Region:Asia

Author(s):Dev

Product Code:KRAC4041

Pages:81

Published On:October 2025

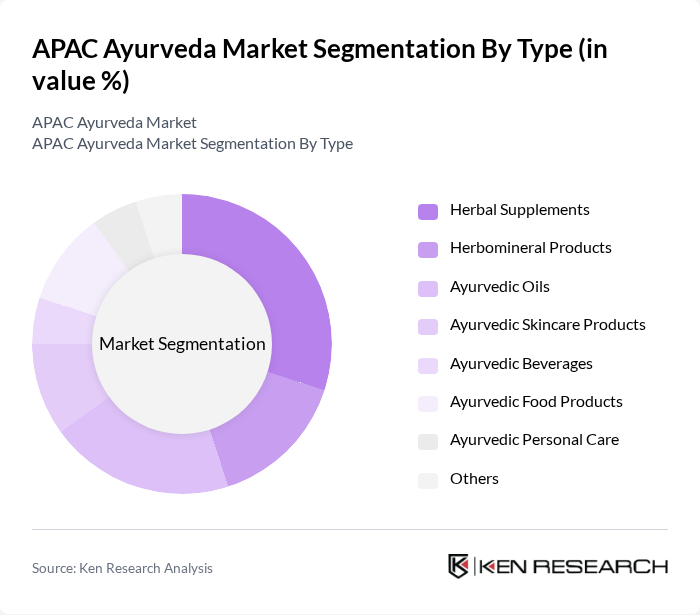

By Type:The Ayurveda market can be segmented into herbal supplements, herbomineral products, Ayurvedic oils, Ayurvedic skincare products, Ayurvedic beverages, Ayurvedic food products, Ayurvedic personal care, and others. Herbal supplements and herbomineral products are the largest segments, reflecting strong consumer demand for immunity boosters and natural remedies. Ayurvedic oils and skincare products are increasingly popular due to rising interest in wellness and personal care. Ayurvedic beverages and food products are gaining traction among health-conscious consumers, while personal care and other niche products contribute to market diversity .

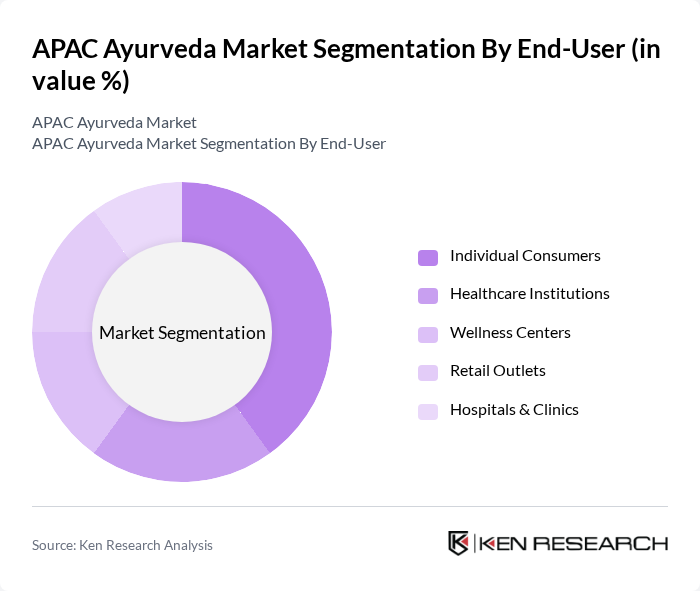

By End-User:The end-user segmentation of the Ayurveda market includes individual consumers, healthcare institutions, wellness centers, retail outlets, and hospitals & clinics. Individual consumers represent the largest segment, driven by self-care trends and the popularity of direct-to-consumer brands. Healthcare institutions and wellness centers play a key role in formalizing Ayurveda’s integration into mainstream health and wellness, while retail outlets and hospitals & clinics support broad distribution and access .

The APAC Ayurveda market is characterized by a dynamic mix of regional and international players. Leading participants such as Himalaya Wellness Company, Dabur India Limited, Patanjali Ayurved Limited, Baidyanath Ayurvedic Bhawan Pvt. Ltd., Zandu Realty Limited, Kerala Ayurveda Limited, Charak Pharma Pvt. Ltd., Maharishi Ayurveda Products Pvt. Ltd., Organic India Pvt. Ltd., Sri Sri Tattva, Vaidya Sane Ayurvedic Pharmacy, Amrutanjan Health Care Limited, Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Dhanvantari Ayurvedic Pharmacy, Vaidya Vasant Patil Ayurvedic Clinic, Vicco Laboratories, Emami Limited, Jiva Ayurveda, Arya Vaidya Pharmacy (Coimbatore) Ltd., SBL Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC Ayurveda market is poised for significant transformation, driven by technological integration and a growing emphasis on sustainability. As consumers increasingly seek personalized health solutions, companies are expected to leverage data analytics to tailor Ayurvedic products to individual needs. Additionally, the focus on eco-friendly sourcing will likely enhance brand loyalty, as consumers become more environmentally conscious. This evolving landscape presents a unique opportunity for innovation and collaboration within the industry, fostering a more robust market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbal Supplements Herbomineral Products Ayurvedic Oils Ayurvedic Skincare Products Ayurvedic Beverages Ayurvedic Food Products Ayurvedic Personal Care Others |

| By End-User | Individual Consumers Healthcare Institutions Wellness Centers Retail Outlets Hospitals & Clinics |

| By Region | India China Japan Australia Southeast Asia Others |

| By Application | Preventive Healthcare Therapeutic Treatments Beauty and Personal Care Dietary Supplements |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Ayurvedic Products Tax Incentives for Manufacturers Grants for Research in Ayurveda Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Ayurvedic Products | 120 | Health-conscious Consumers, Ayurveda Enthusiasts |

| Practitioner Insights on Ayurveda | 60 | Ayurvedic Doctors, Wellness Coaches |

| Retail Sector Feedback on Ayurvedic Sales | 50 | Store Managers, Product Buyers |

| Market Trends in Herbal Supplements | 45 | Nutritionists, Herbal Product Distributors |

| Consumer Attitudes Towards Natural Remedies | 70 | General Consumers, Alternative Medicine Users |

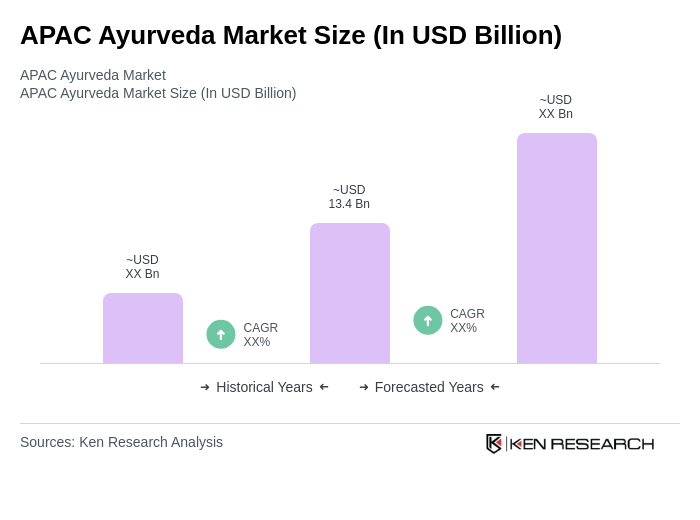

The APAC Ayurveda market is valued at approximately USD 13.4 billion, reflecting significant growth driven by increasing consumer awareness of natural health solutions and the rising demand for preventive healthcare.