APAC Edge AI Market Overview

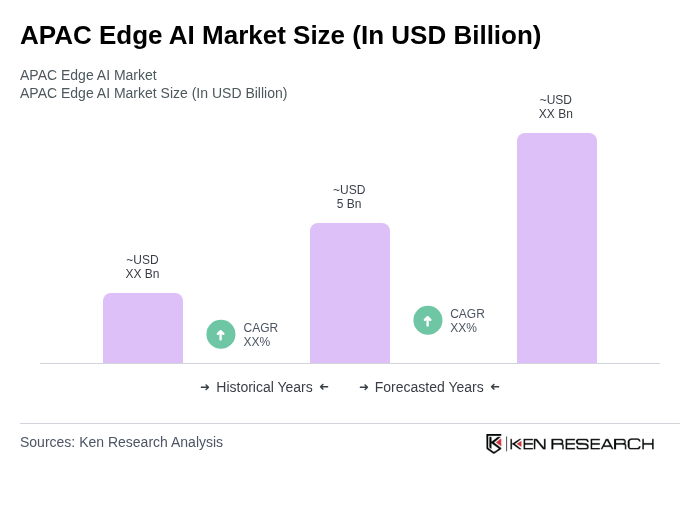

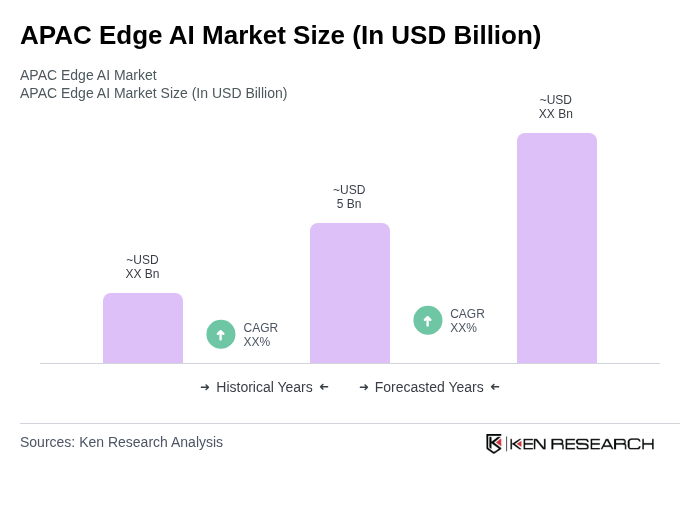

- The APAC Edge AI Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for real-time data processing, rapid urbanization, the proliferation of IoT devices, and advancements in AI technologies. The integration of edge computing with AI enables faster decision-making and improved operational efficiency across various sectors, including healthcare, manufacturing, and transportation. The rollout of 5G networks and significant investments in smart infrastructure further accelerate adoption in the region .

- Key players in this market include China, Japan, and South Korea, which dominate due to their robust technological infrastructure, substantial investments in AI research and development, and a high concentration of leading tech companies. These countries are at the forefront of innovation, leveraging advanced manufacturing capabilities and strong government support to foster growth in the Edge AI sector. The Asia-Pacific region is projected to account for over 40% of the global edge AI market share, reflecting its leadership in adoption and innovation .

- In 2023, the Indian government introduced the National Strategy for Artificial Intelligence, issued by NITI Aayog, which aims to promote the development and adoption of AI technologies, including Edge AI. This initiative focuses on enhancing research capabilities, fostering public-private partnerships, and establishing a regulatory framework to accelerate the growth of AI applications across various industries. The strategy outlines operational guidelines for data privacy, ethical AI, and sectoral standards, supporting the expansion of Edge AI in healthcare, agriculture, and manufacturing .

APAC Edge AI Market Segmentation

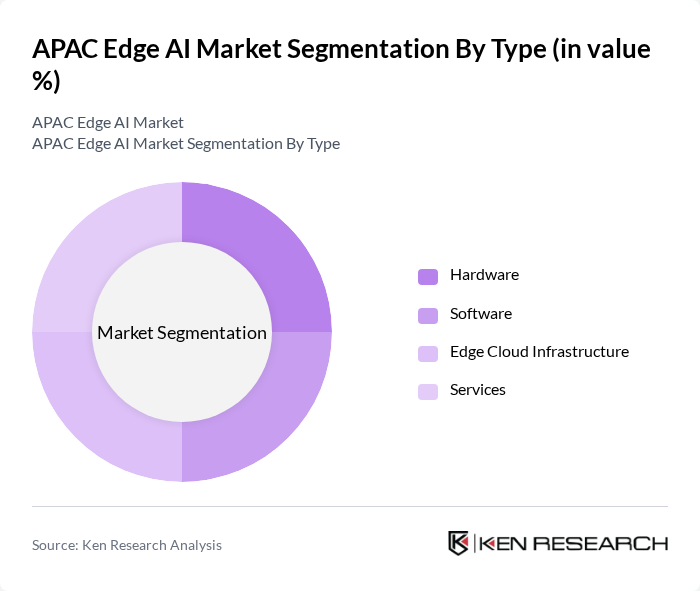

By Type:The Edge AI market can be segmented into four main types: Hardware, Software, Edge Cloud Infrastructure, and Services. Each of these segments plays a crucial role in the overall market dynamics, with hardware being the largest revenue-generating segment and software registering the fastest growth. Hardware and software are foundational in deploying Edge AI solutions, while Edge Cloud Infrastructure and Services support scalability and integration .

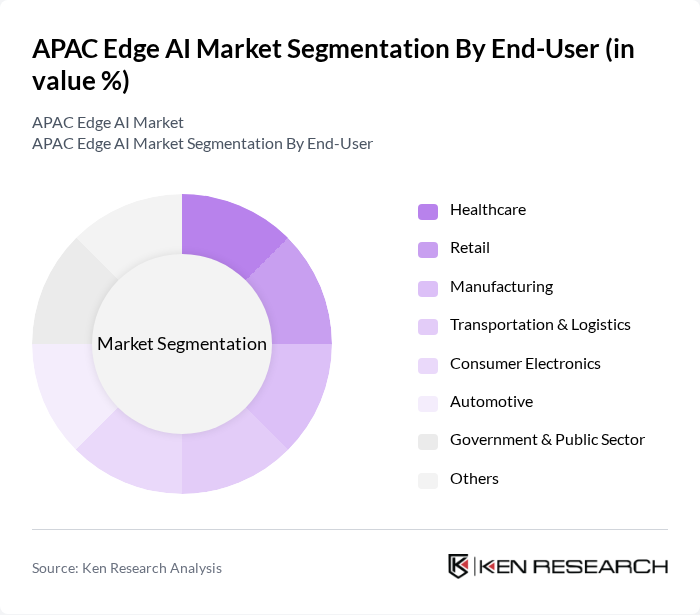

By End-User:The Edge AI market is also segmented by end-user industries, including Healthcare, Retail, Manufacturing, Transportation & Logistics, Consumer Electronics, Automotive, Government & Public Sector, and Others. Each sector utilizes Edge AI technologies to enhance operational efficiency, improve customer experiences, and support digital transformation. Healthcare and manufacturing are leading adopters, driven by the need for real-time analytics and automation .

APAC Edge AI Market Competitive Landscape

The APAC Edge AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Intel Corporation, Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., Qualcomm Technologies, Inc., Baidu, Inc., Alibaba Group Holding Limited, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Cisco Systems, Inc., ADLINK Technology Inc., Socionext Inc., Gorilla Technology Group Inc., Nutanix Inc., Synaptics Incorporated, Fujitsu Limited, NEC Corporation, Lenovo Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

APAC Edge AI Market Industry Analysis

Growth Drivers

- Increasing Demand for Real-Time Data Processing:The APAC region is witnessing a surge in demand for real-time data processing, driven by the need for immediate insights across various sectors. In future, the region is expected to generate approximately $15 billion in revenue from edge AI solutions, reflecting a 20% increase from the previous year. This growth is largely attributed to industries such as finance and healthcare, where timely data analysis is critical for decision-making and operational efficiency, as highlighted by the World Economic Forum.

- Proliferation of IoT Devices:The rapid expansion of Internet of Things (IoT) devices in APAC is a significant growth driver for the edge AI market. In future, the number of connected IoT devices in the region is projected to reach 30 billion, up from 25 billion. This proliferation enhances the need for edge AI solutions to process data locally, reducing latency and bandwidth usage. The International Telecommunication Union reports that this trend is crucial for sectors like manufacturing and smart homes, where real-time data processing is essential.

- Enhanced Network Connectivity and 5G Rollout:The rollout of 5G technology across APAC is set to revolutionize edge AI applications by providing faster and more reliable connectivity. In future, it is estimated that 5G networks will cover over 60% of the region, facilitating the deployment of advanced edge AI solutions. This enhanced connectivity allows for seamless data transfer and processing, particularly in sectors such as autonomous vehicles and smart cities, as reported by the Asia-Pacific Telecommunity.

Market Challenges

- High Implementation Costs:One of the primary challenges facing the APAC edge AI market is the high cost associated with implementation. In future, the average expenditure for deploying edge AI solutions is expected to exceed $1 million per project, which can deter smaller enterprises from adopting these technologies. This financial barrier is compounded by the need for specialized hardware and software, as noted in a report by the Asian Development Bank, limiting market penetration.

- Lack of Skilled Workforce:The shortage of skilled professionals in AI and data science poses a significant challenge to the growth of the edge AI market in APAC. In future, it is estimated that there will be a deficit of over 1 million AI specialists in the region, according to the World Bank. This skills gap hampers the ability of organizations to effectively implement and manage edge AI solutions, ultimately slowing down innovation and adoption rates across various industries.

APAC Edge AI Market Future Outlook

The future of the APAC edge AI market appears promising, driven by technological advancements and increasing adoption across various sectors. As organizations prioritize real-time data processing and enhanced connectivity, the demand for edge AI solutions is expected to rise significantly. Furthermore, the integration of AI into smart city initiatives and the growing focus on energy-efficient models will likely shape the market landscape. Companies that invest in research and development will be well-positioned to capitalize on these emerging trends, fostering innovation and competitive advantage.

Market Opportunities

- Expansion in Smart City Initiatives:The ongoing development of smart city projects across APAC presents a substantial opportunity for edge AI solutions. In future, investments in smart city technologies are projected to reach $100 billion, creating demand for AI-driven analytics and real-time data processing to enhance urban living and infrastructure management.

- Growth in Edge Computing Applications:The increasing reliance on edge computing applications in sectors such as healthcare and manufacturing offers significant market opportunities. In future, the edge computing market in APAC is expected to grow to $25 billion, driven by the need for localized data processing and reduced latency, enabling organizations to optimize operations and improve service delivery.