Region:Africa

Author(s):Shubham

Product Code:KRAA0855

Pages:95

Published On:August 2025

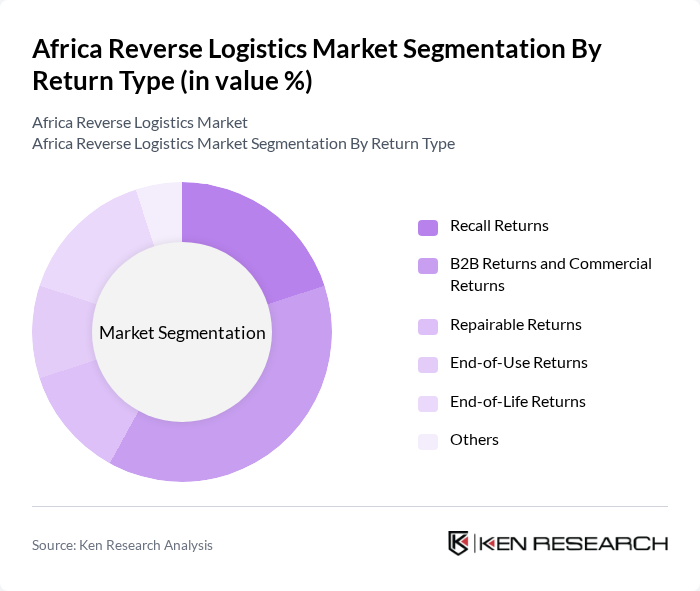

By Return Type:The return type segmentation includes categories such as Recall Returns, B2B Returns and Commercial Returns, Repairable Returns, End-of-Use Returns, End-of-Life Returns, and Others. Each of these subsegments plays a crucial role in the overall reverse logistics process, addressing various needs and challenges faced by businesses, from regulatory compliance and product recalls to asset recovery and responsible disposal .

The B2B Returns and Commercial Returns subsegment is currently dominating the market, accounting for the largest share due to the increasing volume of goods returned in business transactions. This trend is driven by the growth of e-commerce, higher return rates, and the need for businesses to manage returns efficiently. Companies are focusing on streamlining their return processes to enhance customer satisfaction and reduce operational costs, making this subsegment critical for maintaining competitiveness .

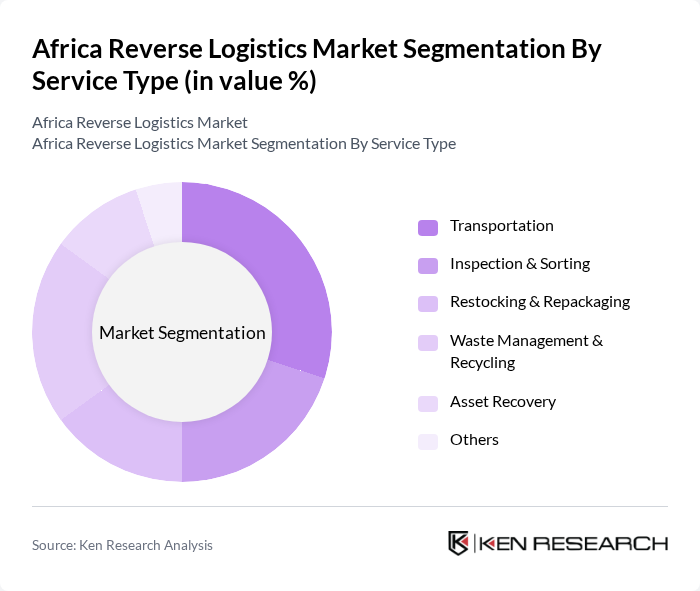

By Service Type:The service type segmentation encompasses services such as Transportation, Inspection & Sorting, Restocking & Repackaging, Waste Management & Recycling, Asset Recovery, and Others. These services address specific needs within the reverse logistics process, from the movement and classification of returned goods to their repurposing, recycling, or responsible disposal .

Transportation remains the leading service type in the market, driven by the need for efficient logistics solutions to handle the increasing volume of returned goods. Companies are investing in transportation networks and digital tracking technologies to ensure timely and cost-effective returns processing. The growth of e-commerce and consumer expectations for fast, hassle-free returns have further amplified the demand for reliable transportation services, making it a critical component of reverse logistics operations .

The Africa Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, UPS Supply Chain Solutions, FedEx Logistics, DB Schenker, CEVA Logistics, Bolloré Logistics, Imperial Logistics, DSV, Rhenus Logistics, Aramex, Transworld Group, Unitrans Africa, Cartlow, and Bidvest International Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa reverse logistics market appears promising, driven by increasing e-commerce activities and a growing emphasis on sustainability. As consumer preferences shift towards eco-friendly practices, companies are likely to invest more in reverse logistics solutions. Additionally, advancements in technology, such as AI and automation, will enhance operational efficiency. Collaborative efforts between businesses and governments will further support the development of infrastructure, enabling a more streamlined approach to managing returns and waste.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recall Returns B2B Returns and Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns Others |

| By Service Type | Transportation Inspection & Sorting Restocking & Repackaging Waste Management & Recycling Asset Recovery Others |

| By End-User | E-Commerce Retail Electronics Automotive Pharmaceuticals Consumer Goods Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Product Category | Electronics Clothing Furniture Automotive Parts Others |

| By Return Reason | Defective Products Customer Dissatisfaction Wrong Item Shipped End-of-Life/Obsolete Others |

| By Policy Support | Subsidies for Recycling Initiatives Tax Exemptions for Reverse Logistics Grants for Sustainable Practices Extended Producer Responsibility (EPR) Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 50 | eCommerce Managers, Fulfillment Center Supervisors |

The Africa Reverse Logistics Market is valued at approximately USD 38 billion, driven by the increasing demand for sustainable practices, the rapid expansion of e-commerce, and the need for efficient waste management solutions across the continent.