APAC Colorectal Surgery Market Overview

- The APAC Colorectal Surgery Market is valued at USD 5.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of colorectal diseases, rapid advancements in minimally invasive and robotic-assisted surgical technologies, and rising healthcare expenditure across the region. The demand for minimally invasive surgical procedures continues to expand, as patients and providers prioritize quicker recovery times, reduced hospital stays, and improved clinical outcomes.

- Key players in this market include China, Japan, and India, which dominate due to their large populations and increasing awareness of colorectal health. China leads with its extensive healthcare infrastructure and significant investment in medical technologies, while Japan is recognized for its advanced surgical techniques and high-quality healthcare services, particularly in robotic-assisted and minimally invasive procedures. India is witnessing rapid growth driven by rising healthcare access, a growing middle class, and government initiatives to improve cancer screening and surgical care.

- In 2023, the Indian government implemented the National Health Mission, which aims to enhance healthcare services, including colorectal surgery. This initiative focuses on improving access to surgical care, increasing funding for healthcare facilities, and promoting awareness about colorectal diseases, thereby supporting the growth of the colorectal surgery market in the region. The National Health Mission (Ministry of Health & Family Welfare, Government of India, 2023) mandates operational standards for surgical facilities, sets compliance requirements for equipment and personnel, and establishes funding thresholds for public hospitals to expand colorectal surgical services.

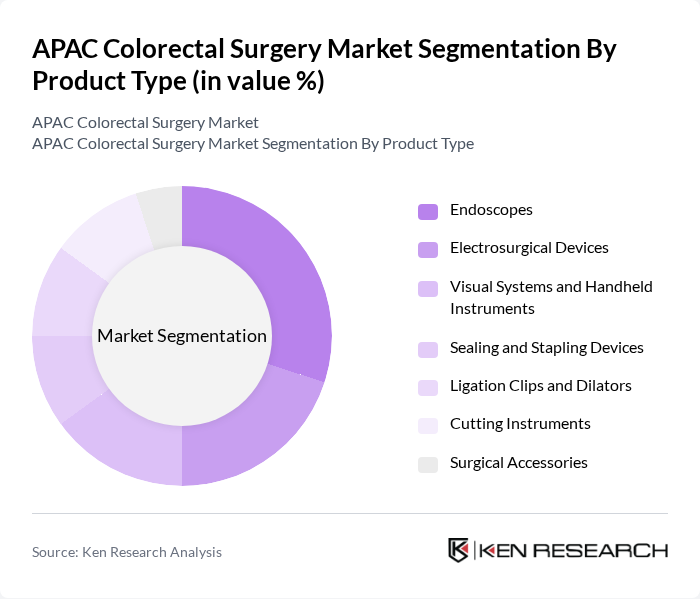

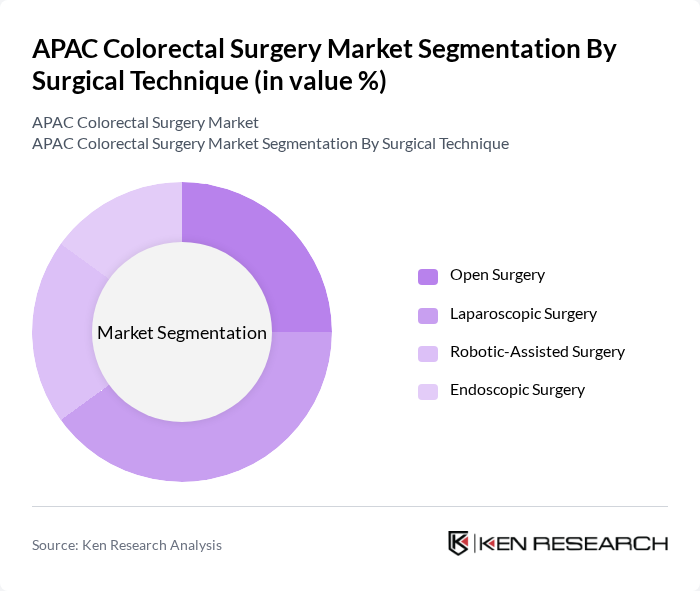

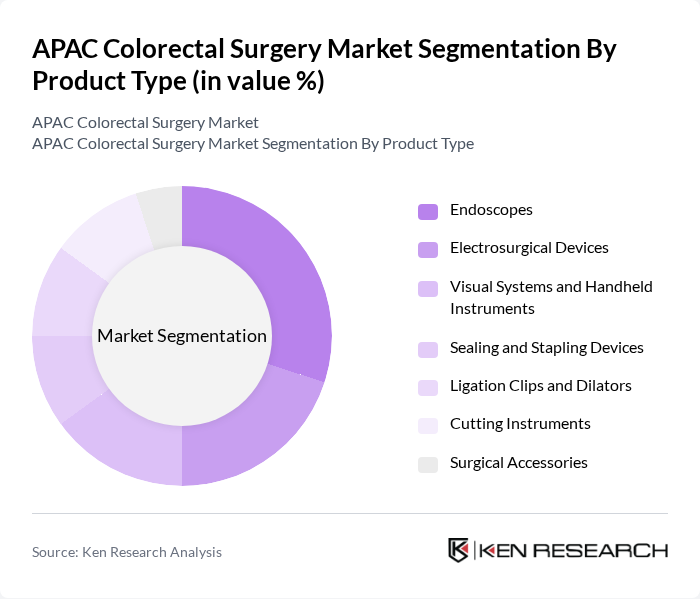

APAC Colorectal Surgery Market Segmentation

By Product Type:The product type segmentation includes a comprehensive range of instruments and devices used in colorectal surgeries. The subsegments are Endoscopes, Electrosurgical Devices, Visual Systems and Handheld Instruments, Sealing and Stapling Devices, Ligation Clips and Dilators, Cutting Instruments, and Surgical Accessories. Among these, Endoscopes are leading the market due to their essential role in minimally invasive procedures, enabling superior visualization and precision during surgeries. Electrosurgical devices and stapling systems are also witnessing increased adoption as hospitals upgrade to advanced surgical platforms.

By Surgical Technique:The surgical technique segmentation encompasses Open Surgery, Laparoscopic Surgery, Robotic-Assisted Surgery, and Endoscopic Surgery. Laparoscopic Surgery remains the dominant technique, accounting for the largest share due to its minimally invasive nature, which results in shorter recovery times, less postoperative pain, and lower complication rates. The adoption of robotic-assisted systems is accelerating, driven by their ability to enhance precision, control, and outcomes in complex colorectal procedures. Endoscopic surgery is also expanding, supported by the increasing availability of advanced visualization and diagnostic tools.

APAC Colorectal Surgery Market Competitive Landscape

The APAC Colorectal Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson, Boston Scientific Corporation, Stryker Corporation, Olympus Corporation, B. Braun Melsungen AG, Cook Medical, Intuitive Surgical, Inc., Smith & Nephew plc, Zimmer Biomet Holdings, Inc., CONMED Corporation, Hologic, Inc., Merit Medical Systems, Inc., Ethicon (Johnson & Johnson subsidiary), Medline Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Colorectal Surgery Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Colorectal Diseases:The rise in colorectal diseases is significant, with approximately 1.9 million new cases reported in 2020 across the Asia-Pacific region. This alarming statistic is projected to increase by 2.5% annually, driven by lifestyle changes and dietary habits. The World Health Organization indicates that colorectal cancer is the third most common cancer in the region, necessitating enhanced surgical interventions and driving demand for colorectal surgeries.

- Advancements in Surgical Technologies:The APAC region has witnessed substantial advancements in surgical technologies, with investments exceeding USD 1.5 billion in future alone. Innovations such as robotic-assisted surgeries and laparoscopic techniques have improved surgical outcomes and reduced recovery times. The integration of these technologies is expected to enhance the efficiency of colorectal surgeries, making them more accessible and appealing to patients, thus propelling market growth.

- Rising Geriatric Population:The geriatric population in the APAC region is projected to reach 1 billion in future, representing a significant demographic shift. Older adults are at a higher risk for colorectal diseases, leading to increased surgical demand. According to the United Nations, the proportion of individuals aged 65 and older will rise to approximately 15% in future, creating a pressing need for specialized colorectal surgical services tailored to this age group.

Market Challenges

- High Cost of Surgical Procedures:The cost of colorectal surgeries in the APAC region can range from USD 5,000 to USD 20,000, depending on the complexity and technology used. This high cost poses a significant barrier for many patients, particularly in developing countries where healthcare budgets are constrained. The financial burden often leads to delayed treatments, adversely affecting patient outcomes and overall market growth.

- Limited Access to Healthcare Facilities in Rural Areas:Approximately 60% of the APAC population resides in rural areas, where access to specialized healthcare facilities is severely limited. This disparity results in inadequate surgical care for colorectal diseases, as many patients must travel long distances to receive treatment. The lack of infrastructure and resources in these regions hampers the overall growth of the colorectal surgery market.

APAC Colorectal Surgery Market Future Outlook

The future of the APAC colorectal surgery market appears promising, driven by technological advancements and demographic shifts. The integration of artificial intelligence and robotics in surgical procedures is expected to enhance precision and patient outcomes. Additionally, the growing emphasis on outpatient surgical procedures will likely reshape care delivery models, making surgeries more accessible. As healthcare infrastructure improves, particularly in rural areas, the market is poised for significant growth, addressing the rising demand for colorectal surgeries.

Market Opportunities

- Expansion of Minimally Invasive Surgical Techniques:The increasing adoption of minimally invasive surgical techniques presents a significant opportunity for market growth. These procedures, which reduce recovery times and hospital stays, are gaining traction, with an estimated 30% increase in their use expected in future. This trend aligns with patient preferences for less invasive options, driving demand for innovative surgical solutions.

- Development of Innovative Surgical Devices:The market for innovative surgical devices is expanding rapidly, with investments in research and development projected to exceed USD 500 million in future. This focus on innovation is expected to yield advanced tools that enhance surgical precision and patient safety. As healthcare providers seek to improve outcomes, the demand for cutting-edge surgical devices will continue to grow, creating lucrative opportunities in the market.