Region:North America

Author(s):Dev

Product Code:KRAA0427

Pages:92

Published On:August 2025

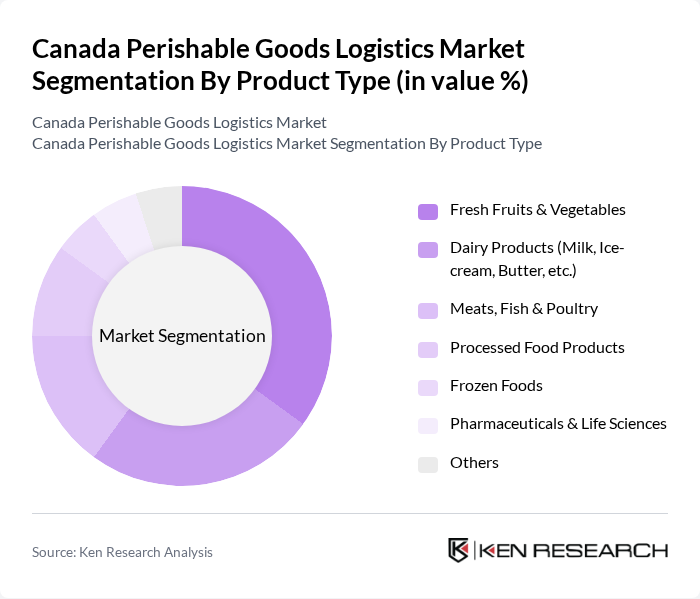

By Product Type:The product type segmentation includes various categories such as Fresh Fruits & Vegetables, Dairy Products, Meats, Fish & Poultry, Processed Food Products, Frozen Foods, Pharmaceuticals & Life Sciences, and Others. Among these, Fresh Fruits & Vegetables are leading the market due to the growing consumer preference for healthy eating and organic produce. The demand for dairy products is also significant, driven by the increasing consumption of yogurt and cheese. The market is characterized by a trend towards organic and locally sourced products, influencing logistics strategies. The chilled and frozen segments, particularly horticulture and dairy, are major contributors to market expansion .

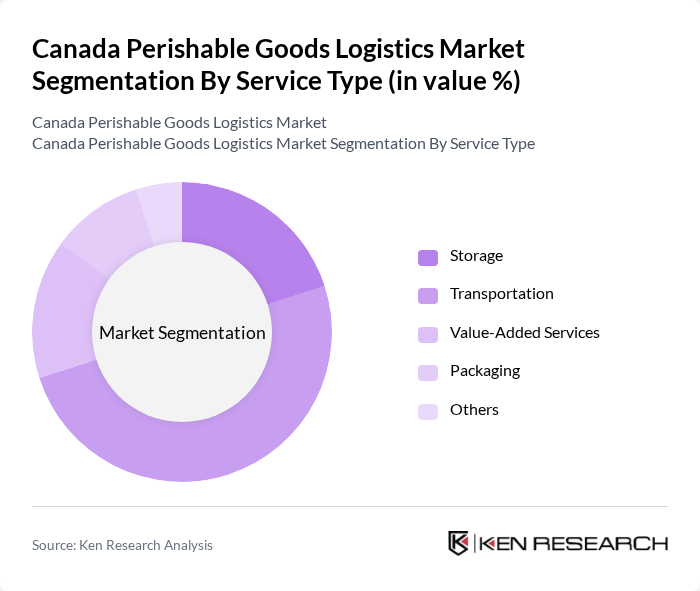

By Service Type:The service type segmentation encompasses Storage, Transportation, Value-Added Services, Packaging, and Others. Transportation services dominate this segment, driven by the need for timely delivery of perishable goods and the expansion of e-commerce. Storage services are also critical, as they ensure that products are kept under optimal conditions to maintain quality and safety. The trend towards integrated logistics solutions, including automation and digital management systems, is shaping service offerings in this market .

The Canada Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lineage Logistics Ltd., Americold Logistics, Congebec Logistics Inc., Trenton Cold Storage Inc., VersaCold Logistics Services, Confederation Freezers, Groupe Robert, VersaCold Transport Solutions, Day & Ross Inc., Maple Leaf Foods (Logistics Division), McCain Foods (Logistics Division), Burnac Produce Ltd., Sobeys Inc. (Logistics Division), Metro Inc. (Distribution & Logistics), Loblaw Companies Limited (Supply Chain & Logistics) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canada perishable goods logistics market appears promising, driven by increasing consumer demand for fresh and organic products. As e-commerce continues to expand, logistics providers will need to adapt to new technologies and consumer preferences. The integration of smart logistics solutions and sustainable practices will likely become essential for maintaining competitiveness. Additionally, partnerships with local farmers and producers can enhance supply chain efficiency, ensuring that fresh goods reach consumers promptly and safely, thereby reducing waste and improving profitability.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Fruits & Vegetables Dairy Products (Milk, Ice-cream, Butter, etc.) Meats, Fish & Poultry Processed Food Products Frozen Foods Pharmaceuticals & Life Sciences Others |

| By Service Type | Storage Transportation Value-Added Services Packaging Others |

| By Transportation Mode | Road Rail Air Sea Others |

| By Temperature Control | Chilled Frozen Ambient Others |

| By End-User | Horticulture (Fresh Fruits & Vegetables) Dairy Industry Meat, Fish & Poultry Industry Processed Food Industry Pharma & Life Sciences Retail Chains Food Service Providers Wholesalers Exporters Others |

| By Region | Western Canada Central Canada Eastern Canada Northern Canada |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 120 | Logistics Managers, Supply Chain Analysts |

| Cold Chain Transportation | 90 | Operations Directors, Fleet Managers |

| Food Distribution Networks | 60 | Warehouse Supervisors, Inventory Managers |

| Perishable Goods Storage Solutions | 50 | Facility Managers, Cold Storage Operators |

| Consumer Behavior in Perishable Goods | 70 | Market Researchers, Consumer Insights Analysts |

The Canada Perishable Goods Logistics Market is valued at approximately USD 12 billion, reflecting a significant growth driven by increasing consumer demand for fresh produce, dairy, and meat products, as well as advancements in logistics technologies.