Region:Asia

Author(s):Dev

Product Code:KRAD6455

Pages:97

Published On:December 2025

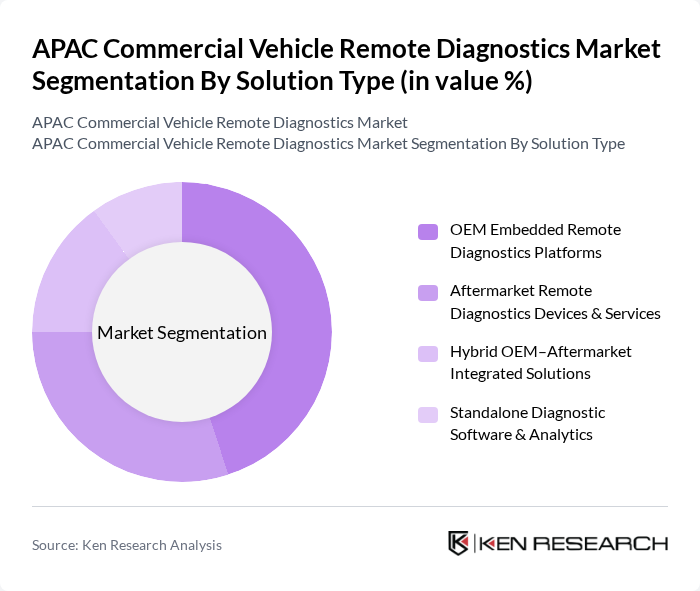

By Solution Type:

The solution type segment includes OEM Embedded Remote Diagnostics Platforms, Aftermarket Remote Diagnostics Devices & Services, Hybrid OEM–Aftermarket Integrated Solutions, and Standalone Diagnostic Software & Analytics. Among these, the OEM Embedded Remote Diagnostics Platforms are leading the market due to their seamless integration with vehicle systems, providing manufacturers and fleet operators with real-time data and insights. The growing trend of connected vehicles and the increasing focus on preventive maintenance are driving the adoption of these platforms, as they enhance vehicle performance and reduce operational costs.

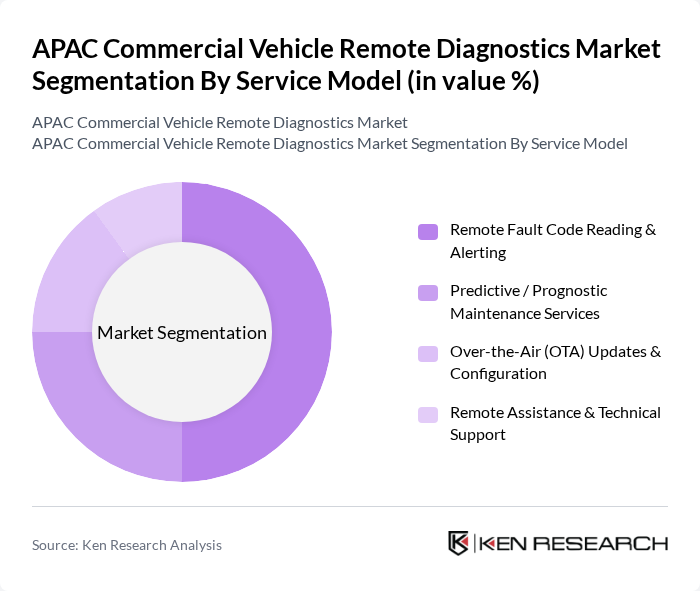

By Service Model:

This segment encompasses Remote Fault Code Reading & Alerting, Predictive / Prognostic Maintenance Services, Over-the-Air (OTA) Updates & Configuration, and Remote Assistance & Technical Support. The Remote Fault Code Reading & Alerting service model is currently the most dominant, as it allows fleet operators to quickly identify and address issues, minimizing vehicle downtime. The increasing complexity of vehicle systems and the need for timely maintenance are driving the demand for this service, making it essential for efficient fleet management.

The APAC Commercial Vehicle Remote Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Teletrac Navman (A Vontier Company), Geotab Inc., Trimble Inc., HARMAN International (Samsung Electronics Co., Ltd.), Verizon Connect, MiX Telematics, Noregon Systems LLC, Fleet Complete, Inseego Corp., ORBCOMM Inc., Shenzhen iTriangle Infotech / Asia-Pacific Regional Players, and Denso Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC Commercial Vehicle Remote Diagnostics Market is poised for significant evolution, driven by technological advancements and increasing regulatory pressures. As fleet operators prioritize predictive maintenance and data-driven decision-making, the integration of AI and machine learning will enhance diagnostic capabilities. Furthermore, the rise of electric and hybrid vehicles will necessitate advanced diagnostic tools, creating a demand for innovative solutions. This shift will likely lead to increased partnerships between technology providers and vehicle manufacturers, fostering a collaborative ecosystem focused on efficiency and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | OEM Embedded Remote Diagnostics Platforms Aftermarket Remote Diagnostics Devices & Services Hybrid OEM–Aftermarket Integrated Solutions Standalone Diagnostic Software & Analytics |

| By Service Model | Remote Fault Code Reading & Alerting Predictive / Prognostic Maintenance Services Over-the-Air (OTA) Updates & Configuration Remote Assistance & Technical Support |

| By Vehicle Type | Light Commercial Vehicles (LCVs) Medium-Duty Trucks Heavy-Duty Trucks Buses & Coaches |

| By Connectivity & Technology | Embedded Telematics Control Units (TCUs) Smartphone / BYOD-based Telematics Cloud-Based Remote Diagnostics Platforms G/5G & V2X-Enabled Diagnostics |

| By Application | Real-Time Vehicle Health Monitoring Fleet Maintenance Optimization Warranty & Recall Management Compliance & Emissions Monitoring |

| By Fleet Size | Small Fleets (1–50 Vehicles) Medium Fleets (51–250 Vehicles) Large Fleets (>250 Vehicles) OEM & Captive Fleets |

| By Country | China India Japan South Korea ASEAN (Indonesia, Thailand, Malaysia, Vietnam, Others) Australia & New Zealand Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Solutions | 140 | Fleet Managers, Operations Directors |

| Telematics Providers | 100 | Product Managers, Business Development Executives |

| Commercial Vehicle Maintenance | 80 | Service Center Managers, Technicians |

| Logistics and Transportation Companies | 120 | Logistics Coordinators, Supply Chain Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

The APAC Commercial Vehicle Remote Diagnostics Market is valued at approximately USD 2.5 billion, driven by the increasing adoption of telematics solutions and the demand for fleet management systems, enhancing operational efficiency and reducing downtime.