Region:Middle East

Author(s):Geetanshi

Product Code:KRAE2206

Pages:95

Published On:February 2026

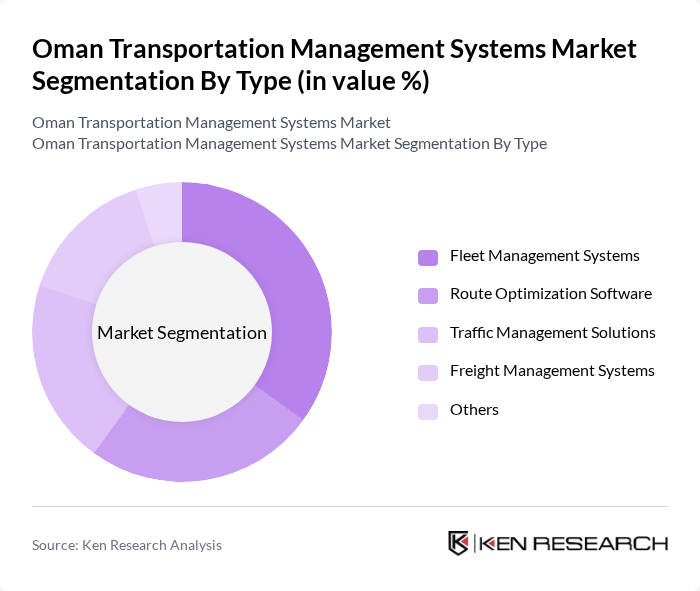

By Type:The market is segmented into various types, including Fleet Management Systems, Route Optimization Software, Traffic Management Solutions, Freight Management Systems, and Others. Fleet Management Systems are gaining traction due to their ability to enhance operational efficiency and reduce costs. Route Optimization Software is also critical as it helps in minimizing travel time and fuel consumption, which is essential for logistics companies. Traffic Management Solutions are increasingly important in urban areas to manage congestion and improve safety.

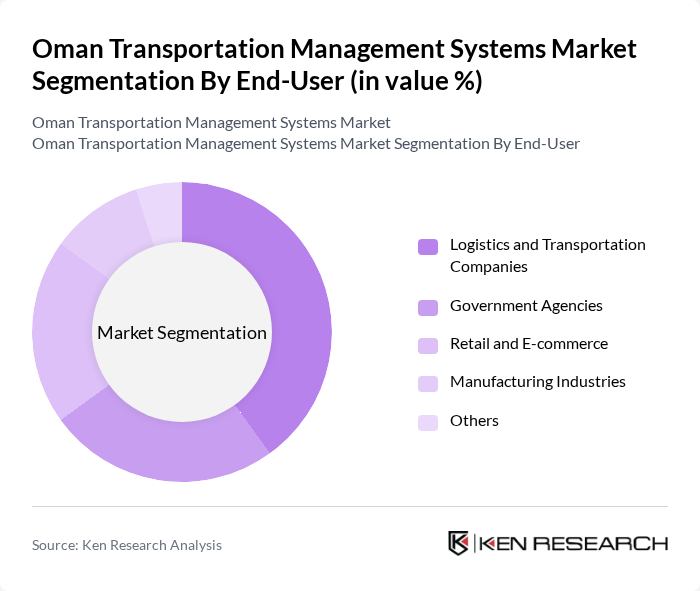

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Government Agencies, Retail and E-commerce, Manufacturing Industries, and Others. Logistics and Transportation Companies are the primary users of transportation management systems, as they seek to optimize their operations and improve service delivery. Government Agencies are also significant users, focusing on public transportation efficiency and safety. Retail and E-commerce sectors are increasingly adopting these systems to manage their supply chains effectively.

The Oman Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Oman Air, Oman Logistics, Muscat Municipality, Oman National Transport Company, Gulf Transport, Al Jazeera Transport, Oman Shipping Company, Oman Rail, Oman Roads and Transport Authority, Oman International Container Terminal, Oman Maritime, Oman Air Cargo, Oman Transport and Logistics, Oman Freight Services contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Transportation Management Systems market is poised for significant transformation as urbanization accelerates and government initiatives promote infrastructure development. In the future, the integration of smart technologies and real-time data analytics will become increasingly vital for optimizing logistics operations. Companies will likely prioritize investments in cloud-based solutions and AI-driven systems to enhance efficiency and sustainability, aligning with global trends towards smarter, greener transportation solutions that meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Systems Route Optimization Software Traffic Management Solutions Freight Management Systems Others |

| By End-User | Logistics and Transportation Companies Government Agencies Retail and E-commerce Manufacturing Industries Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Application | Public Transportation Freight and Logistics Emergency Services Others |

| By Technology | GPS Tracking Systems IoT Solutions Data Analytics Tools Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Systems | 100 | Transport Planners, City Officials |

| Logistics and Freight Management | 80 | Logistics Managers, Supply Chain Analysts |

| Smart Transportation Technologies | 70 | IT Managers, Technology Officers |

| Infrastructure Development Projects | 60 | Project Managers, Civil Engineers |

| Regulatory Compliance in Transportation | 90 | Compliance Officers, Legal Advisors |

The Oman Transportation Management Systems market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient logistics and transportation solutions, alongside government initiatives to enhance infrastructure.