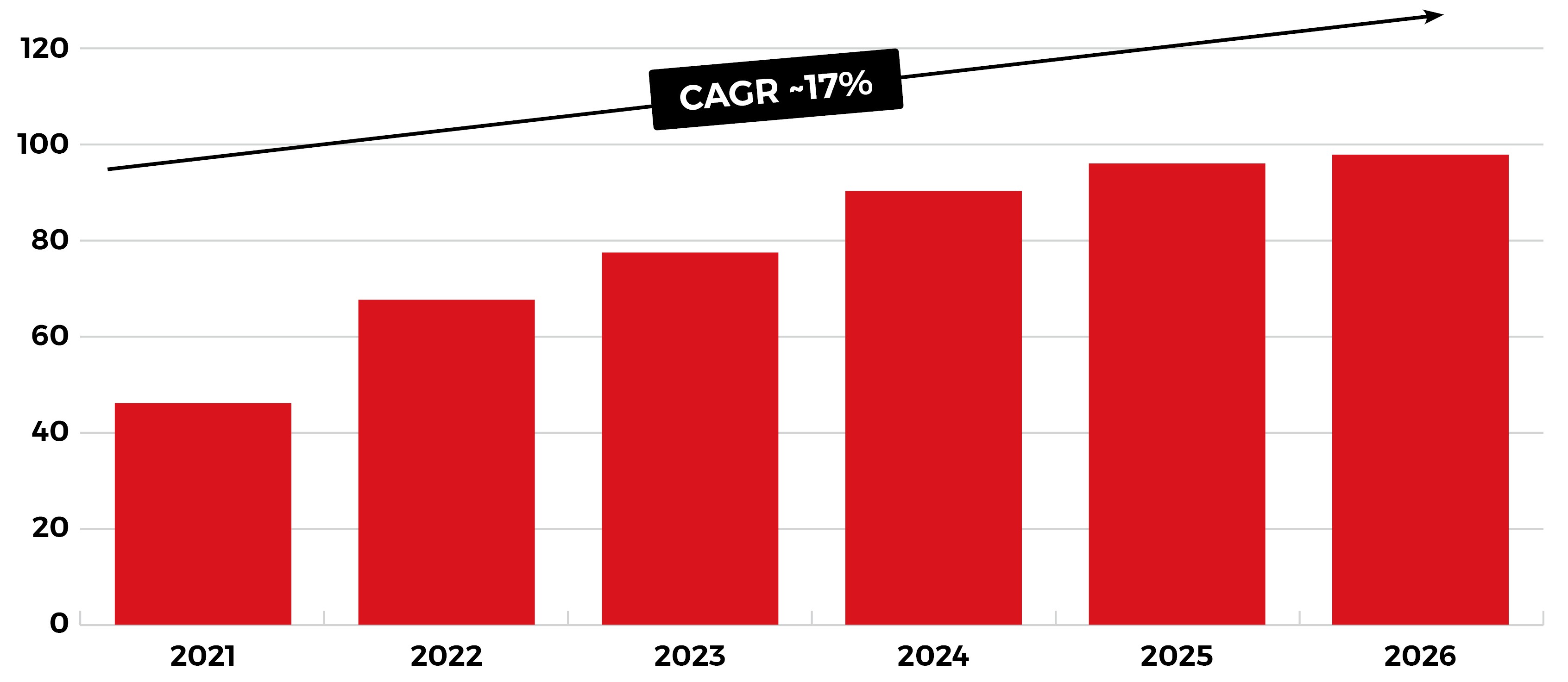

The UAE auto finance market faced a huge impact during COVID-19, but soon the market ramped up as the sales of new vehicles spiked. Presently, growing digital advancements and an increasing number of Finance Aggregators are driving the UAE auto finance industry. Further, the market is expected to grow at a CAGR of ~17% in the coming years.

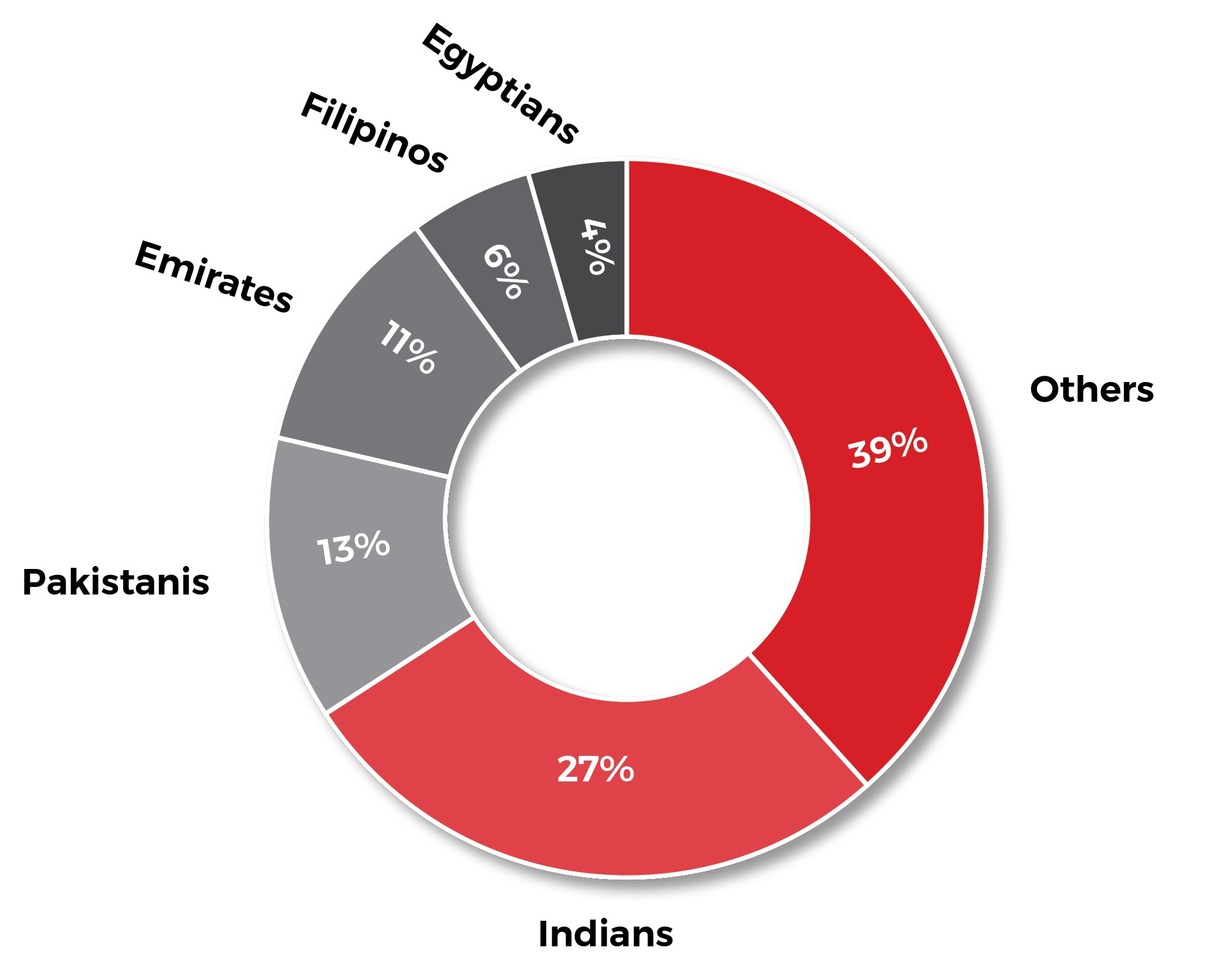

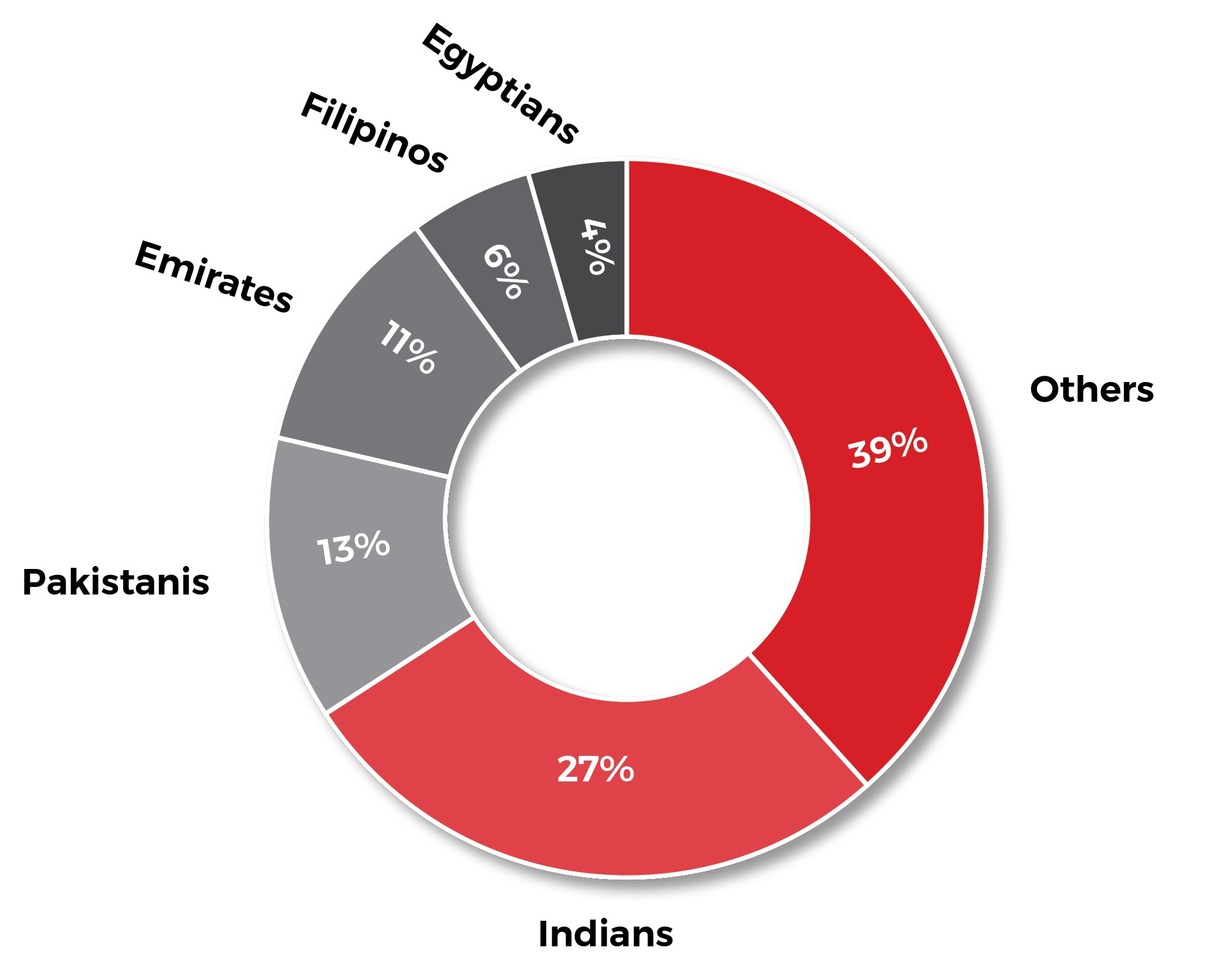

1. UAE population is constantly rising due to the high number of foreigners settling in the country who prefer owning a car over renting

UAE Country Overview

The number of foreigners settling in the UAE has increased. As a result, the population of the UAE grew to about 10 million by the end of 2021 from 2005. These people prefer having their own car over renting one.

Percentage of Citizens by Ethnic Group, 2021

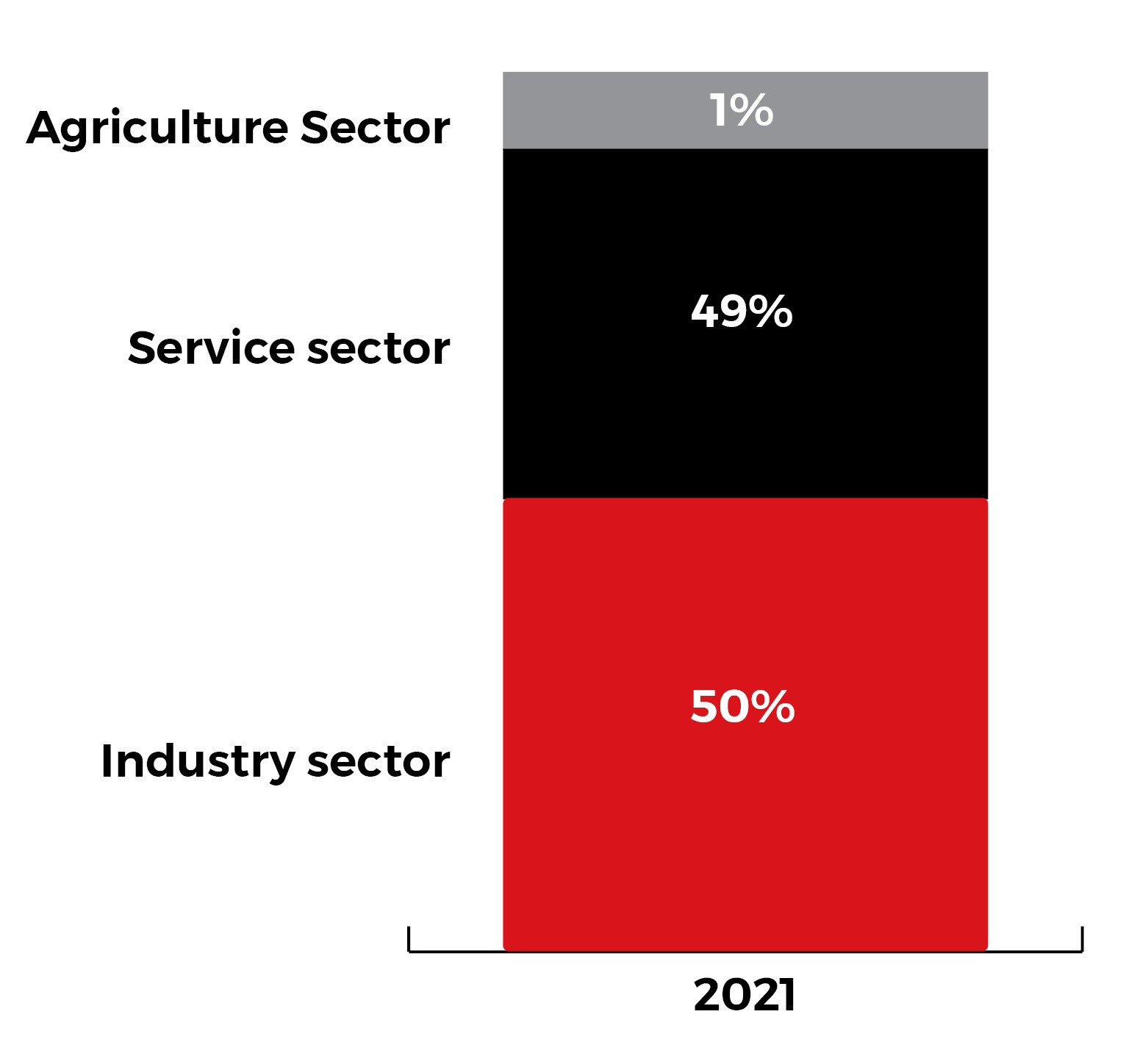

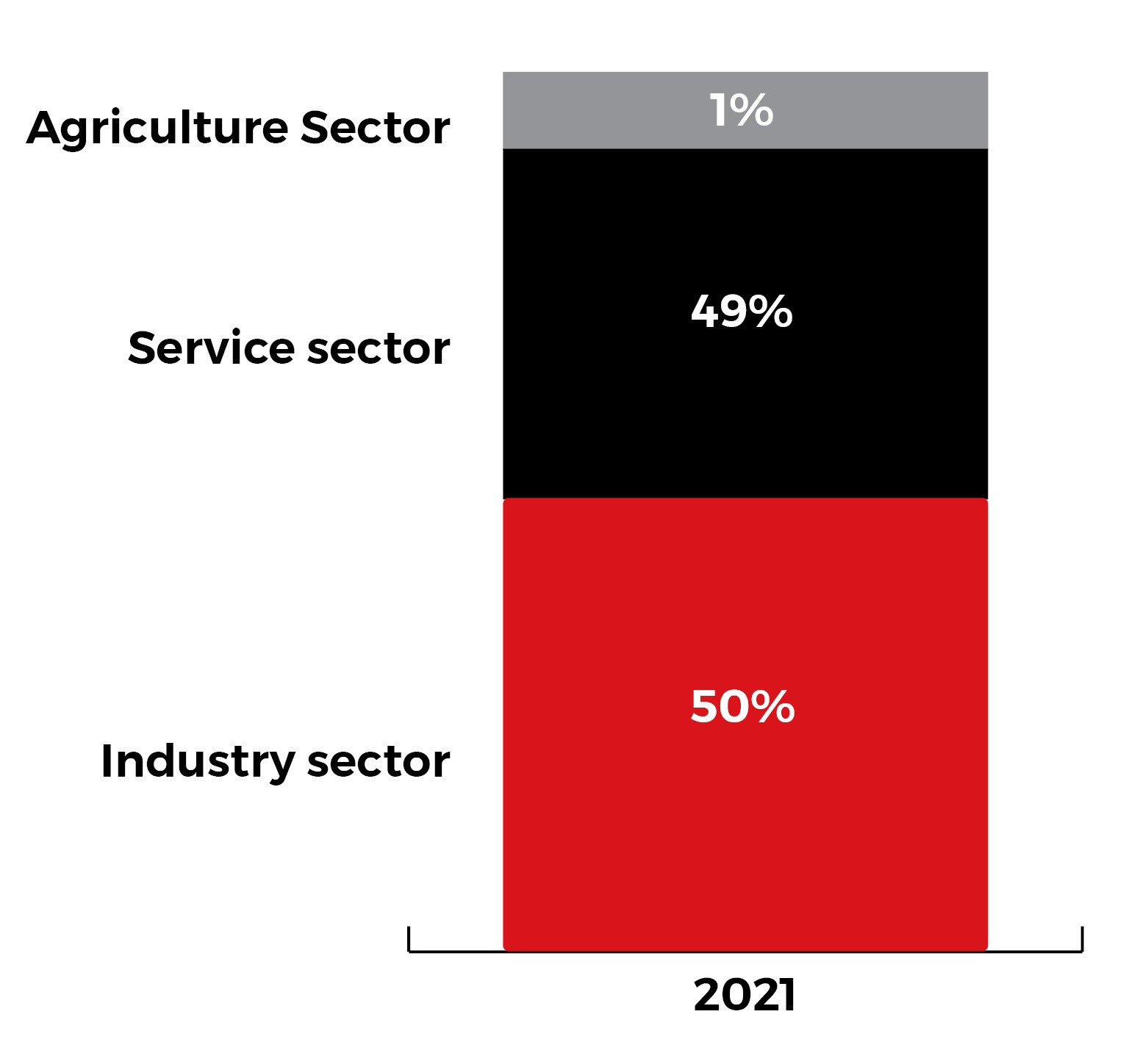

Percentage of GDP Composition Sector wise

UAE Automotive Market Overview

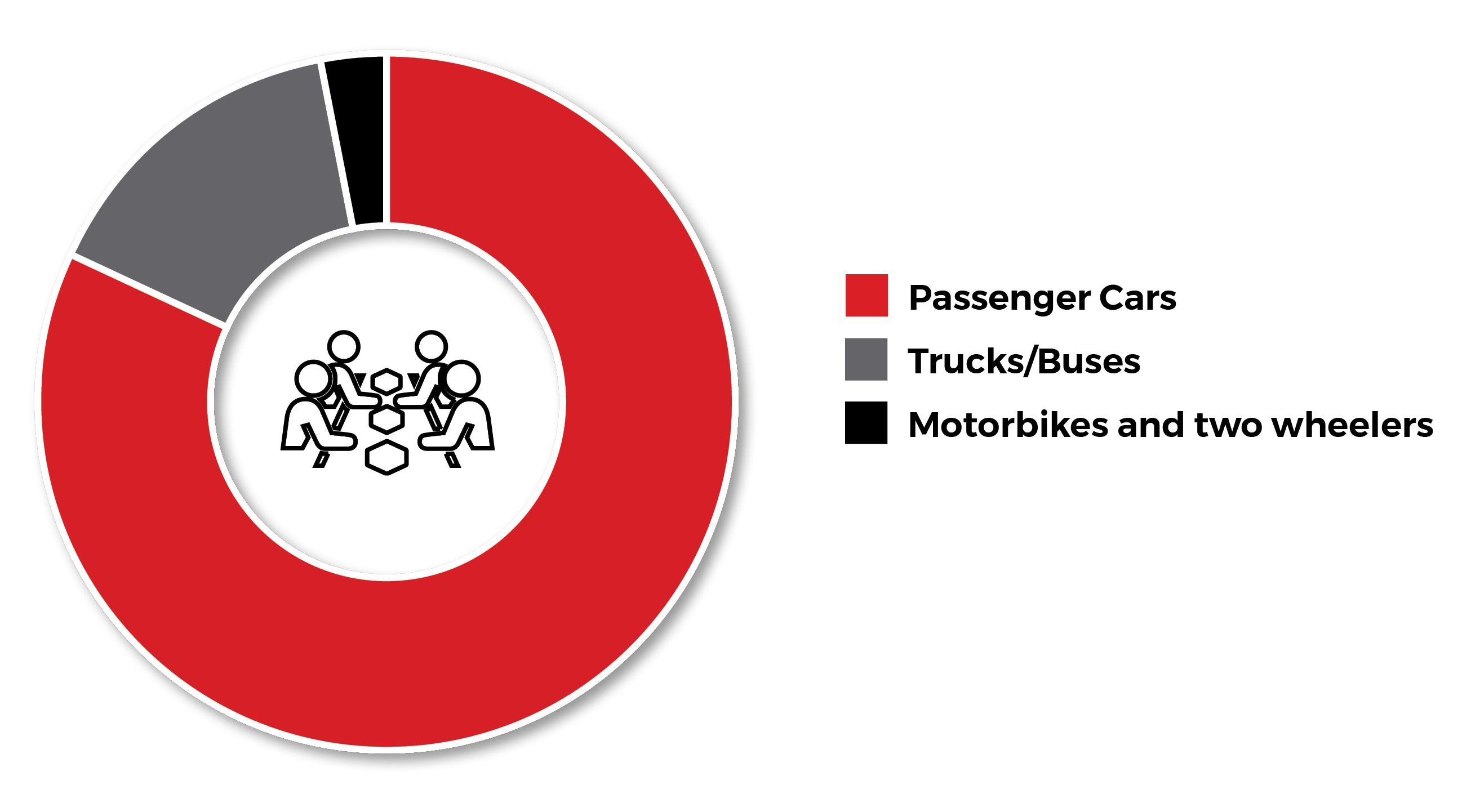

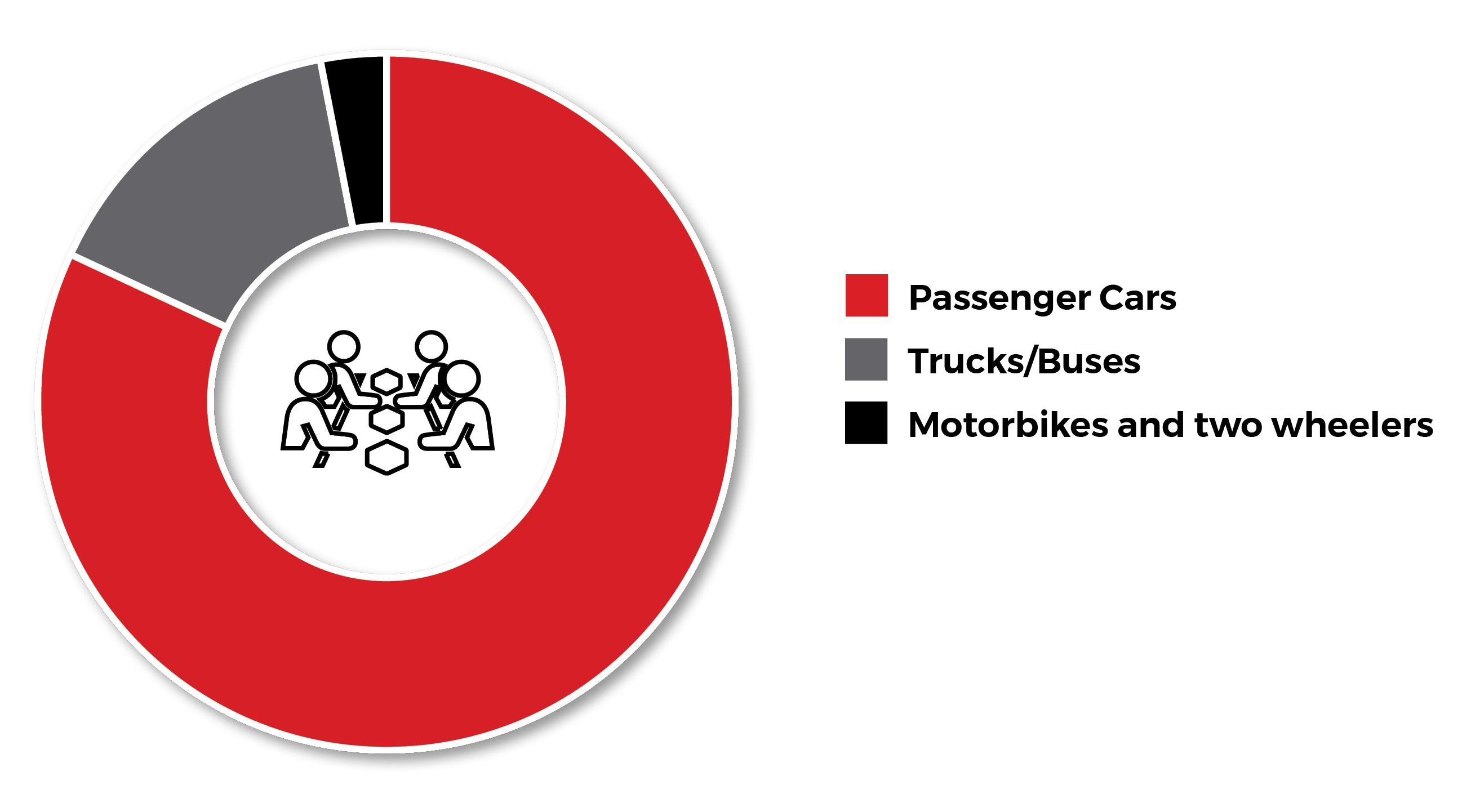

Cars are the most preferred vehicles in UAE. Trucks, busses Motorbikes and two-wheelers occupy the other half of the pie.

% contribution by type of new vehicles sold (2021)

Key Findings

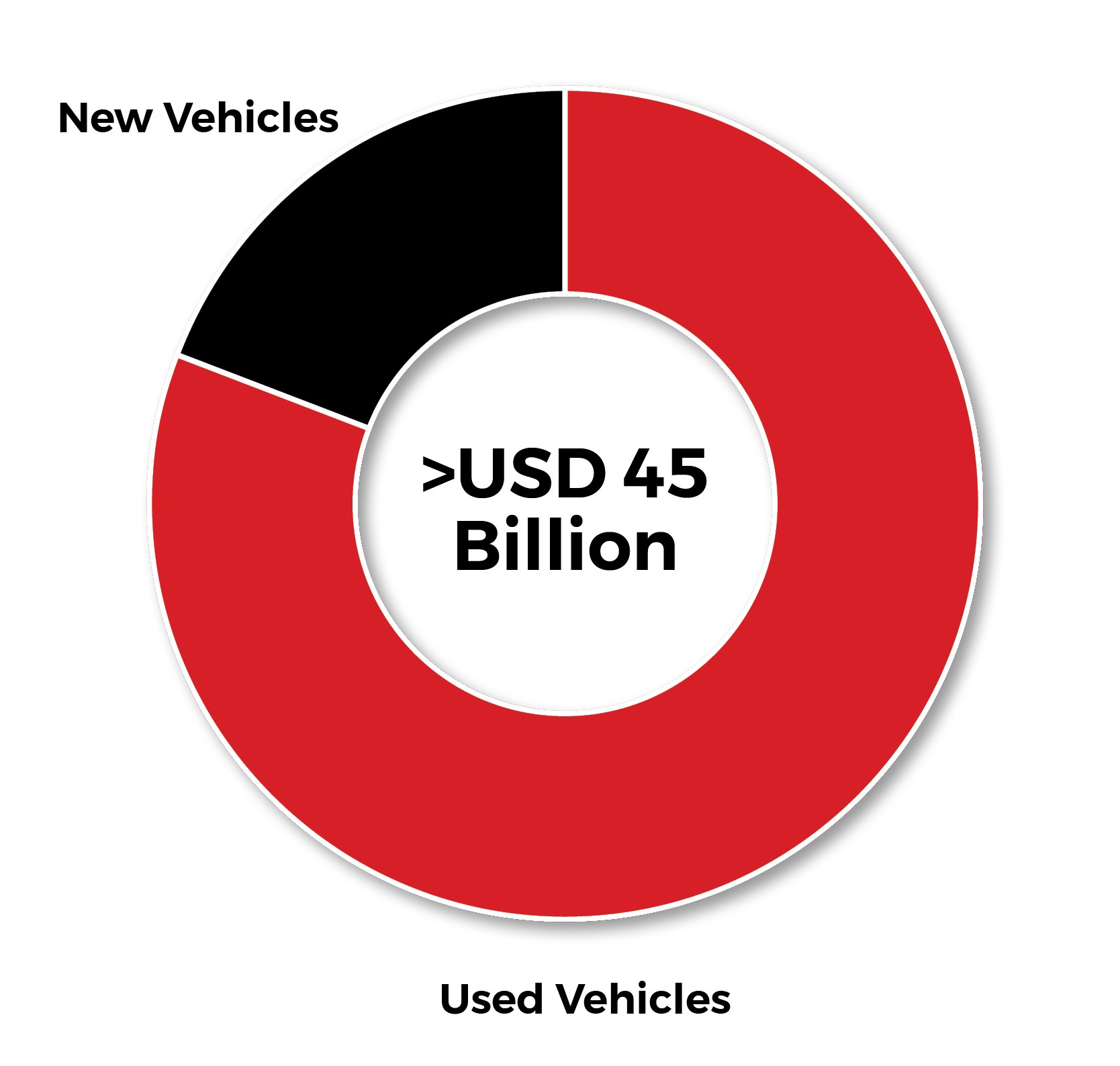

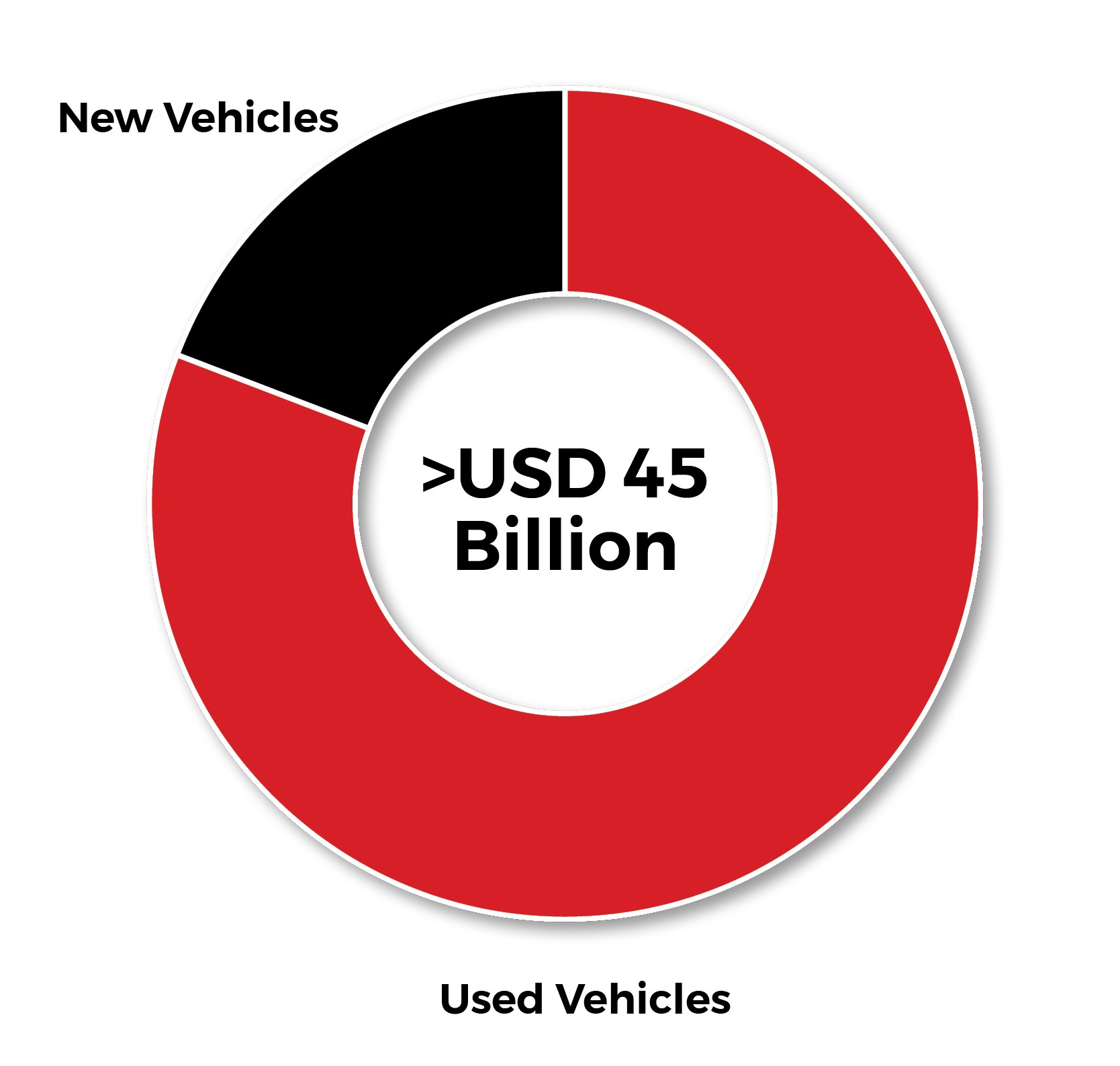

- 3.28 Old vehicles to new vehicles ratio by 2021.

- 1.74% UAE Automotive Market Forecasted CAGR for the period between 2022 and 2026.

- 5.76 (in USD Bn) Projected Market Volume of the UAE Automotive Market in 2026.

2. Customers in UAE prefer buying used vehicles over new ones due to less cost, and similar rates of interest on auto finance loans

UAE Auto Finance Market Segmentation by Ownership of Vehicles, 2021

Key Observation

Unlike other countries like India where customers shy away from buying used cars, UAE is a country whose people understand the value proposition offered by used vehicles, and opt for them in order to get all the luxuries on offer at a fraction of the price. Also, the interest rates for used car loans are quite similar to those on new cars, unlike other countries where interest rates on used car loans are atrociously high.

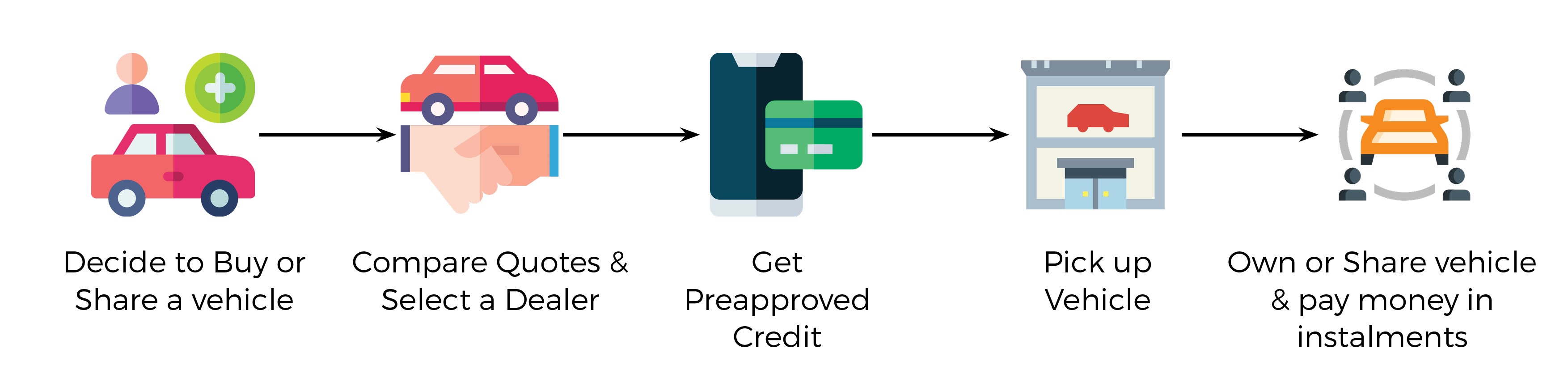

Types of Car Loans in the UAE Auto Finance Industry

New Car Loan

New Car Loan is a loan for new cars. Customers can borrow up to 80% of the value of the car they are trying to purchase, according to guidelines set by the Financial Authority of UAE. Interest rates for the last quarter of 2021 were around 2.49% per annum.

Similar to the new car loan system, in this case, the interest rates were around 3.19% per annum, for the last quarter of 2021. The interest rate is higher because used cars often do not come with a warranty, and their resale value often varies, making it hard to pinpoint their actual value.

Used Car Loan

Lease buyouts

For lease buyouts, the car dealer plays the role of a middleman to secure a loan from the bank on the customer’s behalf. This is basically leasing the car to the customer until the entire cost of the car has been paid off, after which ownership of the car is transferred to the customer.

Refinancing is basically the replacement of an existing debt obligation (automotive loan) with another debt obligation (automotive loan) under a different term and interest rate. This may get the lower monthly payments at better interests of ~3.5% which helps to strategize the finance for a certain duration.

Refinancing

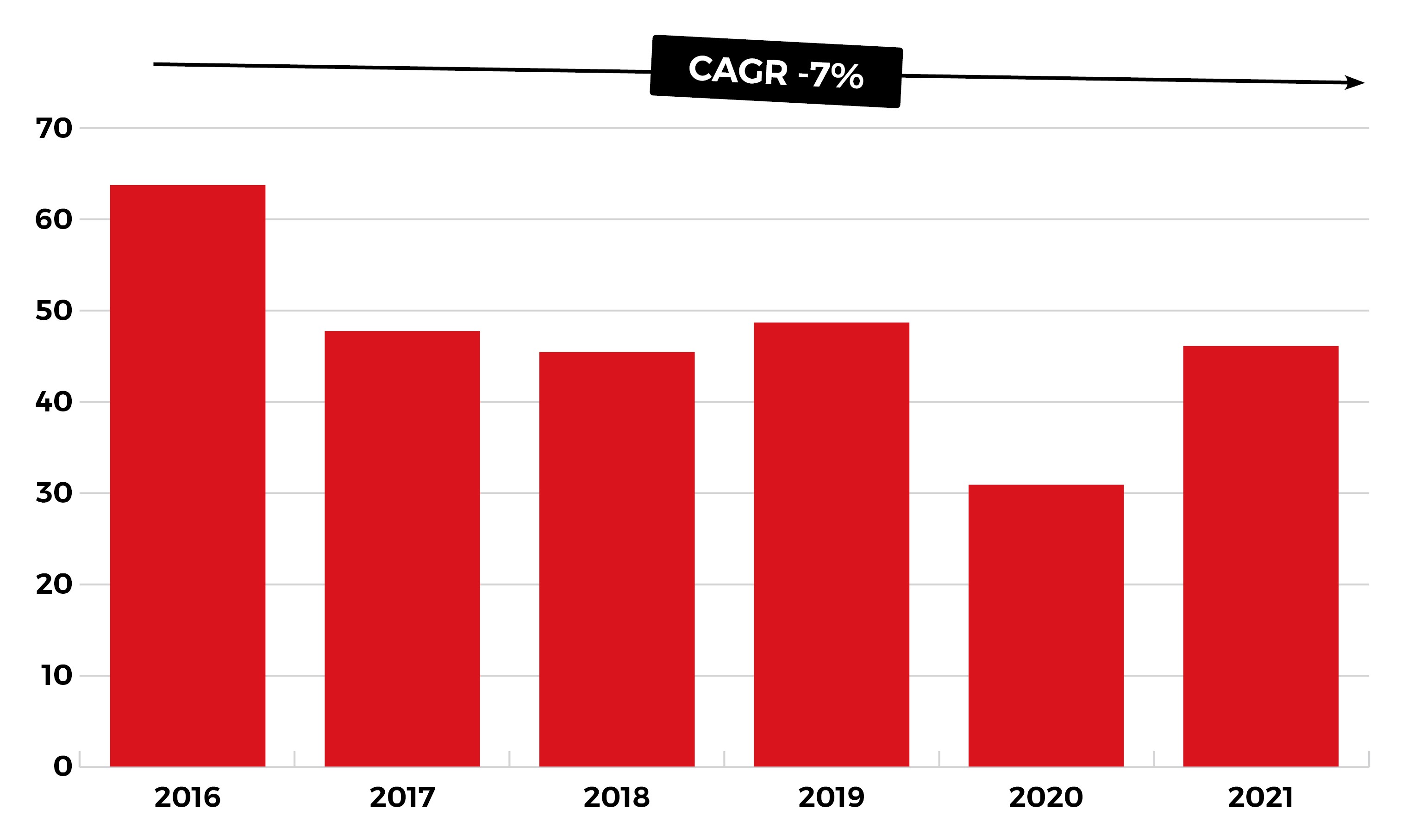

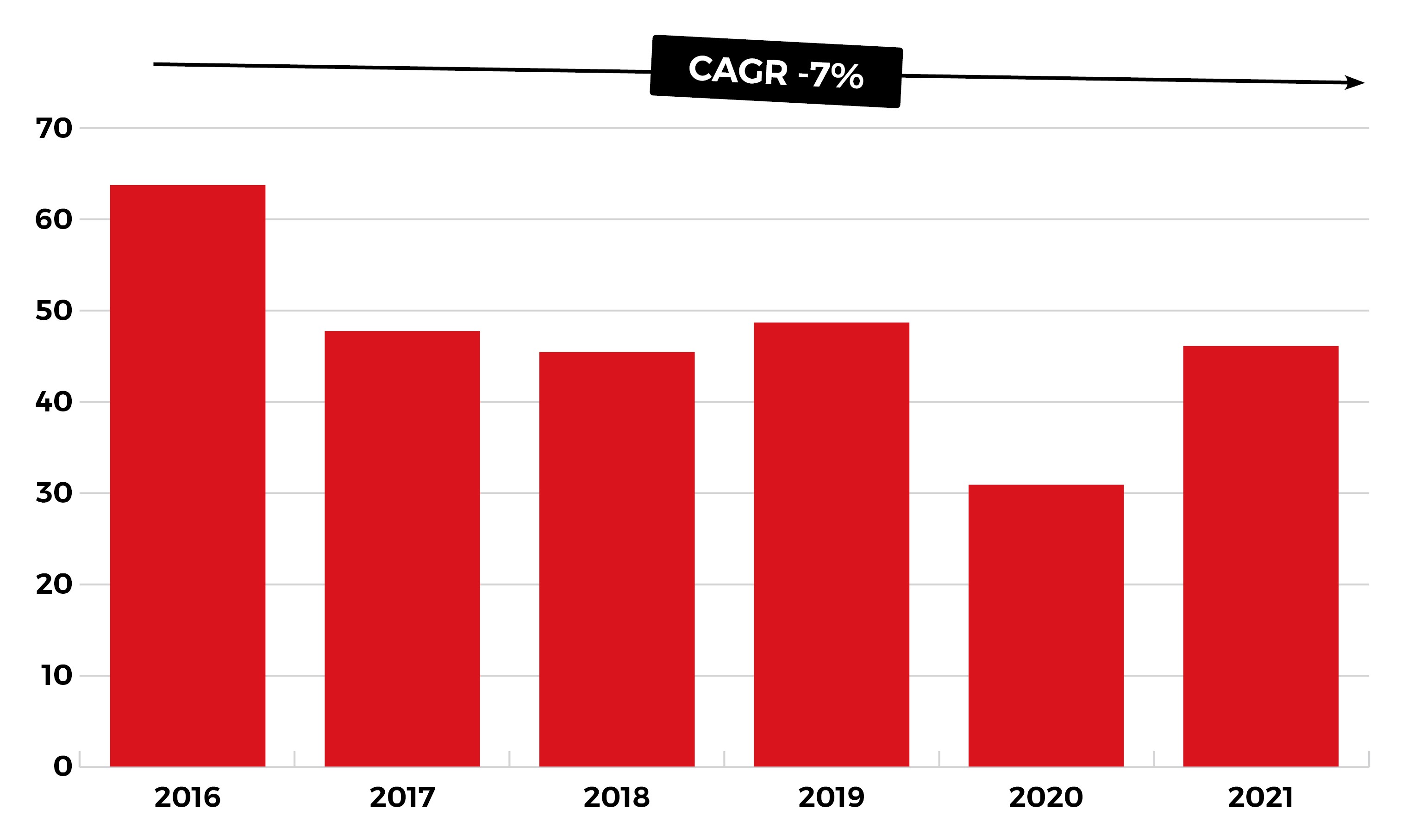

3. UAE Auto Finance Market has decreased from 2016 to 2021 at a CAGR of around -7% owing to government regulations, lifestyle changes and the COVID-19 lockdown.

Market size of UAE Auto Finance sector (in terms of Credit Disbursed) reduced with a CAGR of -7% between 2016 and 2021, in Bn USD

Market Structure, Infrastructure, and Facts

- On average, interest rates for auto loans start from 2.75%, making it very easy for loan-seeking individuals to opt for a loan.

- 18% of system-wide loans have been restructured due to COVID-19.

- The Central Bank of UAE and DFSA have mandated a 20% down payment requirement for vehicle loans extended by multi-finance companies in a bid to keep the industry tightly regulated.

Government Regulations in the UAE Auto Finance Market

The UAE Auto Finance Market is regulated by The Central Bank of the United Arab Emirates, and the Dubai Financial Services Authority (DFSA)

Eligibility Criteria for Auto Finance in the UAE

- Residential Status: One must be a citizen or an expat living in the country.

- Age: One must be between the ages of 21 and 65, and hold a valid driving license.

- No more than 60 months: Loans for financing new or used cars have a tenure of up to a maximum of 60 months. However, the maximum tenure of a loan can be shorter for older used cars.

- 20 percent down payment: Consumers can only finance 80 percent of the new or used car’s value, which implies a 20 percent down payment.

- At least Dh 25,000: Many banks have a minimum loan value they are willing to finance, which is generally around Dh20,000. Since banks finance 80 percent of the car’s value, this means a minimum car value of Dh25,000 is required for the car to qualify for financing (that is 80 percent of Dh25,000 which yields a Dh20,000 loan)

- Monthly Payments must be less than half one’s salary: The resulting EMI of the car loan cannot be greater than half of one’s salary minus existing liabilities, which includes credit cards.

4. Monthly payment restrictions, down payment, loan tenure restrictions, and the time consumed in the process are some of the other challenges faced by end-users in UAE Auto Finance Industry

Challenges faced by End Users in UAE Auto Finance Market

clinical_notes

Time Consuming Process

- Often high amount of paperwork is required for a salesperson and customer to complete an average car loan application in UAE. Generally, it takes 5 to 7 days to process a loan, assuming all documents are complete.

- Consumers also face difficulty understanding loan features during the loan negotiations owing to which they often find the terms of their auto financing confusing and time-consuming

other_admission

Loan Tenure

- Loans for financing new or used cars have a tenure of up to a maximum of 60 months. However, the maximum tenure of a loan can be shorter for older used cars.

- For example, some banks require that a used car is no older than 10 years upon completion of the loan. As a result, a 2014 model bought today could only secure finance for under two years.

heap_snapshot_multiple

Down Payment

- Consumers can only finance 80 percent of the new or used car’s value, which implies a 20 percent down payment. This restricts the capacity to take a loan as a certain fixed amount is to be paid only at the time of taking the loan.

- The down payment is generally paid directly to the bank, which then settles the car’s full value with its owner.

block

Monthly Payment Restrictions

- This means that the resulting Equal Monthly Installments (EMI) of the car loan cannot be greater than half one’s salary minus existing liabilities, which includes credit cards. If one already has any other loan and he/she is paying off say Dh1,000 a month, then the new loan’s monthly installment cannot be more than Dh4,000, and so on.

- This restriction greatly hinders the capacity of the loan that can be taken, despite some people having a higher risk appetite.

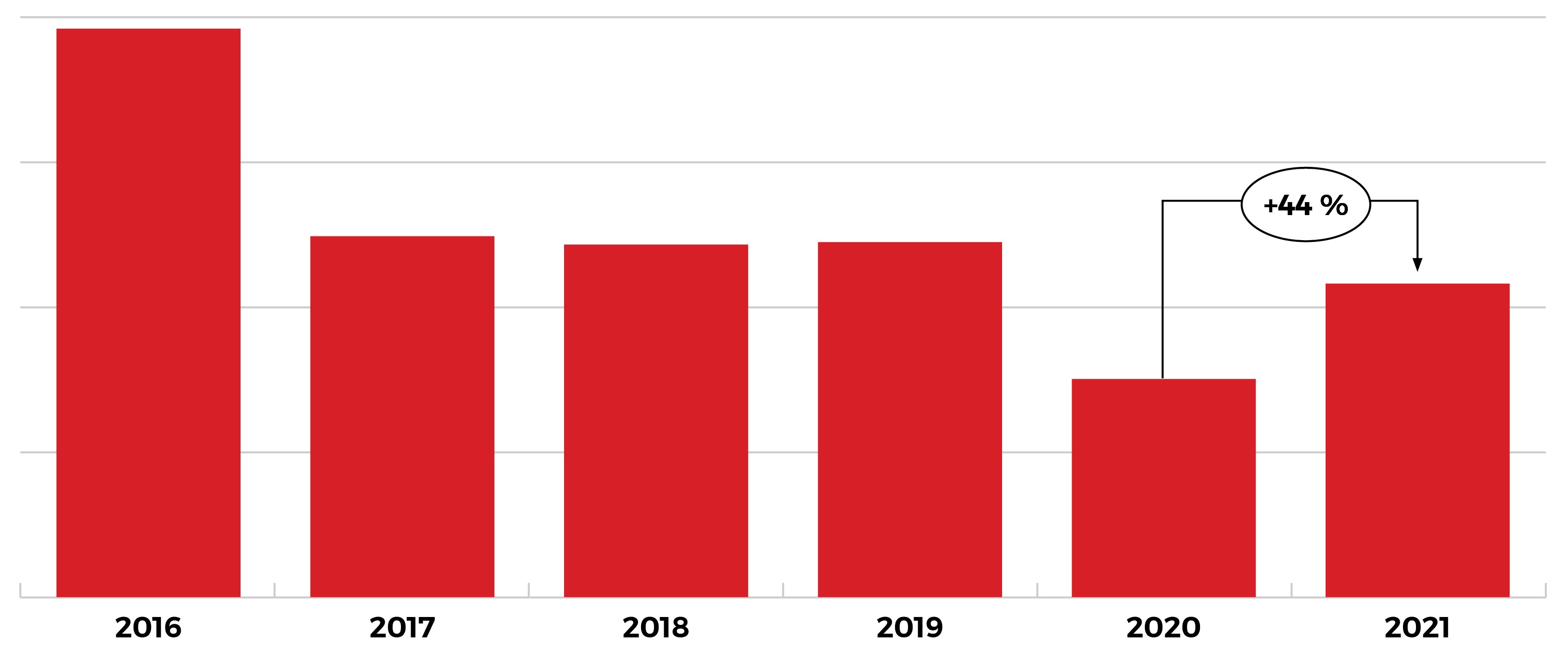

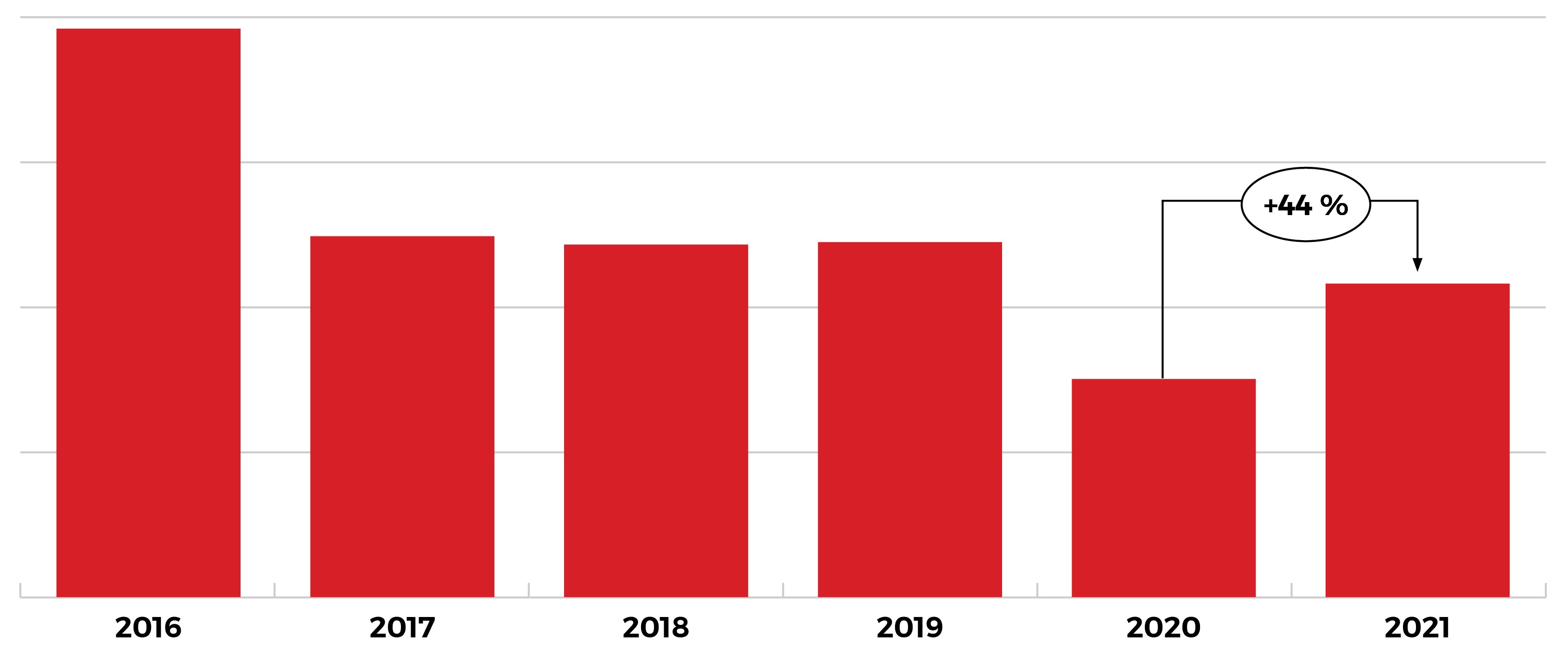

5. Although the sale and financing of vehicles dropped sharply in 2020 owing to the COVID-19 pandemic, it picked up again in 2021 due to consumers preferring personal vehicles

UAE witnessed a sharp decline in automotive sales in 2020 owing to the COVID-19 pandemic but the market ramped up in 2021.

Key Future Implications of COVID on the Future of the Industry

Increase Digitization in the Industry

Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing digital showrooms as well as e-finance

Preference of Personal Vehicles

Before COVID-19, not a lot of UAE residents preferred personal vehicles. But with the outbreak of the pandemic, this proportion increased by a huge margin

Financial Support Provision

Auto Finance Companies and Dealerships are also expected to further increase their financing and contracting options making them more flexible to support retail Sales.

5. Rising demand for automobiles, the growing finance industry, and the potential for fintech growth are the major developments in the UAE Auto Finance Industry

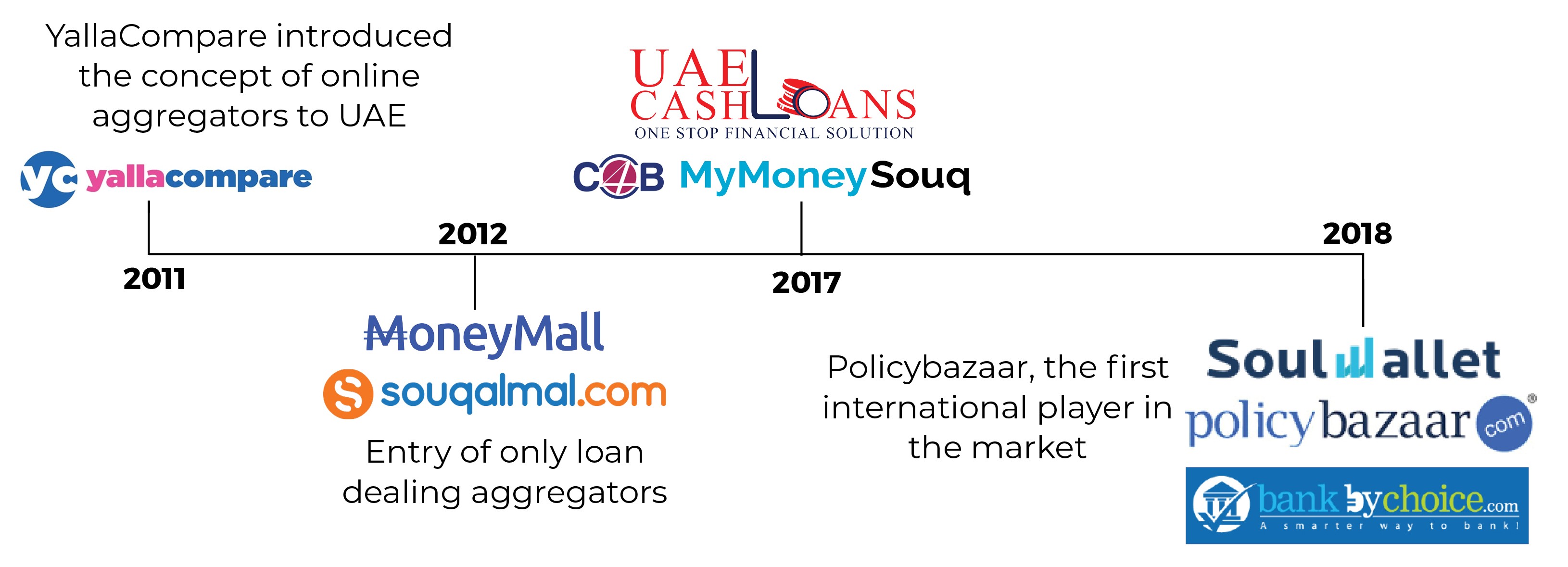

Trends and Developments in UAE Auto Finance Market

Rising Demand for Automobiles

UAE’s low import and fuel costs, conducive tax regime and high disposable incomes have also helped strengthen the automobile sector and encourage global giants like Toyota, Nissan, Mitsubishi, etc. to set up shop here and manufacture in the country. The government has also been encouraging research and development with regards to autonomous or driverless vehicles such as the RTA and General Motors backed “Cruise” that is operating Chevrolet Bolt EVs across the city to create and maintain a navigable map for autonomous vehicles.

Flexible Models of Financing

Younger, tech-savvy buyers, who expect to manage their finances remotely on a mobile device or computer are gaining market share. AI is increasingly making important decisions to offer a very different proposition to third party funders, brokers and banks. Yap, Wio and Zand are pioneering a wave of mobile banking apps that take the branchless model popularized in Europe and the U.S. as their model while catering specifically to the needs of customers in the UAE and its GCC neighbors.

Growing Auto Finance Industry

The vibrant automobile industry in the UAE has spawned auto financing with longer terms and alternative financing. The increase in demand for personal mobility has attracted many new players to the industry, who contribute to the competitiveness of the environment and in the end benefits car buyers with attractive finance schemes. Ideal location, increasing domestic demand for high-end cars and a robust logistics sector have turned the emirate into a major hub for auto finance.

Potential for Fintech Growth

The Emirates has established fintech adoption and growth as its central national priority, shaping the path for digital financial services to become a profound innovation that would modernize the region’s financial status. Fintech in the UAE will prove to be a phenomenal sector reflecting the nation’s regional progress. App-based solutions on offer from the UAE’s banks include Liv and E20 by Emirates NBD, and the Abu Dhabi Islamic Bank’s (ADIB) ADIB Smart Banking and ADIB Amwali.