Region:Global

Author(s):Geetanshi

Product Code:KRAE2208

Pages:88

Published On:February 2026

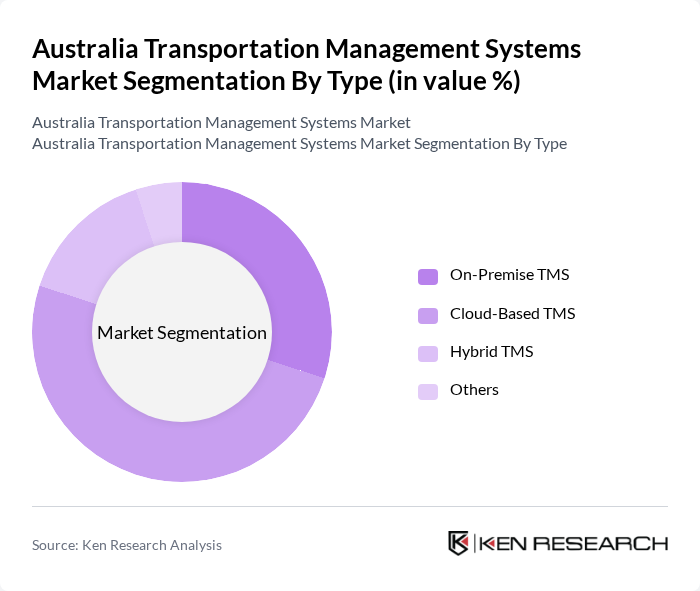

By Type:The market is segmented into On-Premise TMS, Cloud-Based TMS, Hybrid TMS, and Others. Among these, Cloud-Based TMS is gaining significant traction due to its flexibility, scalability, and cost-effectiveness. Businesses are increasingly adopting cloud solutions to enhance collaboration and access real-time data, which is crucial for effective transportation management. On-Premise TMS remains relevant for organizations with specific security and compliance needs, while Hybrid TMS offers a balanced approach for companies looking to leverage both deployment models.

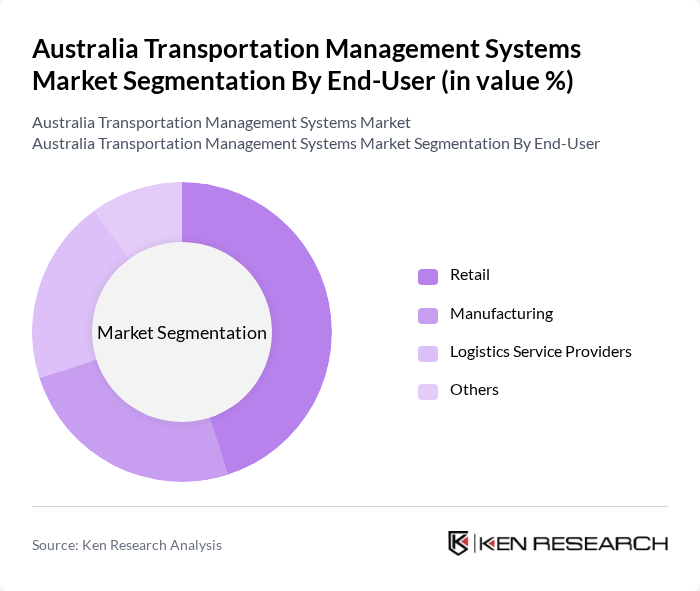

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics Service Providers, and Others. The Retail sector is leading the market due to the rapid growth of e-commerce, which demands efficient logistics and transportation solutions. Retailers are increasingly investing in transportation management systems to streamline their supply chains and improve customer satisfaction. Logistics Service Providers also represent a significant portion of the market, as they require advanced systems to manage complex transportation networks and optimize delivery processes.

The Australia Transportation Management Systems market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, JDA Software Group, Inc., Manhattan Associates, Inc., Descartes Systems Group Inc., Cerasis, Inc., Transporeon Group, BluJay Solutions, Freightos, Kinaxis Inc., Locus.sh, FourKites, Inc., Project44, Trimble Inc., C.H. Robinson Worldwide, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Transportation Management Systems market appears promising, driven by technological advancements and increasing demand for integrated solutions. As businesses prioritize efficiency, the adoption of AI and machine learning technologies is expected to enhance decision-making processes. Furthermore, the growing emphasis on sustainability will push logistics providers to adopt greener practices, aligning with government regulations and consumer expectations. This evolving landscape will create new opportunities for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise TMS Cloud-Based TMS Hybrid TMS Others |

| By End-User | Retail Manufacturing Logistics Service Providers Others |

| By Industry Vertical | E-commerce Food and Beverage Pharmaceuticals Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud Others |

| By Functionality | Freight Management Order Management Fleet Management Others |

| By Region | New South Wales Victoria Queensland Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Management Systems | 100 | Transport Authority Managers, Operations Directors |

| Freight and Logistics Solutions | 80 | Logistics Coordinators, Supply Chain Managers |

| Fleet Management Technologies | 70 | Fleet Managers, IT System Administrators |

| Smart Traffic Management Systems | 60 | City Planners, Traffic Engineers |

| Transportation Analytics and Data Solutions | 90 | Data Analysts, Business Intelligence Managers |

The Australia Transportation Management Systems market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for efficient logistics and supply chain management solutions, particularly in major economic hubs like Sydney, Melbourne, and Brisbane.