Region:Africa

Author(s):Shubham

Product Code:KRAA0868

Pages:95

Published On:August 2025

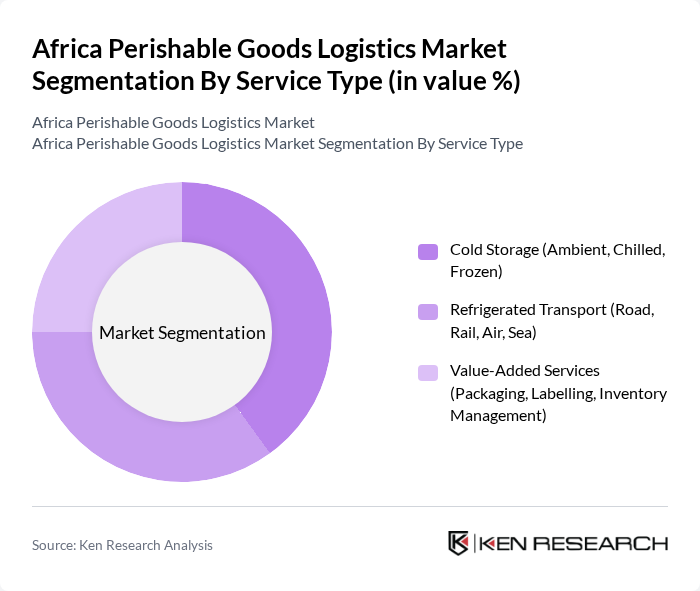

By Service Type:The service type segmentation includes various methods of handling and transporting perishable goods, which are crucial for maintaining product quality and safety. These services encompass cold storage (ambient, chilled, frozen), refrigerated transport (road, rail, air, sea), and value-added services such as packaging, labelling, and inventory management. The integration of IoT and tracking technologies is increasingly common for real-time monitoring and quality assurance .

The cold storage segment is currently dominating the market due to the increasing need for temperature-controlled environments to preserve the quality of perishable goods. This segment includes ambient, chilled, and frozen storage solutions, which are essential for various products, including fruits, vegetables, dairy, and meat. The growing trend of online grocery shopping and export-oriented agriculture has further amplified the demand for cold storage facilities, as retailers and exporters seek to ensure product freshness during distribution. As a result, cold storage is expected to maintain its leadership position in the logistics market .

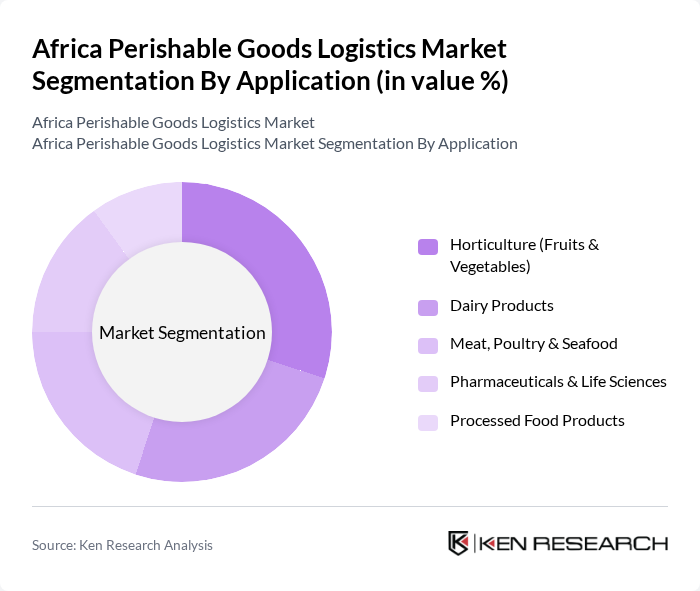

By Application:The application segmentation focuses on the various sectors utilizing perishable goods logistics, highlighting the diverse needs across industries. Key application areas include horticulture (fruits and vegetables), dairy products, meat, poultry and seafood, pharmaceuticals and life sciences, and processed food products. Each sector has specific requirements for temperature, handling, and traceability, with increasing demand for compliance with international standards .

The horticulture application segment is leading the market, driven by the rising demand for fresh fruits and vegetables, particularly in urban areas. The increasing health consciousness among consumers has led to a surge in the consumption of fresh produce, necessitating efficient logistics solutions to ensure timely delivery and quality preservation. Additionally, the growth of export markets for African horticultural products and the expansion of organized retail have further solidified this segment's dominance in the logistics landscape .

The Africa Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CCS Logistics, Vector Logistics, Cold Solutions East Africa, Kold, HFR Transport, Africa Global Logistics (AGL), DHL Supply Chain, Maersk, Imperial Logistics, Bidvest Logistics, Bolloré Logistics, Transnet Freight Rail, Coolworld Rentals, Yamato Transport Co Ltd, and Nippon Express contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Africa perishable goods logistics market appears promising, driven by technological advancements and increasing consumer demand for fresh products. As e-commerce continues to expand, logistics providers are likely to invest in automation and IoT solutions to enhance efficiency. Furthermore, the focus on sustainability will push companies to adopt eco-friendly practices, aligning with global trends. Overall, the market is poised for growth, with significant opportunities for innovation and collaboration within the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cold Storage (Ambient, Chilled, Frozen) Refrigerated Transport (Road, Rail, Air, Sea) Value-Added Services (Packaging, Labelling, Inventory Management) |

| By Application | Horticulture (Fruits & Vegetables) Dairy Products Meat, Poultry & Seafood Pharmaceuticals & Life Sciences Processed Food Products |

| By End-User | Food Retailers (Supermarkets, Hypermarkets) Food Manufacturers Restaurants and Catering Services Healthcare & Pharmaceutical Companies |

| By Region | Southern Africa (South Africa, Namibia, Botswana, etc.) East Africa (Kenya, Tanzania, Uganda, etc.) West Africa (Nigeria, Ghana, Côte d'Ivoire, etc.) North Africa (Egypt, Morocco, Algeria, etc.) Central Africa (Cameroon, DRC, etc.) |

| By Temperature Range | Ambient Chilled Frozen |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Others | Specialty Products Organic Produce Niche Market Segments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distribution | 100 | Logistics Coordinators, Supply Chain Managers |

| Dairy Product Logistics | 80 | Operations Managers, Cold Chain Specialists |

| Meat and Seafood Transport | 70 | Procurement Managers, Quality Assurance Officers |

| Floral and Plant Logistics | 50 | Floral Supply Chain Managers, Distribution Supervisors |

| Export of Perishable Goods | 60 | Export Managers, Compliance Officers |

The Africa Perishable Goods Logistics Market is valued at approximately USD 9 billion, driven by increasing demand for fresh produce, dairy, and meat products, as well as the growth of e-commerce and retail sectors across the continent.