Region:Asia

Author(s):Geetanshi

Product Code:KRAC4451

Pages:89

Published On:October 2025

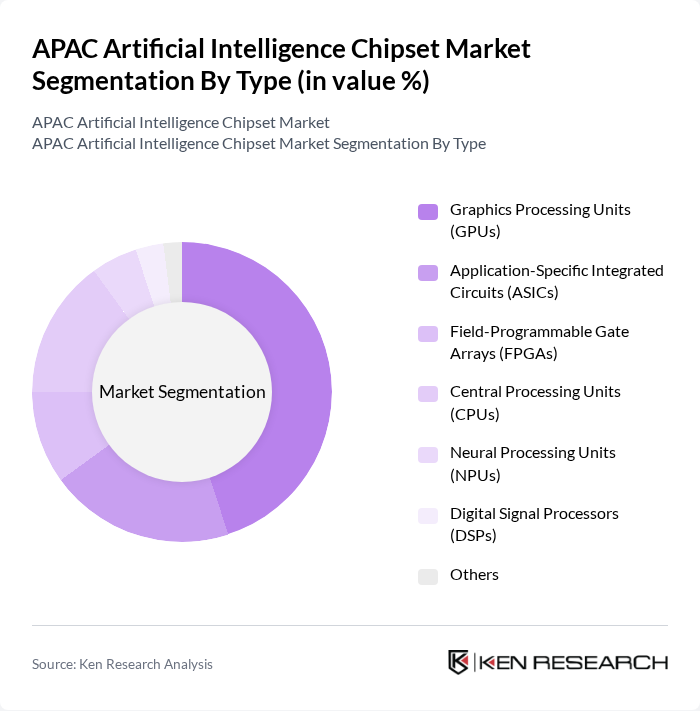

By Type:The market is segmented into various types of chipsets, including Graphics Processing Units (GPUs), Application-Specific Integrated Circuits (ASICs), Field-Programmable Gate Arrays (FPGAs), Central Processing Units (CPUs), Neural Processing Units (NPUs), Digital Signal Processors (DSPs), and Others. Among these, GPUs are leading the market due to their high parallel processing capabilities, making them ideal for AI applications that require extensive data processing. The demand for GPUs is driven by their widespread use in gaming, data centers, and AI research, which has significantly increased their market share. ASICs and NPUs are also gaining traction as AI workloads become more specialized, particularly in edge devices and mobile applications .

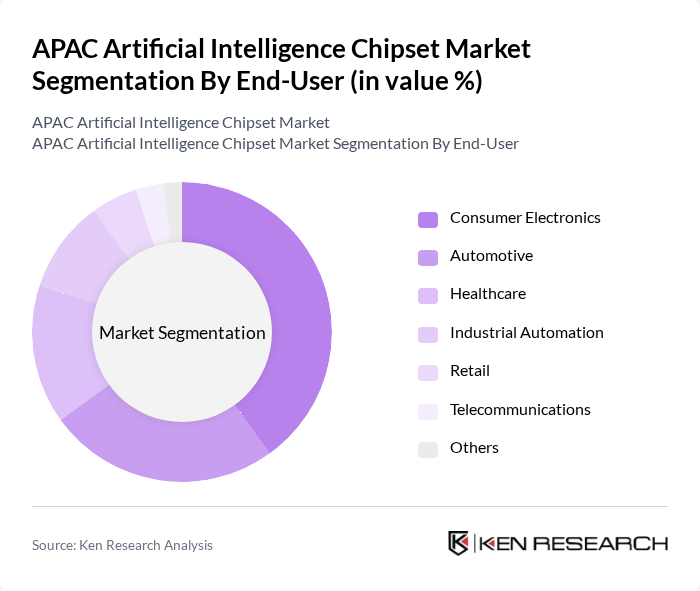

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Healthcare, Industrial Automation, Retail, Telecommunications, and Others. The Consumer Electronics segment is currently the dominant force in the market, driven by the increasing integration of AI technologies in devices such as smartphones, smart speakers, and home automation systems. The growing consumer demand for smart devices that offer enhanced functionalities and personalized experiences is propelling the growth of AI chipsets in this sector. Automotive and healthcare are also rapidly growing segments, fueled by advancements in autonomous vehicles and AI-driven diagnostics, respectively .

The APAC Artificial Intelligence Chipset Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Intel Corporation, AMD (Advanced Micro Devices), Qualcomm Technologies, Inc., Google LLC, IBM Corporation, Micron Technology, Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., MediaTek Inc., Texas Instruments Incorporated, Xilinx, Inc., Baidu, Inc., Arm Holdings, STMicroelectronics N.V., SK Hynix Inc., Graphcore, Cerebras Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC Artificial Intelligence Chipset Market is poised for transformative growth, driven by the integration of AI with cloud computing and the increasing demand for custom AI solutions. As industries adopt AI technologies at an unprecedented rate, the focus will shift towards developing specialized chipsets that cater to specific applications, such as automotive and healthcare. Furthermore, the rise of edge computing will necessitate the creation of more efficient, localized processing solutions, enhancing the overall market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Graphics Processing Units (GPUs) Application-Specific Integrated Circuits (ASICs) Field-Programmable Gate Arrays (FPGAs) Central Processing Units (CPUs) Neural Processing Units (NPUs) Digital Signal Processors (DSPs) Others |

| By End-User | Consumer Electronics Automotive Healthcare Industrial Automation Retail Telecommunications Others |

| By Region | China Japan South Korea India Southeast Asia Others |

| By Technology | Machine Learning Deep Learning Natural Language Processing Computer Vision Robotics Others |

| By Application | Smart Home Devices Autonomous Vehicles Predictive Analytics Fraud Detection Virtual Assistants Others |

| By Investment Source | Private Equity Venture Capital Government Grants Corporate Investments Others |

| By Policy Support | Research and Development Grants Tax Incentives Innovation Hubs Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive AI Chipsets | 100 | Product Development Engineers, Automotive Technology Managers |

| Healthcare AI Solutions | 60 | Healthcare IT Directors, Medical Device Engineers |

| Consumer Electronics AI Integration | 80 | Product Managers, Electronics Design Engineers |

| Industrial AI Applications | 50 | Operations Managers, Automation Engineers |

| AI Chipset Research & Development | 40 | Research Scientists, AI Technology Analysts |

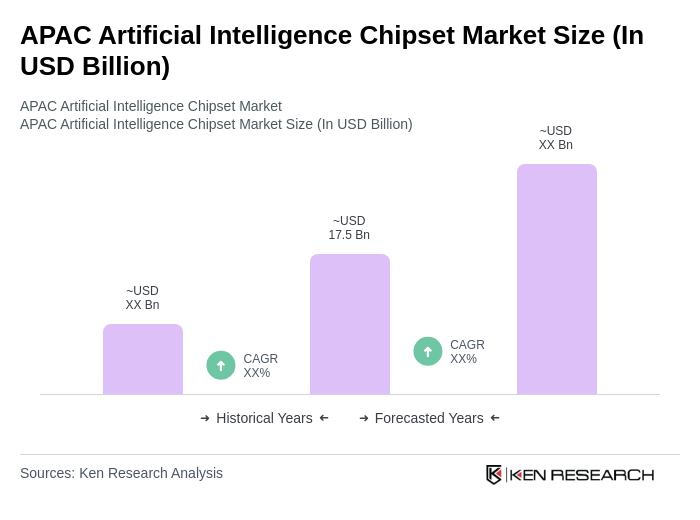

The APAC Artificial Intelligence Chipset Market is valued at approximately USD 17.5 billion, driven by the increasing demand for AI applications across sectors such as healthcare, automotive, and consumer electronics, along with advancements in machine learning and deep learning technologies.