Region:Asia

Author(s):Geetanshi

Product Code:KRAA2017

Pages:98

Published On:August 2025

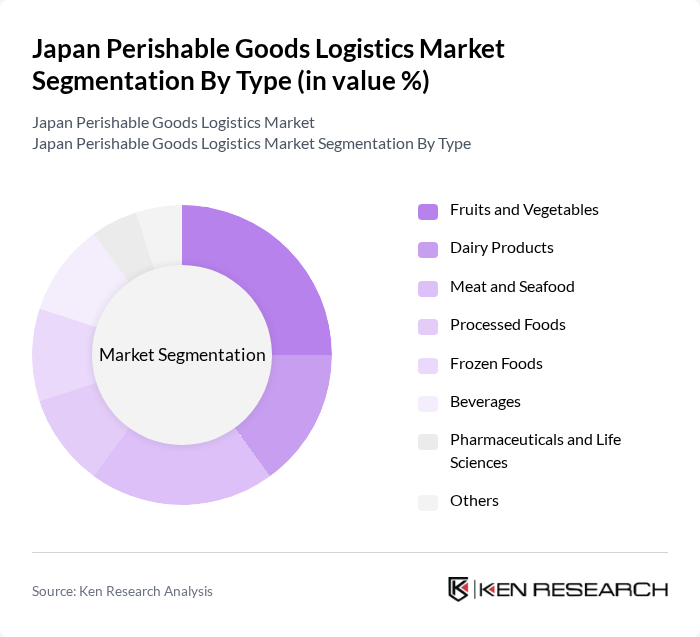

By Type:The market is segmented into various types of perishable goods, including fruits and vegetables, dairy products, meat and seafood, processed foods, frozen foods, beverages, pharmaceuticals and life sciences, and others. Each of these segments plays a crucial role in the overall logistics framework, catering to specific consumer needs and preferences. The rising demand for frozen foods and pharmaceuticals has notably increased the need for advanced cold storage and rapid delivery solutions .

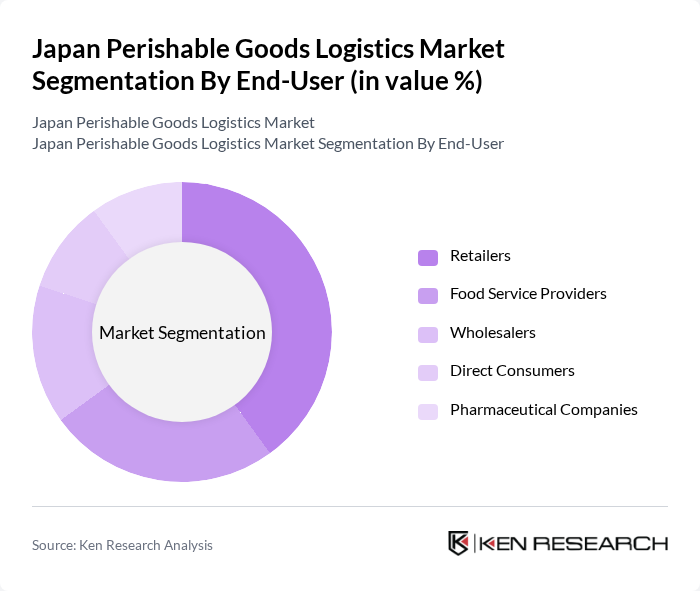

By End-User:The end-user segmentation includes retailers, food service providers, wholesalers, direct consumers, and pharmaceutical companies. Each segment has distinct logistics requirements, influencing the overall demand for perishable goods logistics services. Retailers and food service providers have the highest demand for rapid, reliable cold chain logistics, while pharmaceutical companies require stringent temperature control and traceability .

The Japan Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Seino Holdings Co., Ltd., Marubeni Corporation, Mitsui & Co., Ltd., Kintetsu World Express, Inc., Hitachi Transport System, Ltd., Nichirei Logistics Group Inc., Maruha Nichiro Corporation, TableMark Co., Ltd., Ajinomoto Frozen Foods Co., Ltd., Nissui Logistics Co., Ltd., Itoham Yonekyu Holdings Inc., Takamatsu Transport Group Co., Ltd., Kuehne + Nagel Ltd., DB Schenker, DSV Panalpina A/S, CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan perishable goods logistics market appears promising, driven by technological innovations and evolving consumer preferences. As the demand for fresh and organic products continues to rise, logistics providers are likely to invest in advanced cold chain solutions and automated systems. Furthermore, the integration of IoT technologies will enhance supply chain transparency and efficiency, enabling companies to better manage inventory and reduce waste. This dynamic environment presents significant growth potential for stakeholders in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits and Vegetables Dairy Products Meat and Seafood Processed Foods Frozen Foods Beverages Pharmaceuticals and Life Sciences Others |

| By End-User | Retailers Food Service Providers Wholesalers Direct Consumers Pharmaceutical Companies |

| By Distribution Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Active Packaging Insulated Packaging Others |

| By Temperature Control | Chilled Frozen Ambient |

| By Sales Channel | Online Sales Offline Sales |

| By Price Range | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 150 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 100 | Operations Directors, Quality Assurance Managers |

| Fresh Produce Supply Chain | 60 | Procurement Managers, Distribution Supervisors |

| Frozen Goods Transportation | 50 | Fleet Managers, Cold Storage Facility Operators |

| Retail Perishable Goods Management | 70 | Store Managers, Inventory Control Specialists |

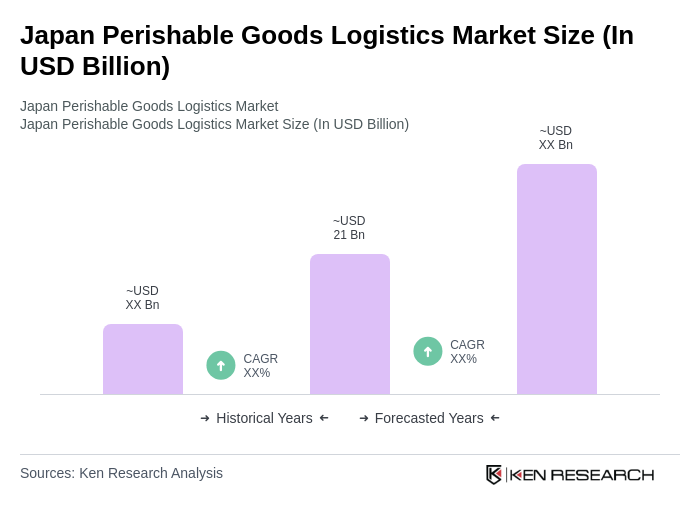

The Japan Perishable Goods Logistics Market is valued at approximately USD 21 billion, reflecting a significant growth driven by the increasing demand for fresh food products and advancements in temperature-controlled logistics.