Region:Asia

Author(s):Rebecca

Product Code:KRAC4730

Pages:87

Published On:October 2025

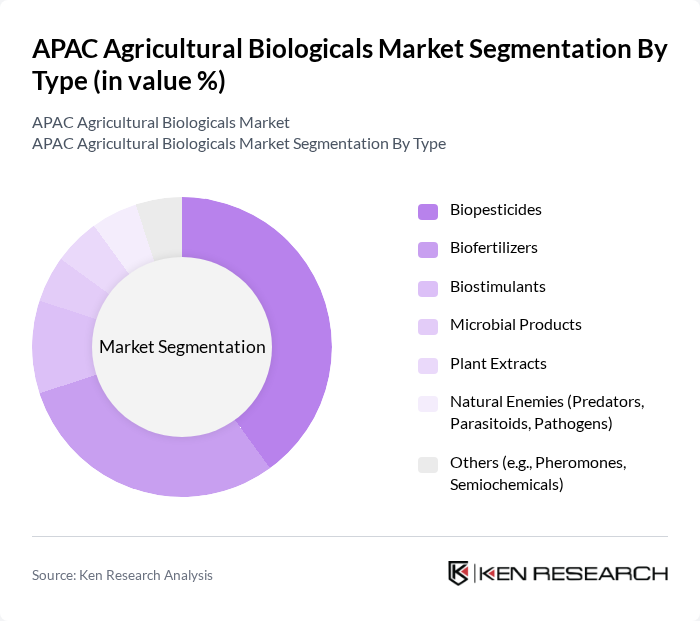

By Type:The market is segmented into various types of agricultural biologicals, including biopesticides, biofertilizers, biostimulants, microbial products, plant extracts, natural enemies, and others. Among these, biopesticides are gaining significant traction due to their effectiveness in pest control and lower environmental impact. Biofertilizers are also increasingly popular as they enhance soil fertility and crop productivity. The demand for these products is driven by the growing trend towards organic farming and sustainable agricultural practices .

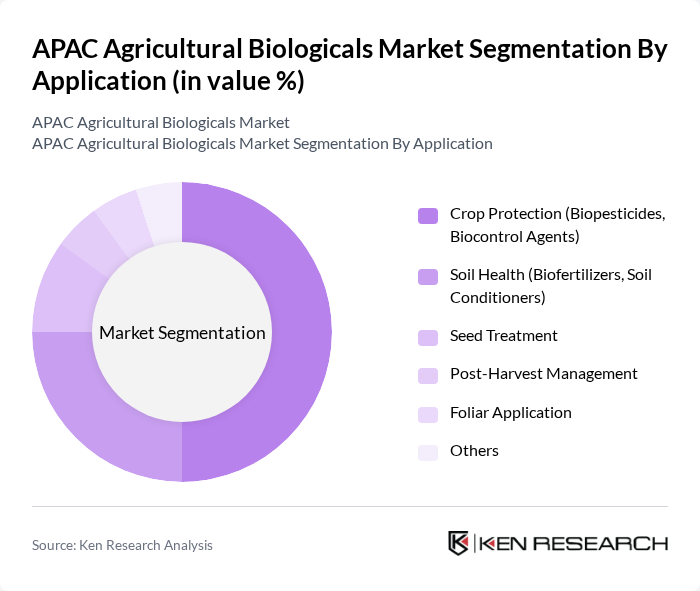

By Application:The applications of agricultural biologicals include crop protection, soil health, seed treatment, post-harvest management, foliar application, and others. Crop protection is the leading application area, driven by the need for effective pest and disease management in agriculture. Soil health applications are also gaining momentum as farmers increasingly recognize the importance of maintaining soil fertility and structure for sustainable crop production .

The APAC Agricultural Biologicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience AG, BASF SE, Syngenta AG, Corteva Agriscience, FMC Corporation, Novozymes A/S, Koppert Biological Systems, Valent BioSciences LLC, UPL Limited, Sumitomo Chemical Co., Ltd., T. Stanes & Company Limited, Rizobacter Argentina S.A., Lallemand Inc., Kiwa Bio-Tech Products Group Corporation, BioWorks, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The APAC agricultural biologicals market is poised for significant transformation, driven by technological advancements and increasing consumer demand for sustainable practices. As governments enhance support for organic farming and research, the market is expected to witness a surge in innovative biological products. Additionally, the integration of precision agriculture technologies will facilitate more efficient use of biological inputs, further promoting their adoption among farmers. This evolving landscape presents a promising future for agricultural biologicals in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Biopesticides Biofertilizers Biostimulants Microbial Products Plant Extracts Natural Enemies (Predators, Parasitoids, Pathogens) Others (e.g., Pheromones, Semiochemicals) |

| By Application | Crop Protection (Biopesticides, Biocontrol Agents) Soil Health (Biofertilizers, Soil Conditioners) Seed Treatment Post-Harvest Management Foliar Application Others |

| By End-User | Smallholder Farmers Large Commercial Farms Agricultural Cooperatives Distributors & Retailers Exporters Others |

| By Distribution Channel | Direct Sales Online Retail/E-commerce Agricultural Supply Stores Distributors/Dealers Others |

| By Region | East Asia (China, Japan, South Korea) Southeast Asia (Indonesia, Vietnam, Thailand, Malaysia, Philippines, etc.) South Asia (India, Bangladesh, Pakistan, Sri Lanka, etc.) Oceania (Australia, New Zealand) Others (Rest of APAC) |

| By Crop Type | Cereals and Grains (Rice, Wheat, Maize, etc.) Fruits and Vegetables Oilseeds & Pulses Turf, Ornamentals & Plantation Crops Others |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets/Small Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopesticide Usage in Rice Cultivation | 100 | Rice Farmers, Agricultural Extension Officers |

| Biofertilizer Adoption in Vegetable Farming | 60 | Vegetable Growers, Agronomists |

| Market Trends in Organic Farming | 55 | Organic Farmers, Certification Bodies |

| Distribution Channels for Agricultural Biologicals | 70 | Distributors, Retail Managers |

| Research and Development in Agricultural Innovations | 50 | R&D Managers, University Researchers |

The APAC Agricultural Biologicals Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by the increasing demand for sustainable agricultural practices and advancements in biotechnology.