Region:Asia

Author(s):Geetanshi

Product Code:KRAD5963

Pages:98

Published On:December 2025

By Product:The product segmentation includes various components essential for blood transfusion diagnostics. The subsegments are Reagents & Kits, Instruments & Analyzers, Consumables & Accessories, and Software & Services. Among these, Reagents & Kits are the most significant due to their critical role in routine blood grouping, antibody screening, and infectious disease testing and screening processes, followed closely by Instruments & Analyzers, which are essential for high-throughput, automated, and accurate diagnostics in both hospital laboratories and blood centers.

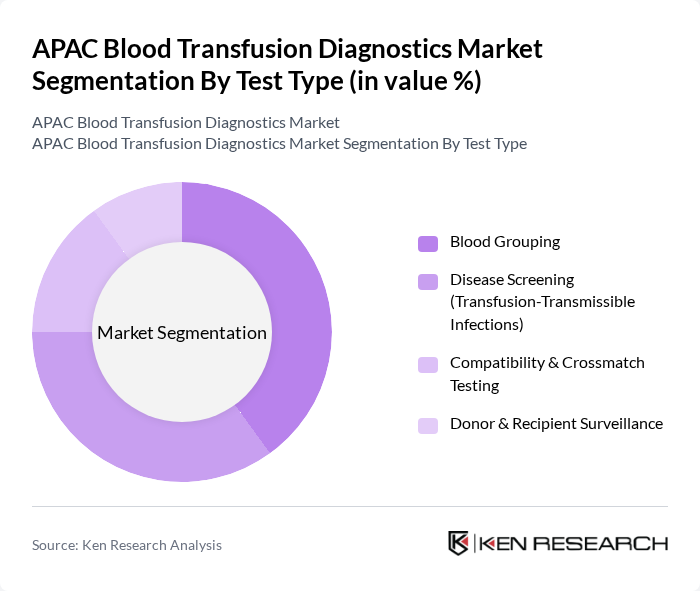

By Test Type:The test type segmentation encompasses Blood Grouping, Disease Screening (Transfusion-Transmissible Infections), Compatibility & Crossmatch Testing, and Donor & Recipient Surveillance. Blood Grouping is the leading subsegment, driven by its fundamental necessity in every transfusion episode and in preoperative, obstetric, and emergency care workflows, while Disease Screening is gaining traction due to increasing awareness of transfusion-transmissible infections such as HIV, hepatitis B and C, syphilis, and emerging pathogens, and the wider adoption of NAT and molecular assays to shorten diagnostic windows and enhance safety.

The APAC Blood Transfusion Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as F. Hoffmann-La Roche Ltd (Roche Diagnostics), Abbott Laboratories, Siemens Healthineers AG, Grifols S.A., Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Hologic, Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Danaher Corporation (Beckman Coulter, Cepheid), Sysmex Corporation, Revvity, Inc. (formerly PerkinElmer, Inc.), DiaSorin S.p.A., Mylab Discovery Solutions Pvt. Ltd., Fujifilm Holdings Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Sansure Biotech Inc., Tosoh Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC blood transfusion diagnostics market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As countries prioritize healthcare infrastructure, particularly in rural areas, the demand for efficient diagnostic solutions is expected to rise. Additionally, the integration of AI and automation in diagnostic processes will enhance accuracy and speed, making blood transfusions safer. These trends indicate a robust growth trajectory for the market, with significant opportunities for innovation and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Product | Reagents & Kits Instruments & Analyzers Consumables & Accessories Software & Services |

| By Test Type | Blood Grouping Disease Screening (Transfusion-Transmissible Infections) Compatibility & Crossmatch Testing Donor & Recipient Surveillance |

| By Technology | Serology (ELISA, CLIA, Agglutination) Nucleic Acid Testing (NAT / PCR-based) Rapid & Point-of-Care Tests Molecular Typing & Genotyping |

| By End-User | Hospitals Blood Banks Diagnostic Laboratories Plasma Fractionation Companies Others |

| By Application | Blood Donation Screening Pre-Transfusion Testing Post-Transfusion Monitoring Hemovigilance & Quality Assurance |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Transfusion Services | 120 | Transfusion Medicine Specialists, Blood Bank Managers |

| Diagnostic Laboratories | 100 | Laboratory Technicians, Quality Control Managers |

| Blood Donation Organizations | 90 | Program Coordinators, Outreach Managers |

| Medical Device Manufacturers | 80 | Product Development Managers, Sales Directors |

| Regulatory Bodies | 60 | Policy Makers, Compliance Officers |

The APAC Blood Transfusion Diagnostics Market is valued at approximately USD 1.6 billion, reflecting its significant share within the global market. This valuation is based on a comprehensive five-year historical analysis of the sector.