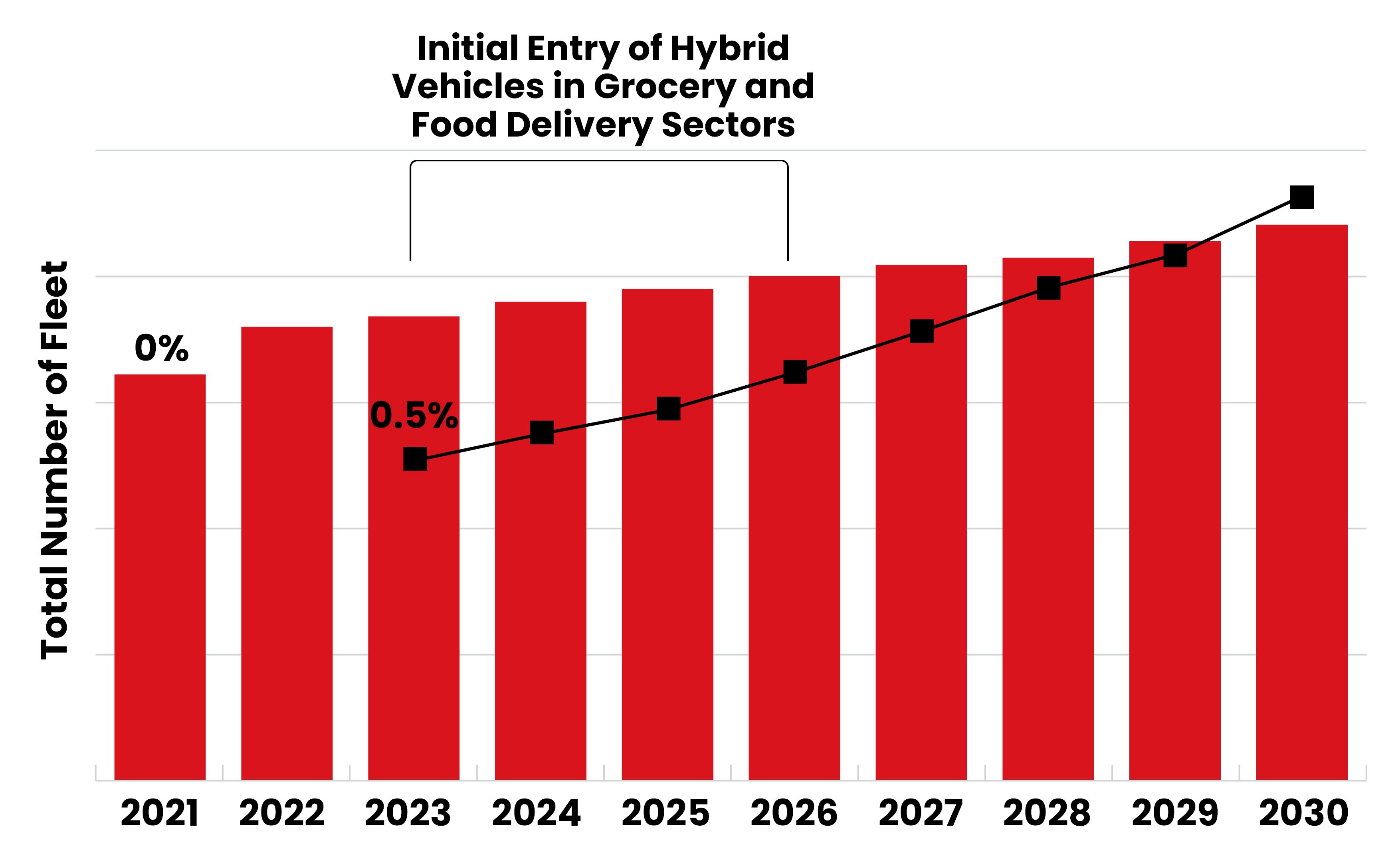

EVs are slowly gaining traction with less than 0.5% of vehicles deployed as PHEVs in Saudi Arabia. Efforts to create a market for EVs are consistent with the Saudi Crown Prince Muhammed bin Salman’s Vision 2030 plan, which aims to reduce the country’s dependence on oil, diversify the economy, and implement a range of social reforms. The EV infrastructure in Saudi Arabia is still lagging behind as the government is yet to install charging stations in public areas.

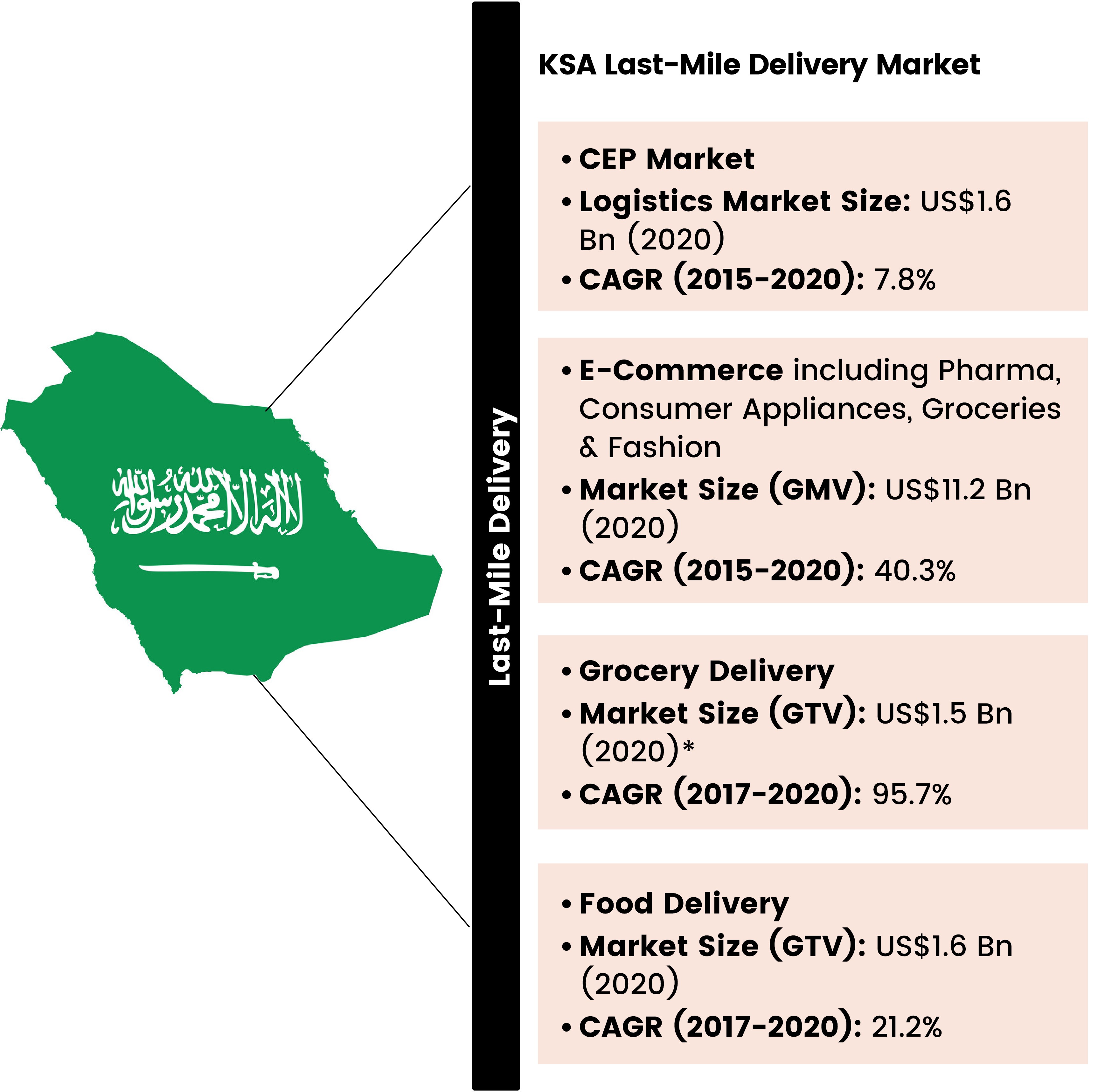

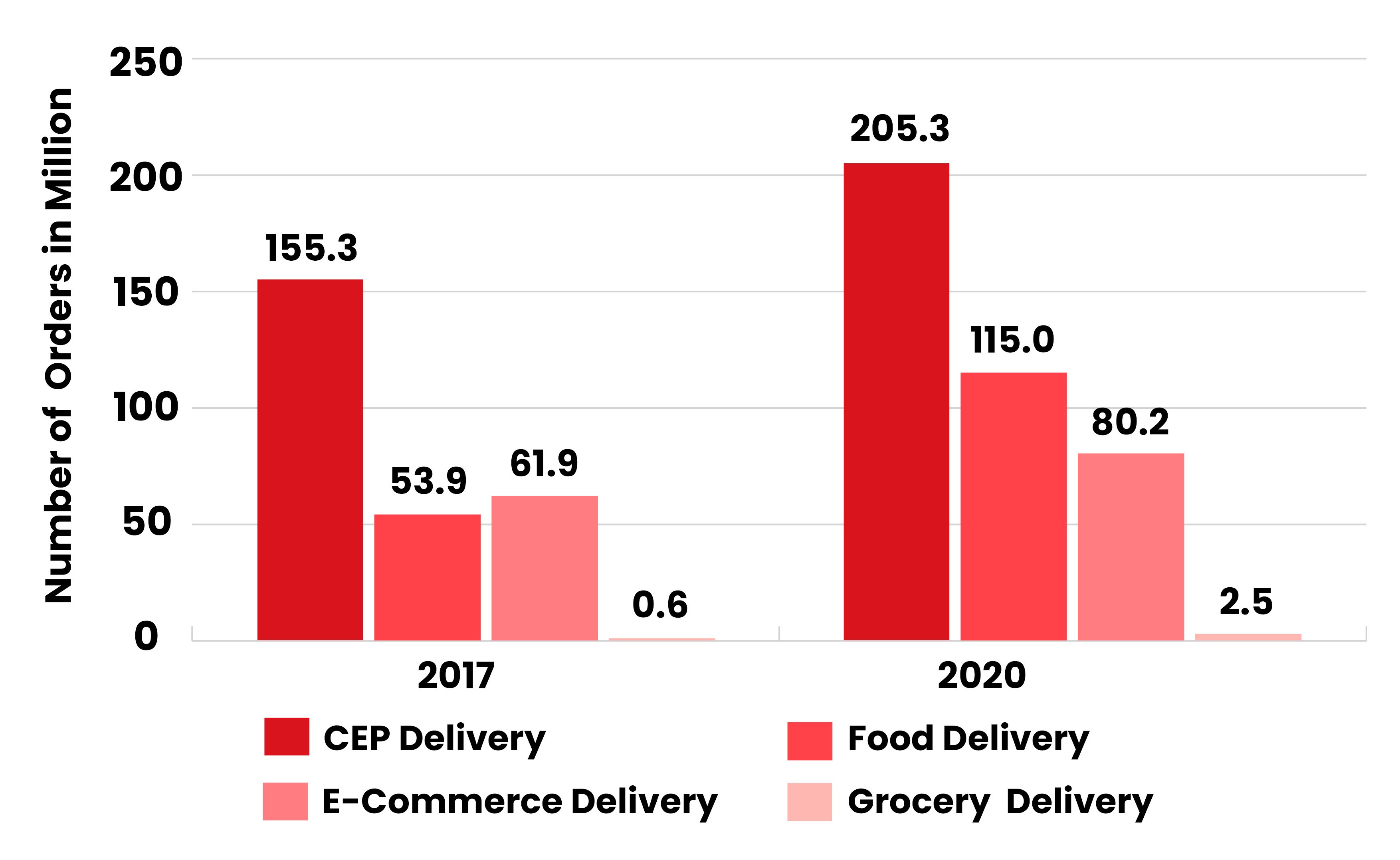

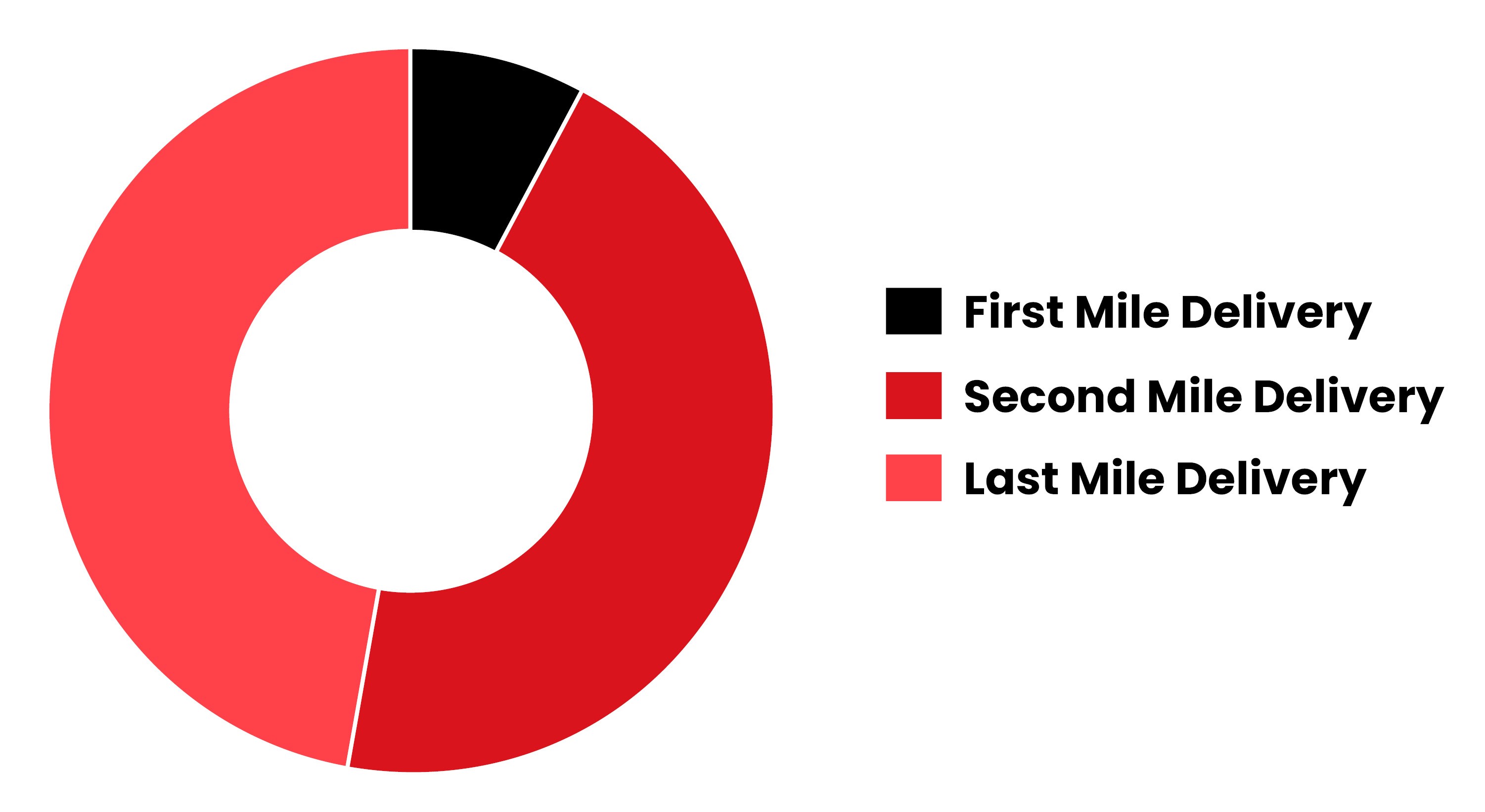

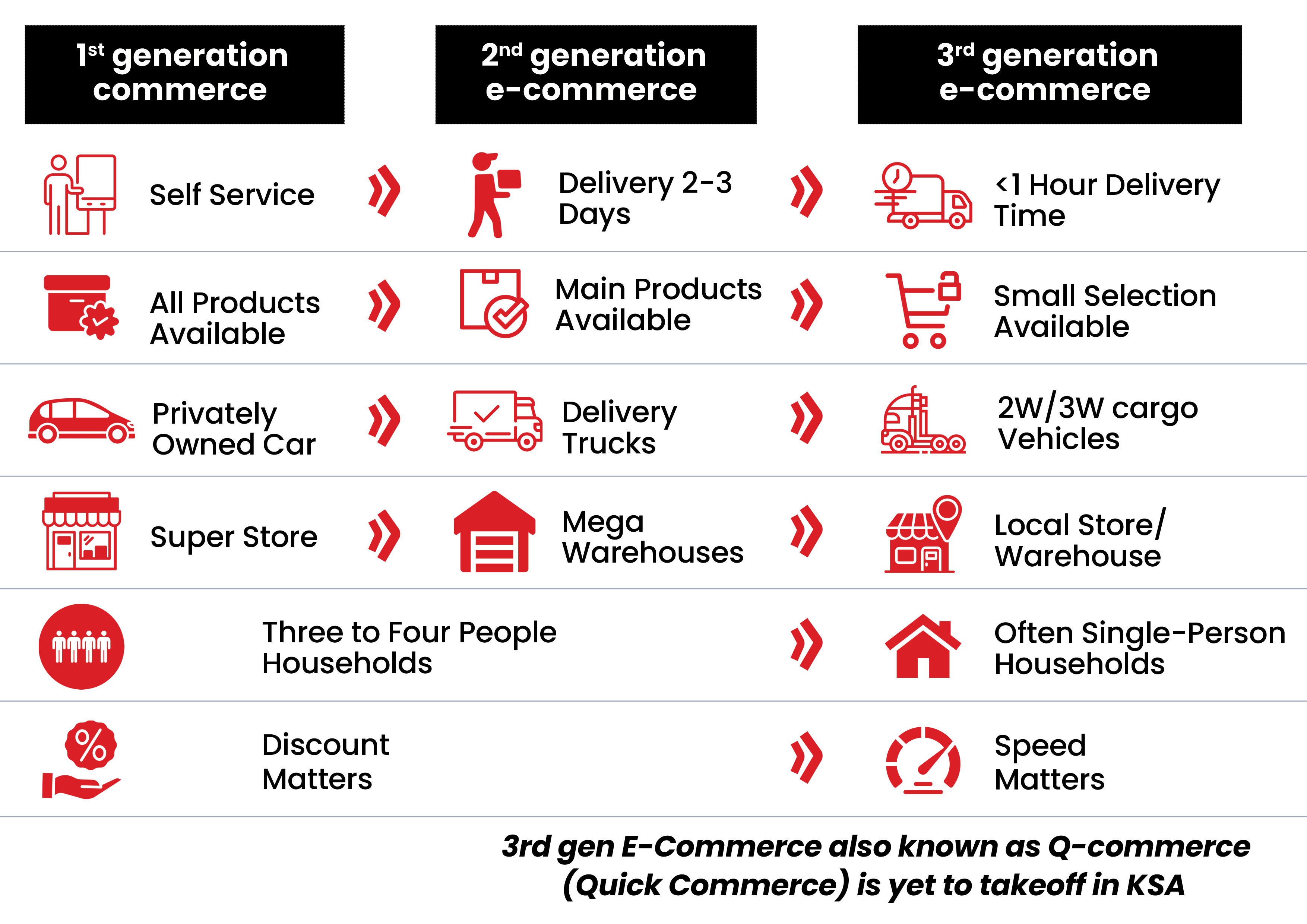

Here is an overview of the future market potential of last-mile LEVs in KSA and also how new types of vehicles like LEVs are going to help e-commerce retailers to overcome the last-mile problem.

Utilization for LEVs differs from city to city. E-commerce delivery vans usually make 45-50 deliveries in a day, with an average trip length of 100 kms in Tier 1 cities and 50 kms in Tier 2/3 cities. Online Grocery companies are expected to adopt In-Home Delivery by the year 2025 which could change the course of conducting deliveries in future.

Very few express companies in Saudi Arabia, barring the E-Commerce and Food Delivery, provide GPS real time tracking as an option to the clients demanding full access to the real-time visibility of their delivery.

Over 60% of customers in Saudi Arabia opt COD services. With higher rates of returns and failed deliveries, COD-based deliveries are estimated to be twice as expensive as prepaid orders. Most global couriers, such as FedEx and DHL, do not offer COD, limiting delivery options to regional and local players.

Vehicle routing is a complex calculation of available drivers and vehicles using the shortest routes to deliver consumer orders within the requested time windows. A routing delay or an inefficient routing mechanism can lead to missed deliveries or slipped SLAs which can greatly hamper customer experience.

Last-mile delivery failure rates range between 15%-25% in Saudi Arabia leading to poor customer satisfaction and lost revenue where returns and reattempts of E-Commerce shipments cause delays and long wait-times. The average cost of a failed delivery can go up to $16.58.

The rising competition to deliver faster has led to ecommerce and hyperlocal delivery players to partner with mobility players to expand their fleet while still staying lean on resources.

However, LEVs need to be as efficient as an ICE vehicles carrying a similar payload and covering more trips and at lesser costs.

Currently, LEVs do not promise a higher adoption potential attributed to both a high cost disparity and a lack of vehicle. Small format EVs may gain momentum in the near future , given their lower fuel and maintenance costs. They are also less dependent on charging infrastructure, since their power requirements are lower, and they are more likely to come in models that allow battery swapping.

Target Segments:

Preferable Serviceable Locations:

Initial Focus on Improving Delivery Infrastructure: