Region:Asia

Author(s):Dev

Product Code:KRAD7752

Pages:87

Published On:December 2025

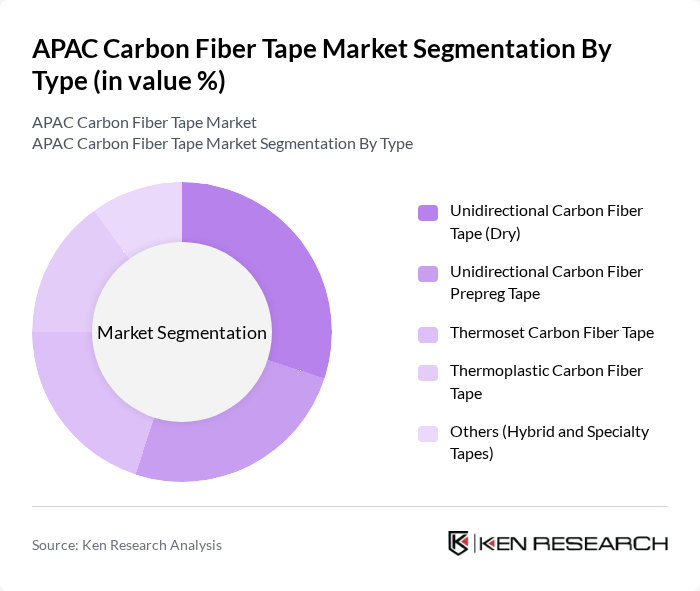

By Type:The market is segmented into various types of carbon fiber tapes, including Unidirectional Carbon Fiber Tape (Dry), Unidirectional Carbon Fiber Prepreg Tape, Thermoset Carbon Fiber Tape, Thermoplastic Carbon Fiber Tape, and Others (Hybrid and Specialty Tapes). Each type serves different applications and industries, catering to specific performance requirements.

The Unidirectional Carbon Fiber Tape (Dry) segment dominates the market due to its high strength-to-weight ratio and versatility in various applications, particularly in aerospace and automotive industries. This type of tape is preferred for structural components where weight reduction is critical. The increasing focus on fuel efficiency and performance in vehicles and aircraft has led to a surge in demand for this segment. Additionally, advancements in manufacturing processes have made these tapes more accessible and cost-effective, further driving their adoption.

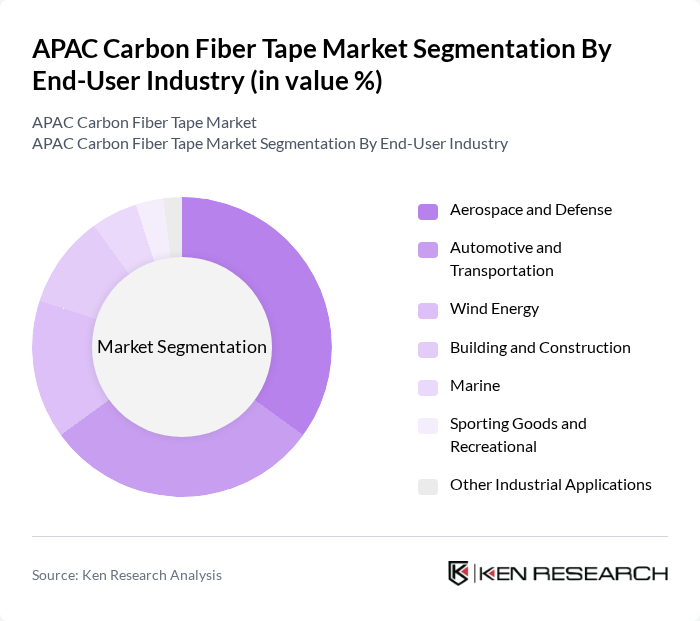

By End-User Industry:The market is segmented based on end-user industries, including Aerospace and Defense, Automotive and Transportation, Wind Energy, Building and Construction, Marine, Sporting Goods and Recreational, and Other Industrial Applications. Each industry has unique requirements that drive the demand for carbon fiber tapes.

The Aerospace and Defense sector is the leading end-user industry for carbon fiber tapes, accounting for a significant portion of the market. This dominance is attributed to the stringent requirements for lightweight and high-strength materials in aircraft manufacturing and defense applications. The increasing focus on reducing fuel consumption and enhancing performance in aviation has led to a higher adoption of carbon fiber tapes. Additionally, the automotive industry is also witnessing substantial growth due to the rising demand for lightweight components in electric vehicles, further supporting the overall market.

The APAC Carbon Fiber Tape Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toray Industries, Inc., Mitsubishi Chemical Group Corporation, Teijin Limited, Hexcel Corporation, SGL Carbon SE, Solvay S.A., Zoltek Companies, Inc. (Toray Group), Gurit Holding AG, Park Aerospace Corp., Axiom Materials, Inc., Jiangsu Hengshen Co., Ltd., Formosa Plastics Corporation, Zhongfu Shenying Carbon Fiber Co., Ltd., DowAksa Advanced Composites Holdings B.V., SK Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC carbon fiber tape market is poised for significant growth, driven by increasing demand across various sectors, particularly aerospace and automotive. As manufacturers continue to innovate and adopt advanced technologies, the market is expected to witness enhanced production capabilities. Additionally, the focus on sustainability will likely propel the adoption of carbon fiber tape, aligning with global environmental goals. Strategic collaborations and government support for advanced materials will further bolster market expansion, creating a dynamic landscape for stakeholders in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Unidirectional Carbon Fiber Tape (Dry) Unidirectional Carbon Fiber Prepreg Tape Thermoset Carbon Fiber Tape Thermoplastic Carbon Fiber Tape Others (Hybrid and Specialty Tapes) |

| By End-User Industry | Aerospace and Defense Automotive and Transportation Wind Energy Building and Construction Marine Sporting Goods and Recreational Other Industrial Applications |

| By Country | China Japan India South Korea ASEAN Countries Australia & New Zealand Rest of APAC |

| By Application | Primary and Secondary Structural Components Laminates and Repair Patches Pressure Vessels and Hydrogen Storage Wind Turbine Blades Sporting and Leisure Equipment Others |

| By Resin System | Epoxy-based Carbon Fiber Tapes Polyamide (PA) and PEEK-based Carbon Fiber Tapes Other Thermoset and Thermoplastic Resin Systems |

| By Distribution Channel | Direct Sales to OEMs Distributors and Tier-1 Suppliers Online and Specialized Composite Retailers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | Design Engineers, Procurement Managers |

| Automotive Manufacturing | 80 | Production Supervisors, Quality Control Managers |

| Sports Equipment Sector | 70 | Product Development Managers, Marketing Directors |

| Industrial Applications | 60 | Operations Managers, Supply Chain Analysts |

| Research & Development | 90 | R&D Directors, Innovation Managers |

The APAC Carbon Fiber Tape Market is valued at approximately USD 1.1 billion, driven by the increasing demand for lightweight and high-strength materials in industries such as aerospace, automotive, and wind energy.