Over a period of time, the way we perceive education has changed and COVID has a big hand behind this transformation. Online learning or e-learning has become the new normal post-pandemic thanks to the plethora of ed-tech startups in India. However, the lack of access to quality education due to weak finances still remains the same.

Traditional loan lending was an option but not the go-to choice of everyone due to interest rates. But in the last 10-24 months, the collaboration of ed-tech startups with Fintech companies are trying to fix this void in India. How?

Well, in this latest white paper, we are going to talk about how the rise of the EduFin industry in India is the next wave of 'value creation' in edtech.

1. With the beginning of the 21st century, the Indian education sector is in a third wave of revolution

Digital technologies are paving the way for the growth of Education sector in India

1

First Wave

- The first wave started around 20-25 years ago with the adoption of smart boards and ERP software to manage day-to-day tasks in schools.

- Smart-boards gained popularity in initial years; available to schools at negligible investment, smart-boards enabled schools to charge higher tuition fees.

2

Second Wave

- Increased internet penetration and a fall in the cost of data and smartphone devices marked the entry of K-12 learning apps (Toppr, BYJU’s etc.) and online test prep startups (TestBook, Embibe etc.)

- The adoption of EdTech startups pushed entrepreneurs to dig deeper for sector-specific learning programmes in subjects such as IT, online certifications (Unacademy, Udemy etc), MOOCs and SPOCs.

- This expanded to the adoption of video-based learning (YouTube, Tata Sky), corporate trainings, teacher training, reskilling & STEAM (Science, Technology, Engineering, Art and Mathematics) DIY kits.

3

Third Wave

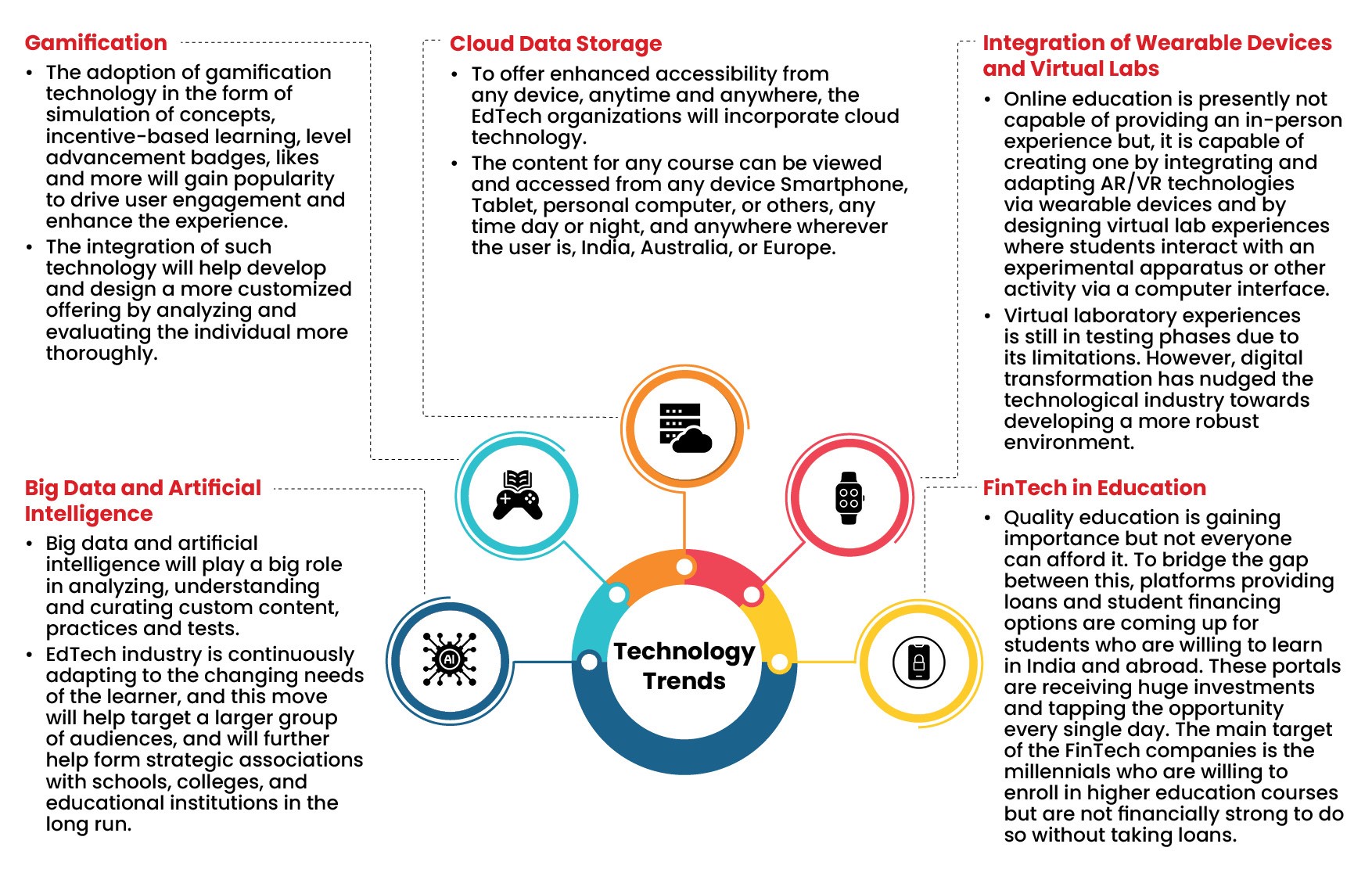

- The Indian EdTech ecosystem is placed at the forefront of new-age technologies including AI/ML, deeptech and gamification, putting customisation and personalization first; startups such as Cuemath, Emotix, iChamp and PlayShifu are leading the path.

Source: Industry Articles, Interview with EdTech Industry Experts, Ken Research Analysis

2. Presently, India is emerging as a leading EdTech market by Revenue & an ever growing market for Up-Skilling & Re-Skilling Courses

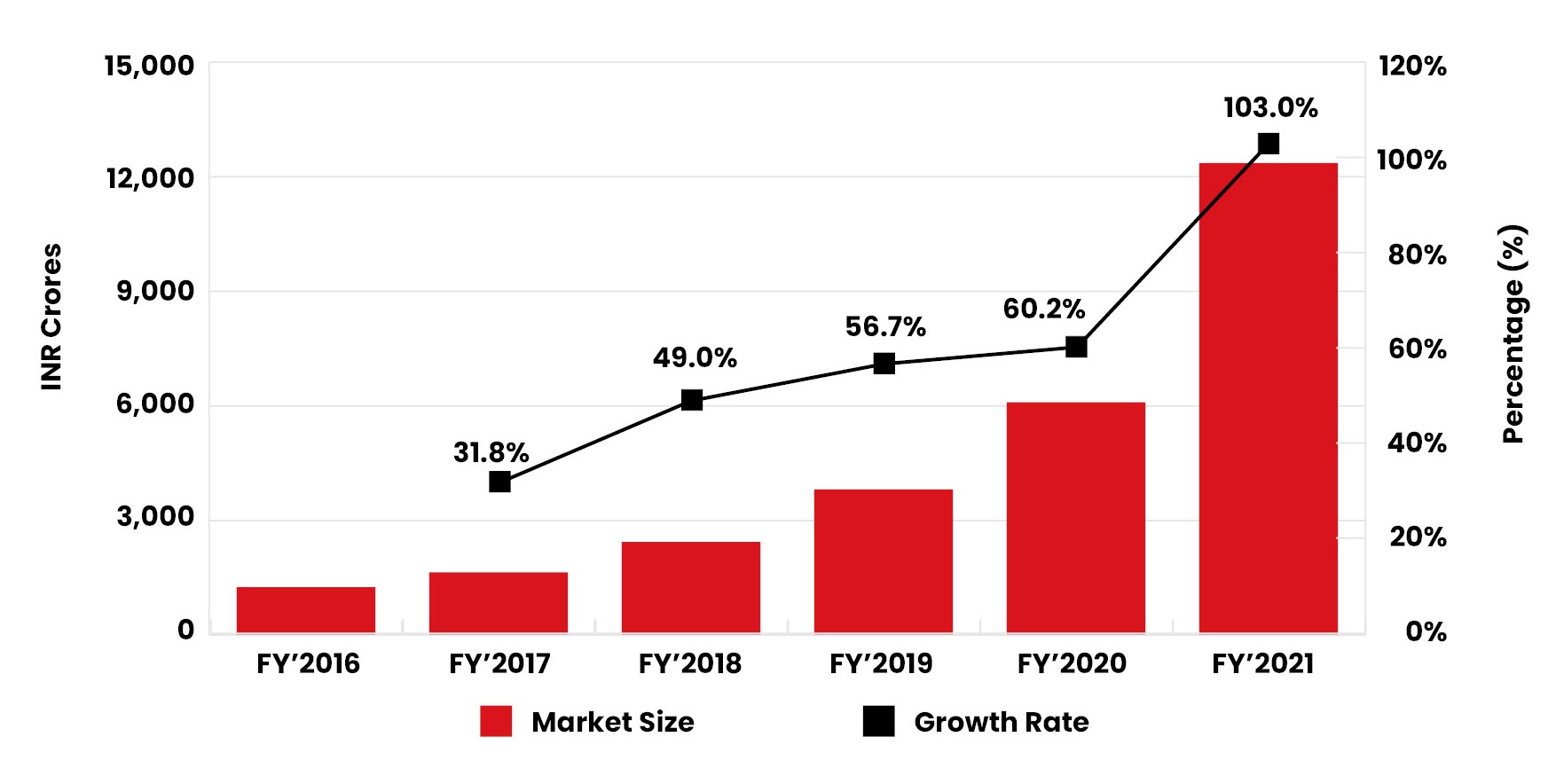

EdTech Industry growing at a CAGR of 58.5% from FY’16 to FY’21

Government Initiatives

- The Government of India is doing its best to promote online learning in the country through initiatives like the SWAYAM programme and DIKSHA.

- Also, because of lockdown restrictions in the country, the Indian Government has been encouraging the heads of Higher Educational Institutions to switch to online methods of education and ensure that the academic sessions are not interrupted.

Key Ed-Tech Supply Ecosystem Trends

Education is around US$ 100Bn market in India with 360 Mn learners in FY’20

- US$ 49Bn1 is spent on school Education, of which primary Education comprises 66% of the spend, followed by secondary Education at 27%

- US$ 42Bn1 is spent on supplementary Education, which primarily comprises private coaching and test preparation

- EdTech market can be divided into 4 segments: K-12, Test preparation, Online Higher Education, Upskill & Reskill

EdTech Market Size & Growth

- The EdTech sector is growing at a CAGR of 58.5% from FY’2016 FY’2021.

- These EdTech startups offer smart classroom solutions, adaptive learning platforms, and learning management systems.

- All these factors combined with inflow of investments, acquisition, up-gradation in offerings and more players quickly shifting and adding students are accelerating the digital learning movement.

Fragmented Competitive Landscape

- Presence of 6,900+ startups2 dominated by Byju, Toppr, Vedantu, Unacademy, Doubtnut, Adda247, etc.

- Players competing across price points, course portfolio, program delivery, tech stack, value added services & target segments

- Rising adoption of online skilling & high investor interest, expected to stimulate expansion of current players & entry of new players.

Source: Source: Industry Articles, Interviews with India EdTech Industry Experts, Ken Research Analysis

1. IVCA Reports 2. Startup Lab Report

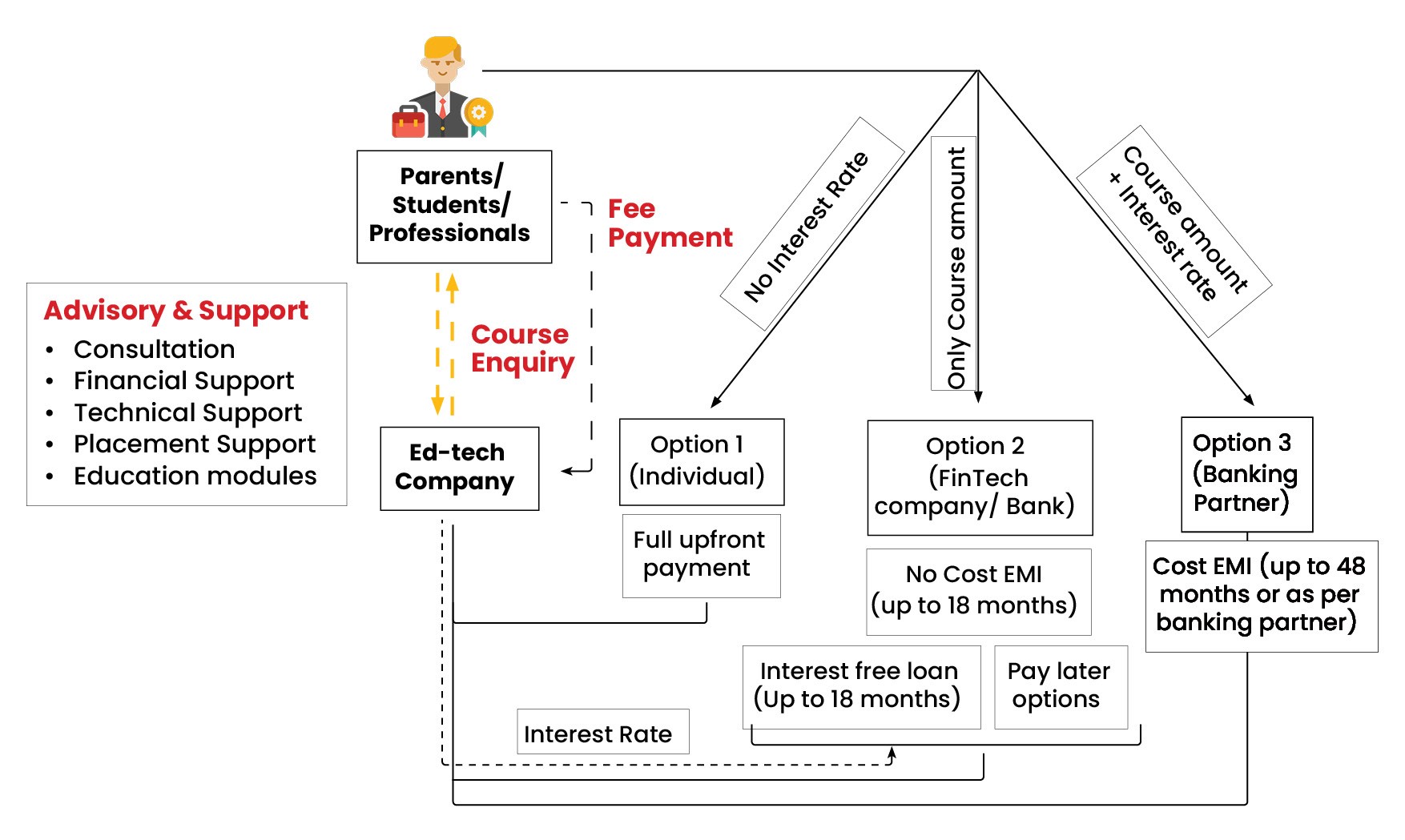

3. Edtech platforms are collaborating with FinTech companies to enable quality education accessible to more and more students

Source: Industry Articles, Interview with EdTech Industry Experts, Ken Research Analysis

4. These education finance startups are making learning affordable for millions of students in India

Key Ed-Tech Supply Ecosystem Trends

Banks via EMI Credit Cards

- Education financing options are available from leading Indian banks to assist students in achieving their academic goals.

- Interest rates for an education loan with a payback term of up to 15 years start at 6.6% (only for offline education) per year.

Fintech Companies

- Startups (Generally NBFCs) at the intersection of fintech and education focus on driving cost efficiencies for schools and affordably financing education for students.

- Interest rates for education loans range between 15-30% depending on the tenure and course opted by a student. (Interest rate keeps varying on the basis of Fintech players).

NBFCs

- NBFCs offer education loans to a wider category of offbeat courses across different colleges. NBFCs cover 100% of the total educational expenses including travel fees, tuition fees, exam fees etc without any margin money.

- Interest rates offered by NBFCs are higher than the PSU Banks ranging between 11-28%.

Source: Industry Articles, Interview with EdTech Industry Experts, Ken Research Analysis

5. FinTech companies generally offer zero cost loans to individuals pursuing vocational/educational courses from a recognized institute

Source: Interviews with India EdTech & EduFin Industry Experts, Industry Articles & Ken Research Analysis

6. Currently, the Indian EduFin Market is at an Early Growth Stage, with promising opportunities in the future

Strong Market Opportunities exist due to Increasing Digital Lending by Fintech Companies

Phase driven by Unorganized Sector

- Market was at a very nascent stage with presence of 1-2 that offer edufin services.

- Most of the EdTech loans were serviced by traditional / unorganized lenders.

- Bajaj Finserv, Eduvanz & Propelld were present in the EduFin sector.

I: Introduction Phase

<2015

Entrance of Various Startups focusing on EduFin services

- In the last 1-2 years, a new crop of startups, digital lenders, and NBFCs have been offering flexible loans at low or zero interest rates, admissions and career counselling support, and a ‘Study Now, Pay Later’ option.

- The space also got a fillip with prominent VCs, including Sequoia Capital India, Omidyar Network, Better Capital, and top angels like Kunal Shah backing edufin startups

- Expansion in service portfolio including different packages for Pre-K, K-12, College & Corporates.

II: Early Growth Phase

2015- 2025

Technological Advancements & More Investments from VCs

- Market will continue to gain momentum with the increasing investments from VCs.

- Technological development such as Blockchain, VR & AI to play active role in the growth.

- More partnerships with lending FinTechs and Large Banks or NBFCs. Industry would be highly organized in the future.

III: Growing Phase

>2025

Market Nature

- Moderately Fragmented with presence of 25+ players in the industry

Market Drivers

- Growing demand of Online EdTech courses

- Increasing cost of education

- Growth in VC funding for Edufin startups

Market Restraints

- Lack of Regulatory Authority

- High Non-Performing Assets

- High Rate of Interest

Source: Industry Articles, Interview with EdTech Industry Experts, Ken Research Analysis

7. Increasing Investments from Venture Capital Firms and Government initiatives will enable the Indian EduFin industry to experience double-digit growth in the next five years

1

Zero Percent Interest - Study Now Pay Later

- In the education financing segment, the SNPL, zero cost, and seamless pay-later options are gaining preference among the students and parents. In contrast to the traditional options, there is an increasing number of novel customer-centric financing plans for education.

- For instance, as per a revised financing model, a student can pay the complete online education fee in one go and pay it back later in multiple installments. With the zero-cost method, the students and the parents can pay for the education in small installments to the FinTech platform rather than giving a lump sum amount at one time.

2

Debt Financing from Private Equity Players

- Education loan segment has seen noticeable buzz in the past couple of years. In the last 18-24 months, a new crop of startups, digital lenders, and NBFCs have attempted to fill the void in the education finance space by offering flexible loans at low or zero interest rates, admissions and career counselling support, and a ‘Study Now, Pay Later’ option - an extension of FinTech’s popular ‘Buy Now, Pay Later’.

- The space also got a fillip with prominent VCs, including Sequoia Capital India, Omidyar Network, Better Capital, and top angels like Kunal Shah backing edufin startups such as Eduvanz & Propelld.

3

Pradhan Mantri Vidya Lakshmi Karyakram

- PMVLK is a first of its kind portal for students seeking Education Loan. It provides single window electronic platform for students to access information and prepares applications for Educational Loans and Government Scholarships. It provides information on the following:

- Educational Loan Schemes of various Banks

- Common Educational Loan Application Form for Students

- Application for Education Loan to multiple Banks

- Facility for Banks to download Students Loan Applications

- Facility for Banks to upload loan processing status

- Facility for Students to email grievances/queries relating to Educational Loans to Banks

- Linkage to National Scholarship Portal for information and application for Government Scholarships

- This initiative aims to bring on board all Banks providing Educational Loans. It is expected that students throughout the country will be benefited by this initiative of the Government, by making available a single window for access to various Educational Loan Schemes of all Banks.

Source: Interviews with India EduFin Industry Experts, Industry Articles & Ken Research Analysis