Region:Global

Author(s):Shubham

Product Code:KRAA0987

Pages:98

Published On:August 2025

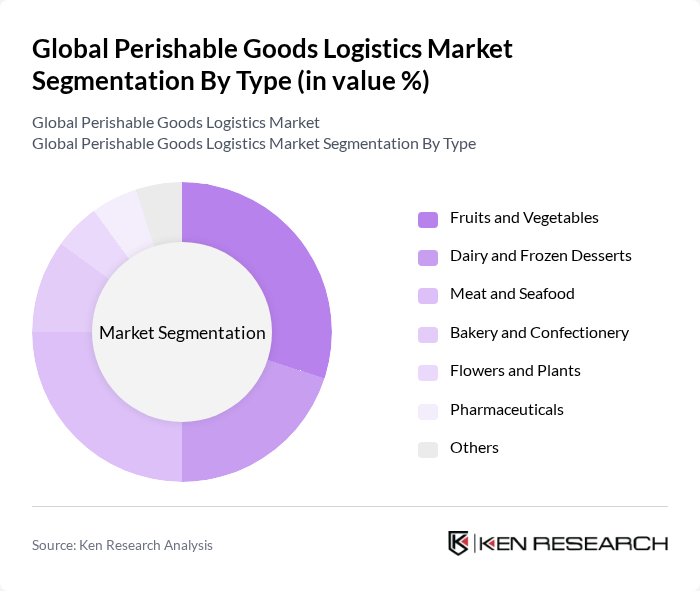

By Type:The market is segmented into various types of perishable goods, including fruits and vegetables, dairy and frozen desserts, meat and seafood, bakery and confectionery, flowers and plants, pharmaceuticals, and others. Each segment requires specialized handling, storage, and transportation solutions to maintain optimal temperature and humidity levels, minimize spoilage, and comply with safety standards. The increasing use of real-time monitoring, AI-driven demand forecasting, and advanced packaging is transforming logistics strategies across all segments .

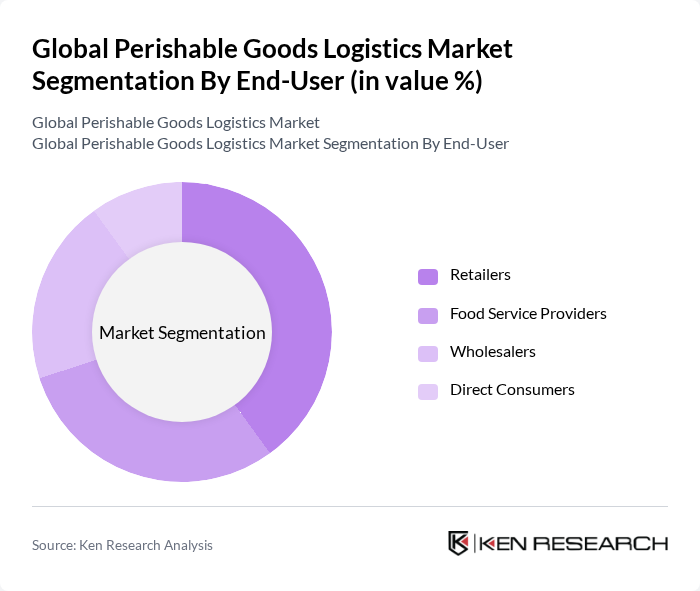

By End-User:The end-user segmentation includes retailers, food service providers, wholesalers, and direct consumers. Each group has distinct logistics needs: retailers and wholesalers require large-scale, reliable cold storage and distribution; food service providers prioritize timely, temperature-controlled deliveries; and direct consumers increasingly demand flexible, last-mile solutions enabled by e-commerce and home delivery platforms .

The Global Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, C.H. Robinson, XPO Logistics, DB Schenker, Americold Logistics, Lineage Logistics, UPS Supply Chain Solutions, Maersk, FedEx, DSV, Agility Logistics, CEVA Logistics, J.B. Hunt Transport Services, and Nippon Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the perishable goods logistics market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As sustainability becomes a priority, companies are expected to adopt eco-friendly practices, including sustainable packaging and energy-efficient transportation. Additionally, the integration of AI and IoT will enhance supply chain transparency and efficiency, enabling logistics providers to better manage inventory and reduce waste. This dynamic landscape will create new opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits and Vegetables Dairy and Frozen Desserts Meat and Seafood Bakery and Confectionery Flowers and Plants Pharmaceuticals Others |

| By End-User | Retailers Food Service Providers Wholesalers Direct Consumers |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Packaging Type | Temperature-Controlled Packaging Vacuum Packaging Modified Atmosphere Packaging Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services |

| By Sales Channel | Online Sales Offline Sales |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Logistics | 120 | Logistics Coordinators, Supply Chain Managers |

| Frozen Food Distribution | 90 | Operations Directors, Cold Chain Specialists |

| Dairy Product Supply Chain | 60 | Procurement Managers, Quality Assurance Officers |

| Pharmaceuticals Cold Chain | 50 | Regulatory Affairs Managers, Distribution Supervisors |

| Meat and Seafood Logistics | 70 | Warehouse Managers, Transportation Analysts |

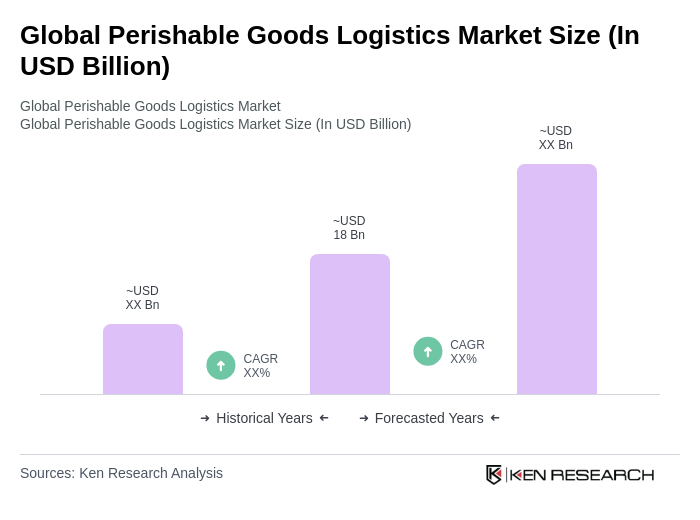

The Global Perishable Goods Logistics Market is valued at approximately USD 18 billion, reflecting a significant growth driven by increasing demand for fresh and processed food products, advancements in cold chain technology, and the rise of e-commerce food delivery services.