Region:Europe

Author(s):Geetanshi

Product Code:KRAA1959

Pages:94

Published On:August 2025

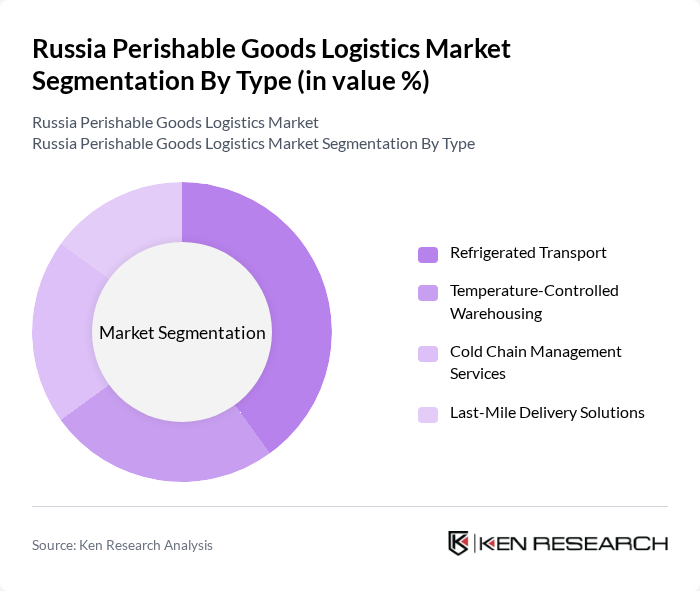

By Type:The market is segmented into Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Management Services, and Last-Mile Delivery Solutions. Each segment is integral to maintaining product integrity, with growing demand for integrated cold chain solutions that ensure end-to-end temperature control and traceability. The adoption of IoT-enabled monitoring and automated warehousing is increasingly prevalent, enhancing operational efficiency and compliance.

The Refrigerated Transport segment leads due to surging demand for fresh produce, dairy, and pharmaceuticals, as well as the need for reliable distribution networks across Russia’s vast geography. Technological advancements in vehicle refrigeration and the proliferation of e-commerce grocery platforms have significantly boosted demand for these services .

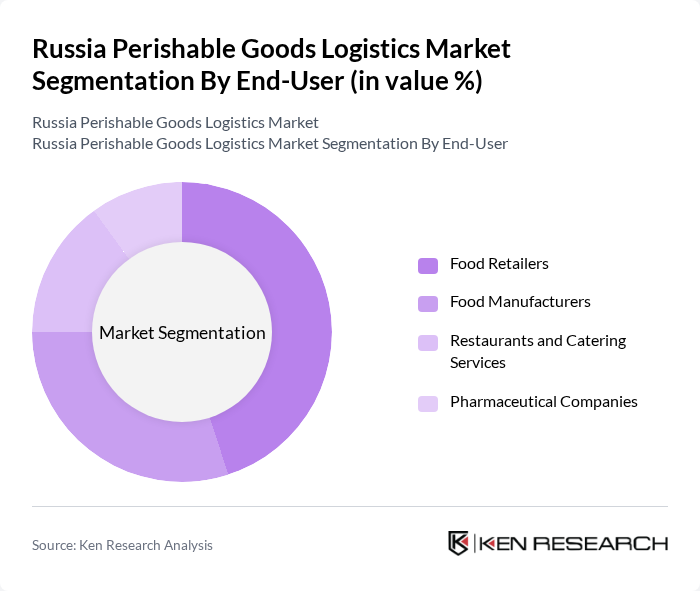

By End-User:The market is segmented into Food Retailers, Food Manufacturers, Restaurants and Catering Services, and Pharmaceutical Companies. Each end-user segment has distinct logistics requirements, with a growing emphasis on traceability, regulatory compliance, and rapid delivery, especially for pharmaceuticals and fresh foods.

Food Retailers remain the dominant end-user, driven by the proliferation of supermarkets, hypermarkets, and online grocery channels. The increasing focus on health and wellness, along with consumer preference for fresh and high-quality products, continues to propel demand for advanced perishable goods logistics solutions .

The Russia Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as X5 Retail Group, Magnit, DPD Russia, Russian Railways (RZD), RUSAL, Ozon, SberLogistics, Kuehne + Nagel, DHL Supply Chain, Pochta Rossii (Russian Post), TransContainer, A1 Logistics, Hellmann Worldwide Logistics, RZD Logistics, and VTB Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia perishable goods logistics market appears promising, driven by increasing consumer demand for fresh and organic products. As e-commerce continues to expand, logistics providers are likely to invest in advanced technologies to enhance efficiency and reduce waste. Additionally, government initiatives aimed at improving infrastructure and supporting agricultural exports will further bolster the market. The focus on sustainability and traceability will also shape logistics strategies, ensuring compliance with evolving consumer preferences and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Management Services Last-Mile Delivery Solutions |

| By End-User | Food Retailers Food Manufacturers Restaurants and Catering Services Pharmaceutical Companies |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Active Packaging Insulated Packaging |

| By Product Type | Fruits and Vegetables Dairy Products Meat and Seafood Pharmaceuticals and Biologics |

| By Sales Channel | Direct Sales Online Sales Distributors Third-Party Logistics Providers |

| By Price Range | Budget Mid-Range Premium Value-Added Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Perishable Goods Logistics | 100 | Logistics Managers, Supply Chain Coordinators |

| Cold Chain Transportation Services | 60 | Operations Managers, Fleet Managers |

| Agricultural Supply Chain Management | 50 | Agricultural Producers, Supply Chain Analysts |

| Food Safety Compliance in Logistics | 40 | Quality Assurance Managers, Compliance Officers |

| Consumer Trends in Perishable Goods | 50 | Market Researchers, Consumer Insights Analysts |

The Russia Perishable Goods Logistics Market is valued at approximately USD 7 billion, driven by increasing demand for temperature-sensitive food and pharmaceutical products, e-commerce growth, and investments in cold chain infrastructure.