Region:Africa

Author(s):Shubham

Product Code:KRAA1010

Pages:94

Published On:August 2025

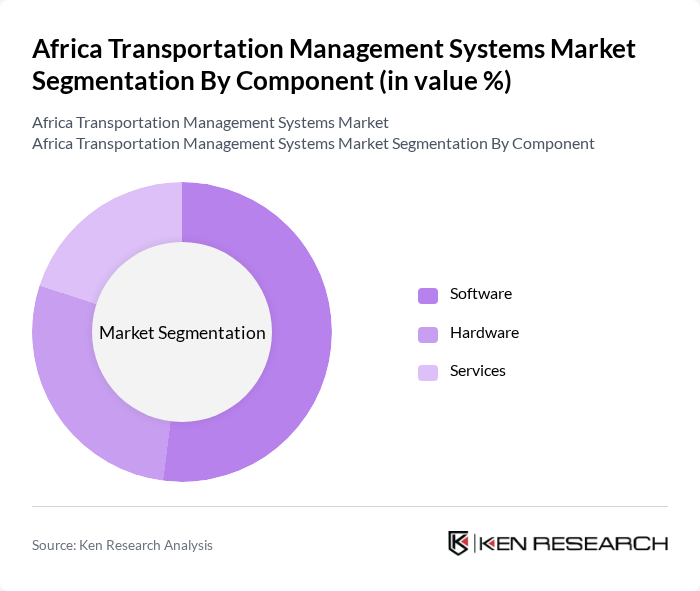

By Component:The components of the market include Software, Hardware, and Services. Software solutions are increasingly being adopted for their ability to enhance operational efficiency, automate route planning, and provide real-time data analytics. Hardware components, such as GPS devices, RFID, and IoT sensors, are essential for tracking and monitoring transportation assets and ensuring compliance with regulatory requirements. Services encompass consulting, system integration, implementation, and ongoing support, which are critical for ensuring the effective deployment and optimization of transportation management systems .

By Deployment Mode:The market is segmented into Cloud-Based and On-Premise deployment modes. Cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and ease of access, enabling businesses to manage transportation operations remotely and integrate with other digital platforms. On-Premise solutions, while traditionally preferred for greater control and data security, are seeing reduced adoption as organizations increasingly prioritize flexibility and lower upfront costs provided by cloud technologies .

The Africa Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Descartes Systems Group, Trimble Inc., WiseTech Global, Transnova Africa, Dovetail (South Africa), MiX Telematics, Locus.sh, FourKites, Project44, Freightos, CargoSense, and FleetOps Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa Transportation Management Systems market is poised for transformative growth, driven by technological advancements and increasing demand for efficient logistics solutions. As urbanization accelerates, cities will prioritize smart transportation systems to manage congestion and enhance mobility. Additionally, the integration of IoT and data analytics will enable real-time tracking and optimization of supply chains, fostering innovation and sustainability in transportation. These trends will create a dynamic landscape for stakeholders in the transportation sector, encouraging investment and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Hardware Services |

| By Deployment Mode | Cloud-Based On-Premise |

| By Mode of Transportation | Roadways Railways Airways Maritime |

| By Application | Freight Transportation Passenger Transportation Public Transport Management Supply Chain Management |

| By End-User | Logistics Companies Retailers Government Agencies Manufacturing Firms |

| By Country/Region | Nigeria South Africa Kenya Egypt Rest of Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Management | 120 | Fleet Managers, Logistics Coordinators |

| Rail Freight Operations | 60 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Services | 50 | Airline Cargo Managers, Freight Forwarders |

| Maritime Logistics | 40 | Port Authority Officials, Shipping Line Executives |

| Technology Adoption in Transportation | 45 | IT Managers, Transportation System Analysts |

The Africa Transportation Management Systems Market is valued at approximately USD 320 million, driven by the increasing demand for efficient logistics, urbanization, and the adoption of digital technologies in transportation management.