Region:Asia

Author(s):Shubham

Product Code:KRAA0994

Pages:87

Published On:August 2025

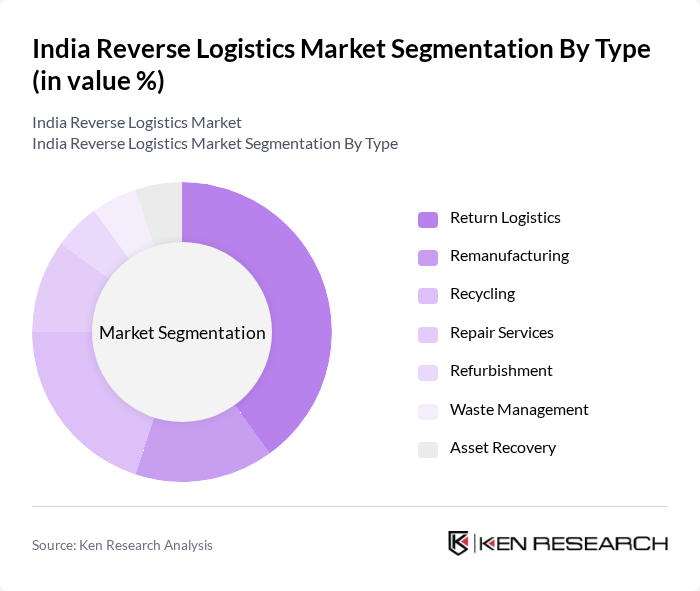

By Type:The reverse logistics market can be segmented into Return Logistics, Remanufacturing, Recycling, Repair Services, Refurbishment, Waste Management, and Asset Recovery. Return Logistics remains the most significant segment, driven by the surge in product returns from the expanding e-commerce sector. The growing emphasis on sustainability and the circular economy has also led to increased Recycling and Remanufacturing activities, as companies seek to minimize waste and maximize resource recovery through advanced sorting, refurbishment, and reuse processes .

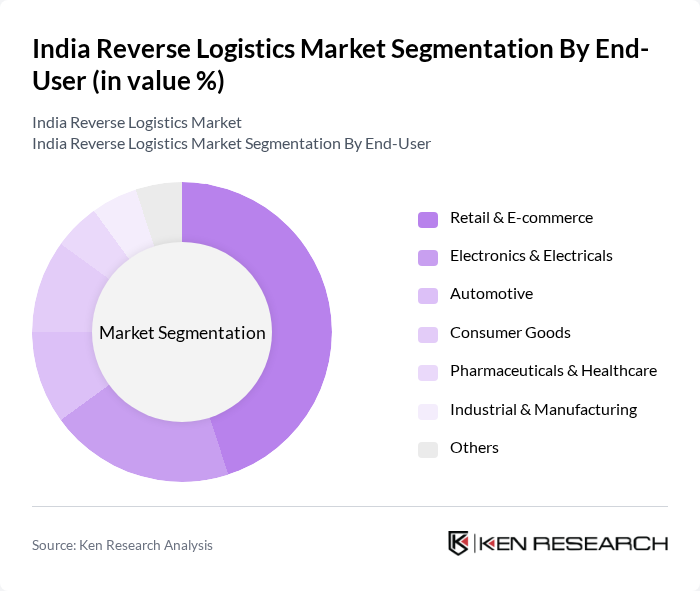

By End-User:The end-user segmentation of the reverse logistics market includes Retail & E-commerce, Electronics & Electricals, Automotive, Consumer Goods, Pharmaceuticals & Healthcare, Industrial & Manufacturing, and Others. Retail & E-commerce is the leading segment, propelled by the increase in online shopping and the critical need for efficient return and exchange processes. The Electronics & Electricals sector is also substantial, as rapid technological advancements and shorter product lifecycles result in frequent returns, recycling, and refurbishment activities .

The India Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Dart Express Ltd., Delhivery Ltd., Gati Ltd., Mahindra Logistics Ltd., TCI Express Ltd., Xpressbees Logistics Pvt. Ltd., Ecom Express Ltd., Rivigo Services Pvt. Ltd., Shadowfax Technologies Pvt. Ltd., Locus.sh, Loadshare Networks Pvt. Ltd., Recykal, Karma Recycling, Attero Recycling Pvt. Ltd., and Ecoreco (Eco Recycling Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India reverse logistics market appears promising, driven by technological advancements and increasing consumer demand for sustainable practices. Companies are expected to invest in AI and automation to streamline operations, while blockchain technology will enhance transparency in the supply chain. Additionally, the focus on omnichannel logistics will facilitate better return management, allowing businesses to adapt to evolving consumer preferences and regulatory requirements effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Logistics Remanufacturing Recycling Repair Services Refurbishment Waste Management Asset Recovery |

| By End-User | Retail & E-commerce Electronics & Electricals Automotive Consumer Goods Pharmaceuticals & Healthcare Industrial & Manufacturing Others |

| By Region | North India South India East India West India |

| By Service Type | Transportation Services Warehousing & Storage Inventory Management Reverse Order Fulfillment Customer Support & After-Sales Service Others |

| By Industry Vertical | Electronics and Appliances Fashion and Apparel Automotive Components Food and Beverage Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics (3PL) Retail Partnerships Others |

| By Policy Support | Subsidies for Recycling Tax Incentives for Green Logistics Grants for Technology Adoption EPR (Extended Producer Responsibility) Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 60 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 50 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 40 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 45 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 55 | eCommerce Managers, Fulfillment Center Supervisors |

The India Reverse Logistics Market is valued at approximately USD 33 billion, driven by the growth of the e-commerce sector, consumer demand for sustainability, and advancements in technology that enhance operational efficiency.