Region:Asia

Author(s):Rebecca

Product Code:KRAA9325

Pages:99

Published On:November 2025

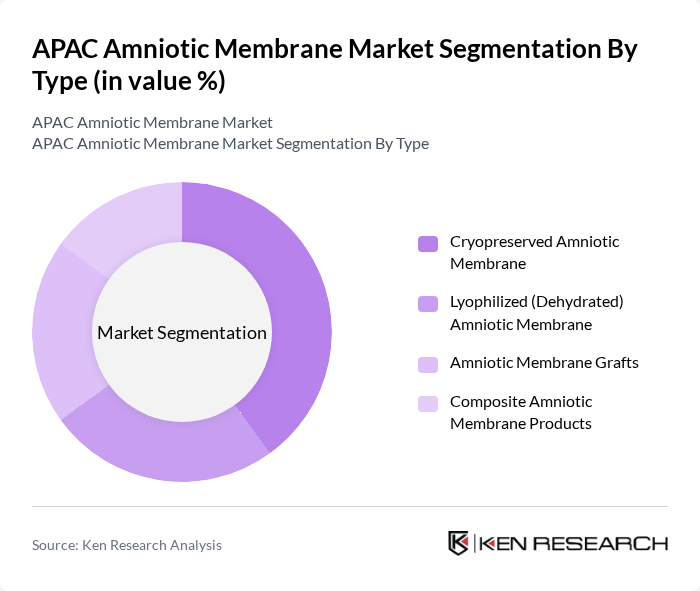

By Type:The market is segmented into various types of amniotic membranes, including Cryopreserved Amniotic Membrane, Lyophilized (Dehydrated) Amniotic Membrane, Amniotic Membrane Grafts, and Composite Amniotic Membrane Products. Each type serves distinct applications in wound care, ophthalmology, and surgical procedures, catering to the diverse needs of healthcare providers.

The Cryopreserved Amniotic Membrane segment is currently dominating the market due to its superior preservation of biological properties, making it highly effective for various medical applications. This type is preferred in surgical procedures and wound care due to its ease of use and effectiveness in promoting healing. The increasing adoption of cryopreserved membranes in hospitals and surgical centers is driven by their proven efficacy and safety, leading to a growing preference among healthcare professionals.

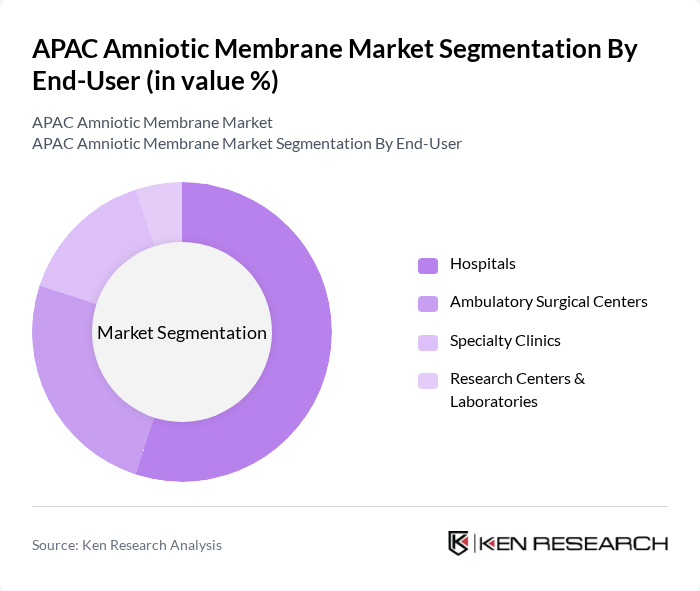

By End-User:The market is segmented based on end-users, including Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research Centers & Laboratories. Each end-user category plays a crucial role in the distribution and application of amniotic membranes, with hospitals being the primary consumers due to their extensive surgical and wound care services.

Hospitals are the leading end-user segment in the amniotic membrane market, accounting for a significant share due to their comprehensive range of surgical procedures and advanced wound care treatments. The increasing number of surgical interventions and the growing focus on regenerative medicine in hospitals drive the demand for amniotic membranes. Additionally, hospitals often have the necessary infrastructure and expertise to utilize these products effectively, further solidifying their position as the primary consumers in the market.

The APAC Amniotic Membrane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amnio Technology LLC, BioTissue Inc., MiMedx Group, Inc., Organogenesis Inc., Smith & Nephew plc, Integra LifeSciences Corporation, Stryker Corporation, Celularity Inc., Surgenex LLC, Human Regenerative Technologies, LLC, Skye Biologics LLC, Applied Biologics LLC, Labtician Ophthalmics Inc., Corza Ophthalmology, Advanced BioHealing, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC amniotic membrane market is poised for significant growth, driven by increasing healthcare investments and advancements in regenerative medicine. As healthcare infrastructure expands, particularly in emerging economies, the demand for innovative wound care solutions will rise. Additionally, the trend towards personalized medicine and minimally invasive surgical techniques will further enhance the adoption of amniotic membranes. These factors, combined with ongoing research and development efforts, are expected to create a dynamic market environment that fosters innovation and improves patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Cryopreserved Amniotic Membrane Lyophilized (Dehydrated) Amniotic Membrane Amniotic Membrane Grafts Composite Amniotic Membrane Products |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Centers & Laboratories |

| By Application | Wound Care (Chronic & Acute) Ophthalmology (Corneal & Ocular Surface Disorders) Orthopedics (Tendon & Ligament Repair) Other Surgical Applications |

| By Distribution Channel | Direct Sales Online Sales Distributors Hospital Procurement |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Vietnam, etc.) Rest of APAC |

| By Product Formulation | Liquid Formulations Gel Formulations Sheet Formulations Powder Formulations |

| By Storage Method | Refrigerated Storage Freeze-Dried Storage Room Temperature Storage Fresh Storage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 60 | Ophthalmologists, Clinic Managers |

| Wound Care Centers | 50 | Wound Care Specialists, Nurses |

| Hospitals with Surgical Departments | 80 | Surgeons, Hospital Administrators |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Regenerative Medicine Research Institutions | 40 | Researchers, Lab Directors |

The APAC Amniotic Membrane Market is valued at approximately USD 890 million, driven by the increasing prevalence of chronic wounds, advancements in surgical techniques, and a growing awareness of regenerative medicine.