Region:Asia

Author(s):Dev

Product Code:KRAD5168

Pages:88

Published On:December 2025

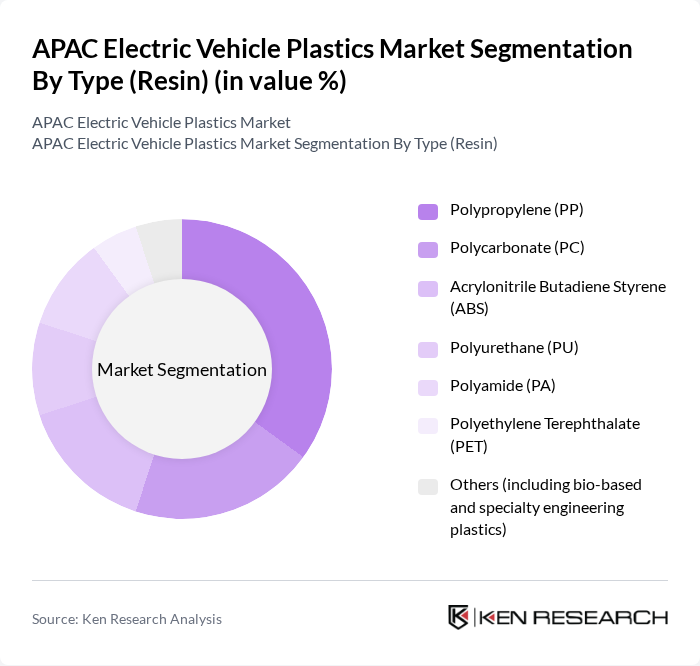

By Type (Resin):The market is segmented into various types of resins used in electric vehicles, including Polypropylene (PP), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Polyamide (PA), Polyethylene Terephthalate (PET), and others, which include bio-based and specialty engineering plastics. This mix reflects the broader use of lightweight thermoplastics and engineering polymers in EV interiors, exteriors, powertrain components, and battery systems across Asia Pacific. Among these, Polypropylene (PP) is the leading subsegment due to its lightweight properties, cost-effectiveness, good chemical resistance, and versatility in applications such as dashboards, trims, battery supports, under-bonnet parts, and cable insulation in electric vehicles. The increasing focus on reducing vehicle weight to enhance battery efficiency and driving range, together with the need for recyclable thermoplastics, has further solidified PP's dominance in the market.

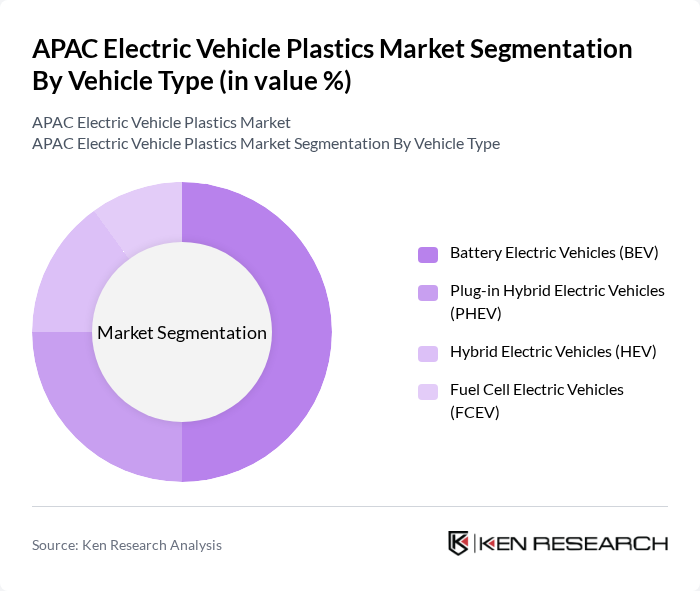

By Vehicle Type:The market is categorized based on the types of electric vehicles, including Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Hybrid Electric Vehicles (HEV), and Fuel Cell Electric Vehicles (FCEV). Battery Electric Vehicles (BEV) are the dominant segment, aligned with the strong regional growth in pure electric passenger cars and two-wheelers in China, Japan, South Korea, and India. This dominance is driven by the growing consumer preference for fully electric options, rapid declines in battery pack costs, and advancements in lithium-ion and next-generation battery technology that enhance range and performance. The increasing availability of public and private charging infrastructure, together with purchase subsidies, tax rebates, and zero-emission vehicle mandates across key APAC markets, further supports the growth of BEVs and consequently boosts demand for high-performance plastics in battery enclosures, thermal management, and lightweight body structures.

The APAC Electric Vehicle Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, SABIC, Covestro AG, DuPont de Nemours, Inc., LG Chem Ltd., LyondellBasell Industries Holdings B.V., Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, LANXESS AG, Mitsubishi Chemical Group Corporation, Toray Industries, Inc., Evonik Industries AG, Celanese Corporation, DSM-Firmenich AG, INEOS Group Holdings S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC electric vehicle plastics market appears promising, driven by technological advancements and increasing consumer demand for sustainable solutions. As manufacturers focus on integrating more lightweight and recyclable materials, the market is expected to witness a significant transformation. Additionally, the expansion of electric vehicle models and improvements in battery technology will likely create new opportunities for plastic applications. The ongoing shift towards a circular economy will further enhance the market's sustainability, positioning it for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Resin) | Polypropylene (PP) Polycarbonate (PC) Acrylonitrile Butadiene Styrene (ABS) Polyurethane (PU) Polyamide (PA) Polyethylene Terephthalate (PET) Others (including bio-based and specialty engineering plastics) |

| By Vehicle Type | Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) Hybrid Electric Vehicles (HEV) Fuel Cell Electric Vehicles (FCEV) |

| By Country | China Japan India South Korea Australia Indonesia Malaysia Vietnam Rest of APAC |

| By Application | Interior Components Exterior Components Under-the-Hood Components Battery Components and Enclosures Electrical & Electronic Components Others |

| By Material Source | Virgin Plastics Recycled Plastics Bio-based Plastics Others |

| By Manufacturing Process | Injection Molding Blow Molding Thermoforming Extrusion Others |

| By Policy Support | Purchase Subsidies for Electric Vehicles Tax Exemptions and Rebates Grants and Incentives for Lightweighting & Plastics R&D Local Content & Green Procurement Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 120 | Product Development Managers, Procurement Officers |

| Plastic Material Suppliers | 90 | Sales Directors, Technical Managers |

| Automotive Industry Analysts | 60 | Market Research Analysts, Industry Consultants |

| Regulatory Bodies | 45 | Policy Makers, Environmental Compliance Officers |

| Electric Vehicle Component Manufacturers | 70 | Operations Managers, Quality Assurance Specialists |

The APAC Electric Vehicle Plastics Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of electric vehicles and government initiatives aimed at promoting sustainable transportation solutions across the region.