Region:Global

Author(s):Geetanshi

Product Code:KRAE2209

Pages:90

Published On:February 2026

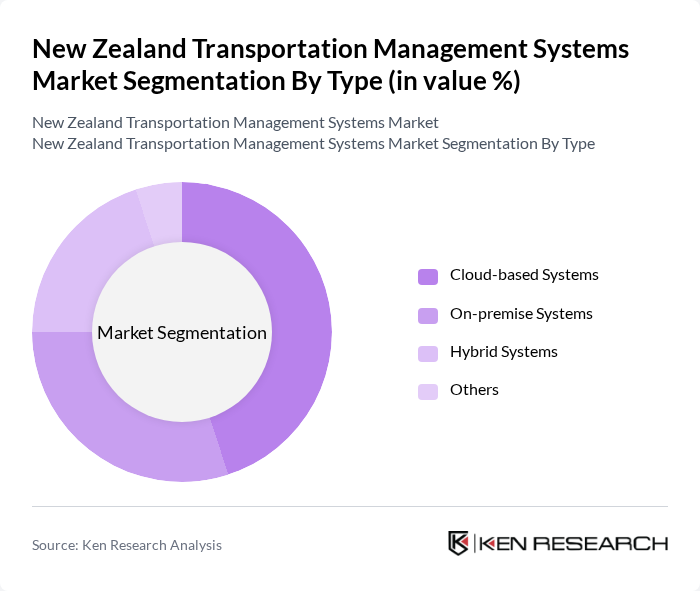

By Type:The market is segmented into Cloud-based Systems, On-premise Systems, Hybrid Systems, and Others. Cloud-based systems are gaining traction due to their scalability and cost-effectiveness, while on-premise systems are preferred by organizations with stringent data security requirements. Hybrid systems offer a blend of both, catering to diverse customer needs. The "Others" category includes niche solutions that cater to specific industry requirements.

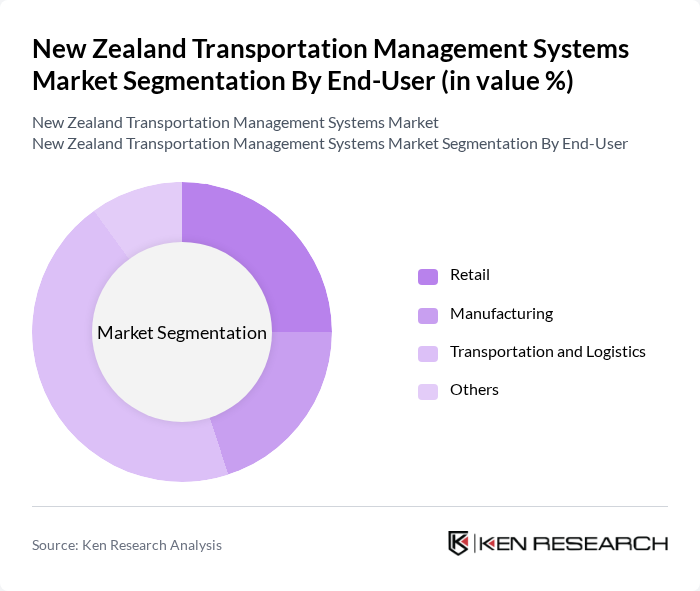

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, and Others. The Transportation and Logistics sector is the largest consumer of transportation management systems, driven by the need for efficient supply chain management. Retail and Manufacturing sectors are also significant users, focusing on optimizing their distribution networks and improving customer service.

The New Zealand Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Freight Management Systems, Transporeon, Oracle Transportation Management, SAP Transportation Management, Manhattan Associates, JDA Software, Descartes Systems Group, Trimble Transportation, Kuebix, Cerasis, Locus TMS, Project44, FourKites, Transwide, Logility contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand transportation management systems market appears promising, driven by technological advancements and increasing demand for efficiency. As businesses prioritize sustainability, the integration of green logistics practices will become essential. Additionally, the rise of autonomous vehicles is expected to reshape logistics operations, enhancing delivery efficiency. Companies that leverage data analytics for decision-making will gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Systems On-premise Systems Hybrid Systems Others |

| By End-User | Retail Manufacturing Transportation and Logistics Others |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud Others |

| By Industry Vertical | Retail and E-commerce Healthcare Construction Others |

| By Geographic Coverage | Urban Areas Rural Areas Regional Transport Hubs Others |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Management | 100 | City Transport Planners, Operations Managers |

| Freight and Logistics Systems | 80 | Logistics Directors, Supply Chain Analysts |

| Smart Traffic Management Solutions | 70 | IT Managers, Traffic Engineers |

| Fleet Management Technologies | 90 | Fleet Managers, Procurement Specialists |

| Integrated Transportation Solutions | 75 | Business Development Managers, System Integrators |

The New Zealand Transportation Management Systems Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by urbanization, e-commerce, and the demand for efficient logistics management solutions.