Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2047

Pages:98

Published On:August 2025

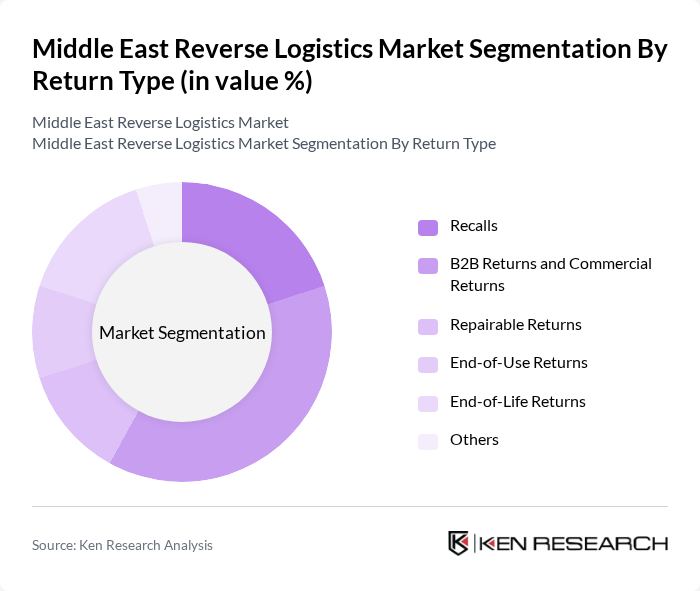

By Return Type:The reverse logistics market is segmented by return types, including recalls, B2B returns and commercial returns, repairable returns, end-of-use returns, end-of-life returns, and others. Each segment plays a vital role in market dynamics, reflecting diverse consumer behaviors and industry-specific requirements. B2B returns and commercial returns represent the largest share, driven by high transaction volumes and the need for efficient asset recovery in business operations .

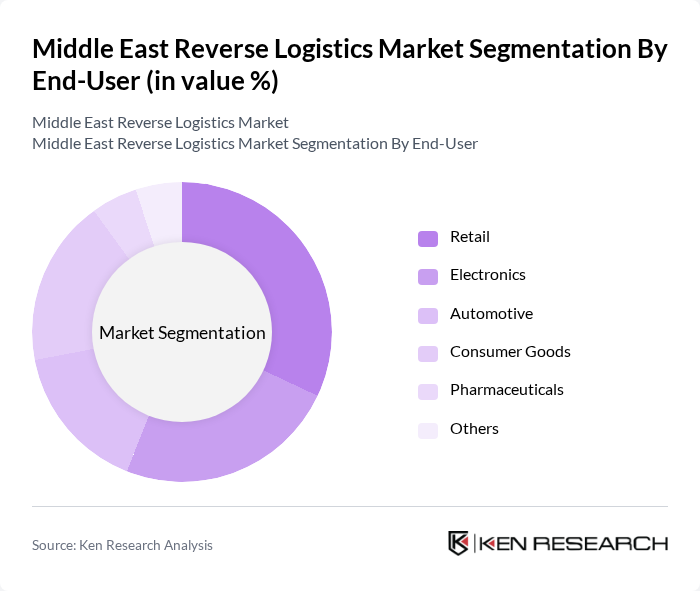

By End-User:End-user segmentation covers industries such as retail, electronics, automotive, consumer goods, pharmaceuticals, and others. Each sector has distinct requirements and challenges influencing reverse logistics processes. Retail and electronics dominate due to high product turnover and frequent returns, while automotive and consumer goods also represent significant shares driven by warranty management and product lifecycle considerations .

The Middle East Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx Express, UPS, DB Schenker, Kuehne + Nagel, CEVA Logistics, Agility Logistics, RSA Global, DSV, GEFCO, Rhenus Logistics, Bolloré Logistics, Geodis, Yusen Logistics, Cartlow, The National Shipping Company of Saudi Arabia (Bahri), Noon Logistics, Emirates Post Group, SMSA Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East reverse logistics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As automation and AI integration become more prevalent, companies will enhance their operational efficiency and customer service capabilities. Additionally, the increasing focus on sustainability will push businesses to adopt eco-friendly practices, aligning with government regulations. This dynamic environment will create opportunities for innovative solutions that streamline return processes and improve overall logistics performance.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recalls B2B Returns and Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns Others |

| By End-User | Retail Electronics Automotive Consumer Goods Pharmaceuticals Others |

| By Service | Transportation Warehousing Reselling Recycling Others |

| By Distribution Mode | Direct Distribution Third-party Logistics E-commerce Platforms Retail Outlets Others |

| By Industry Vertical | E-commerce Manufacturing Automotive Consumer Electronics Pharmaceuticals Others |

| By Geographic Coverage | GCC Countries Levant Region North Africa Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 120 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 90 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 50 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

The Middle East Reverse Logistics Market is valued at approximately USD 38 billion, reflecting significant growth driven by the expansion of e-commerce, consumer sustainability concerns, and the need for efficient supply chain management.