Region:Middle East

Author(s):Geetanshi

Product Code:KRAE2205

Pages:98

Published On:February 2026

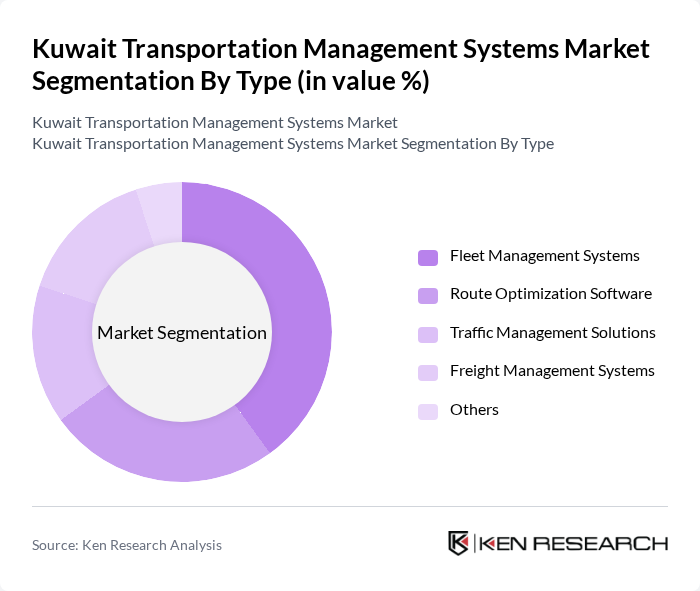

By Type:The market is segmented into various types, including Fleet Management Systems, Route Optimization Software, Traffic Management Solutions, Freight Management Systems, and Others. Fleet Management Systems are currently leading the market due to their ability to enhance operational efficiency and reduce costs for transportation companies. The increasing focus on real-time tracking and management of vehicle fleets has made this sub-segment particularly attractive to businesses looking to optimize their logistics operations.

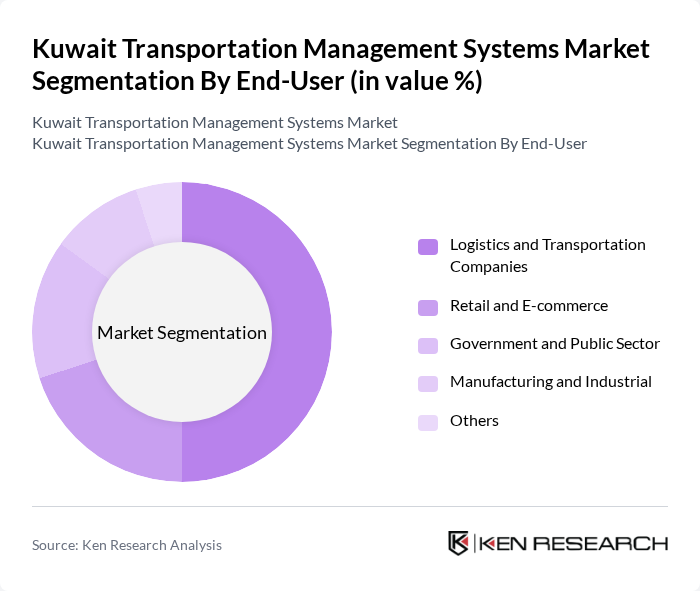

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Retail and E-commerce, Government and Public Sector, Manufacturing and Industrial, and Others. Logistics and Transportation Companies dominate this segment, driven by the increasing need for efficient supply chain management and the growing trend of e-commerce. These companies are increasingly adopting transportation management systems to streamline their operations and enhance customer satisfaction.

The Kuwait Transportation Management Systems market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuehne + Nagel, DHL Supply Chain, Agility Logistics, GAC Group, Aramex, DB Schenker, CEVA Logistics, XPO Logistics, FedEx, UPS, Maersk, Panalpina, SNCF Logistics, Yusen Logistics, C.H. Robinson contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Transportation Management Systems market appears promising, driven by technological advancements and increasing urbanization. The integration of AI and IoT technologies is expected to enhance operational efficiency and data-driven decision-making. Additionally, the government's commitment to smart city initiatives will likely foster innovation in transportation solutions. As the logistics sector expands, the demand for sophisticated transportation management systems will continue to rise, creating a dynamic environment for growth and development in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Systems Route Optimization Software Traffic Management Solutions Freight Management Systems Others |

| By End-User | Logistics and Transportation Companies Retail and E-commerce Government and Public Sector Manufacturing and Industrial Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Application | Public Transportation Freight and Logistics Emergency Services Others |

| By Technology | GPS Tracking Systems RFID Technology Telematics Solutions Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Systems | 100 | Transport Planners, Public Policy Analysts |

| Logistics and Freight Management | 80 | Logistics Managers, Supply Chain Executives |

| Smart Transportation Solutions | 70 | IT Managers, Technology Officers |

| Urban Mobility Initiatives | 60 | Urban Planners, City Officials |

| Private Transportation Services | 90 | Business Owners, Fleet Managers |

The Kuwait Transportation Management Systems market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for efficient logistics and transportation solutions, urbanization, and infrastructure development in the region.