Region:Middle East

Author(s):Shubham

Product Code:KRAA0948

Pages:95

Published On:August 2025

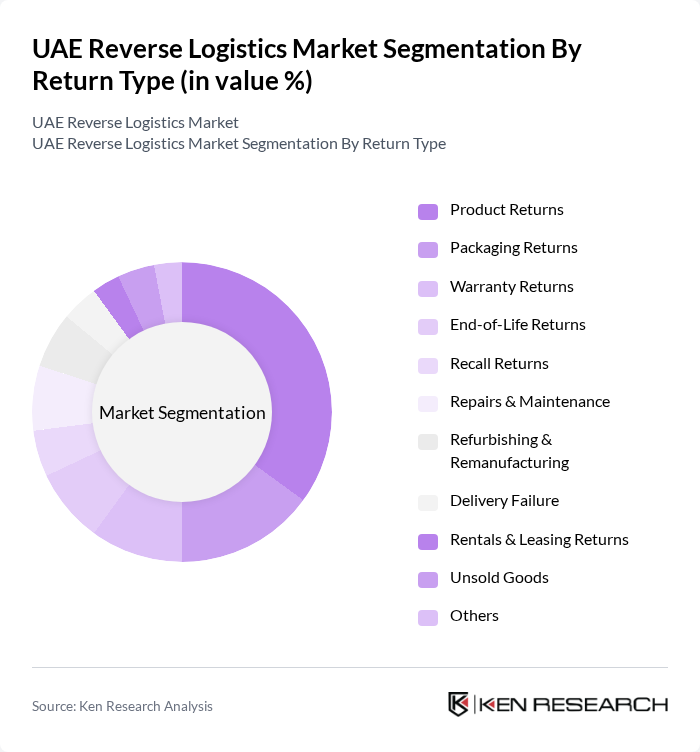

By Return Type:The return type segmentation includes various categories such as product returns, packaging returns, warranty returns, end-of-life returns, recall returns, repairs & maintenance, refurbishing & remanufacturing, delivery failure, rentals & leasing returns, unsold goods, and others. Among these, product returns are the most significant, driven by the growth of e-commerce and consumer expectations for hassle-free return processes. The increasing trend of online shopping has led to a higher volume of product returns, making it a critical focus area for companies aiming to enhance customer satisfaction and loyalty .

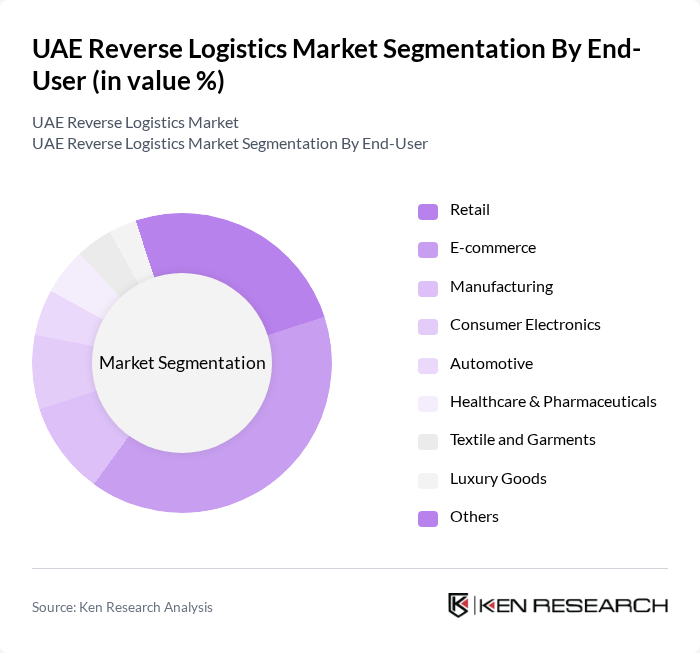

By End-User:The end-user segmentation encompasses various sectors including retail, e-commerce, manufacturing, consumer electronics, automotive, healthcare & pharmaceuticals, textile and garments, luxury goods, and others. The e-commerce sector is currently the leading segment, fueled by the rapid growth of online shopping and the increasing consumer preference for convenience. This trend has resulted in a significant rise in return volumes, compelling retailers to enhance their reverse logistics capabilities to meet customer expectations .

The UAE Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx, UPS, Agility Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, Cartlow, Emirates Post, GEFCO, Rhenus Logistics, DSV Panalpina, Bolloré Logistics, Yusen Logistics, Kerry Logistics, RSA Global, Trukkin contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE reverse logistics market appears promising, driven by the integration of advanced technologies and a growing emphasis on sustainability. As e-commerce continues to expand, companies are likely to adopt more efficient return processes and invest in smart logistics solutions. Additionally, collaboration among stakeholders will enhance operational efficiencies, enabling businesses to meet consumer expectations while adhering to environmental regulations. This evolving landscape will create a dynamic environment for reverse logistics innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Product Returns Packaging Returns Warranty Returns End-of-Life Returns Recall Returns Repairs & Maintenance Refurbishing & Remanufacturing Delivery Failure Rentals & Leasing Returns Unsold Goods Others |

| By End-User | Retail E-commerce Manufacturing Consumer Electronics Automotive Healthcare & Pharmaceuticals Textile and Garments Luxury Goods Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Online Platforms Others |

| By Return Reason | Defective Products Wrong Item Shipped Customer Dissatisfaction End-of-Use Others |

| By Service Type | Reverse Logistics Management Repair and Refurbishment Recycling and Disposal Refund Management Authorization Replacement Management Reselling Warehousing Transportation Others |

| By Industry Vertical | Automotive Electronics Fashion Healthcare Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 120 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 80 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 50 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | E-commerce Managers, Fulfillment Center Supervisors |

The UAE Reverse Logistics Market is valued at approximately USD 15 billion, driven by the increasing demand for sustainable practices, the rise of e-commerce, and the need for efficient supply chain management.