UAE Recycled Plastics Market Overview

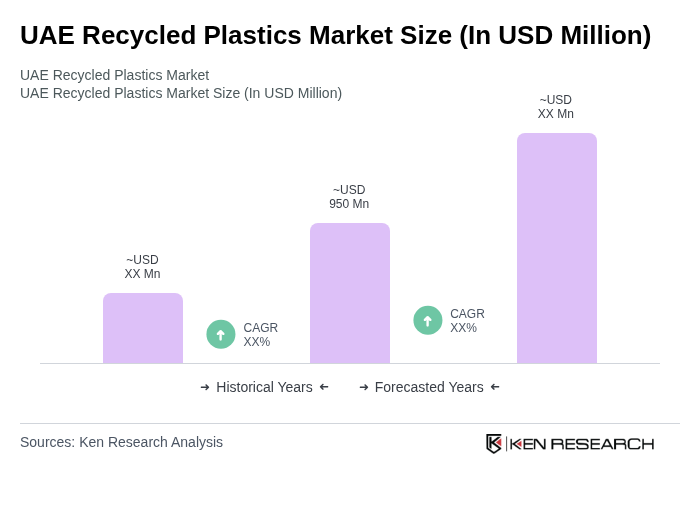

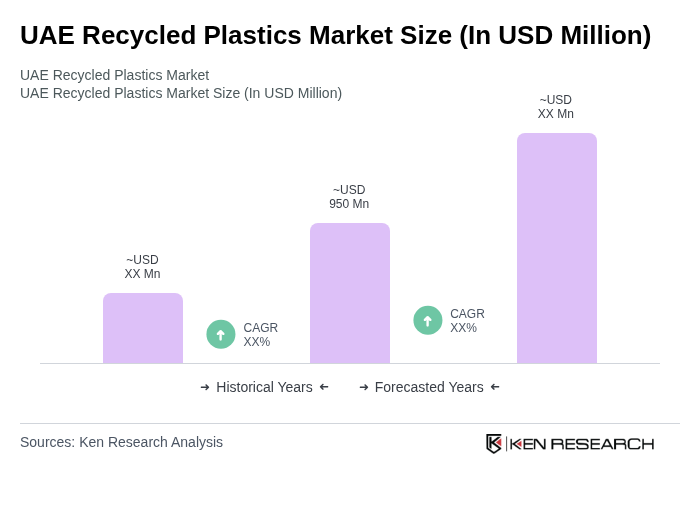

- The UAE Recycled Plastics Market is valued at USD 950 million, based on a five-year historical analysis. Growth is primarily driven by rising environmental consciousness, robust government initiatives promoting recycling, and increasing demand for sustainable packaging solutions. The market has experienced a notable increase in investments directed toward advanced recycling technologies and infrastructure, further accelerating expansion .

- Key cities such as Dubai and Abu Dhabi dominate the market due to their strong industrial base and ongoing sustainability commitments. Dubai’s initiatives, such as the Dubai Clean Energy Strategy, and Abu Dhabi’s focus on integrated waste management and recycling, have established these cities as leaders in the recycled plastics sector. Their advanced infrastructure and supportive regulatory frameworks provide a fertile environment for market growth .

- In 2023, the UAE government enacted the Extended Producer Responsibility (EPR) Policy for Packaging Waste, issued by the Ministry of Climate Change and Environment. This regulation requires producers and importers to manage the entire lifecycle of their plastic products, including collection and recycling targets. The EPR framework mandates compliance reporting, encourages investment in sustainable practices and recycling technologies, and is a key driver for the growth of the recycled plastics market .

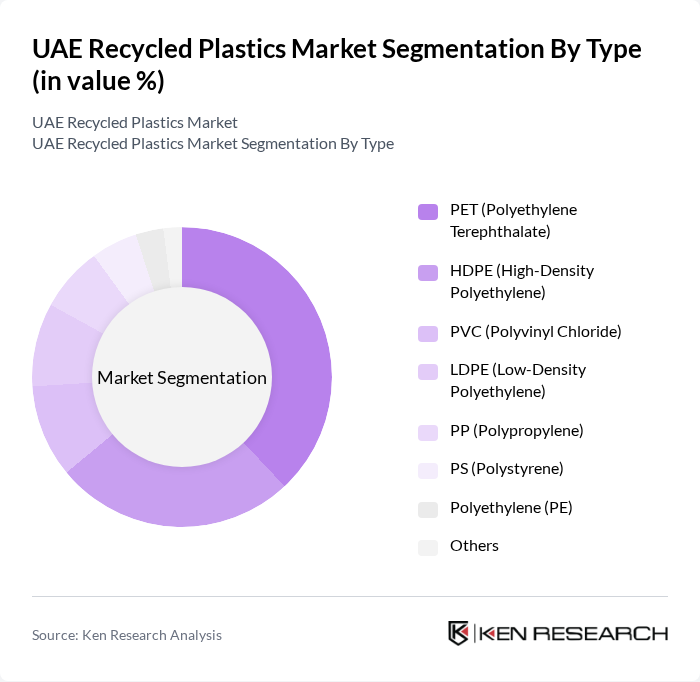

UAE Recycled Plastics Market Segmentation

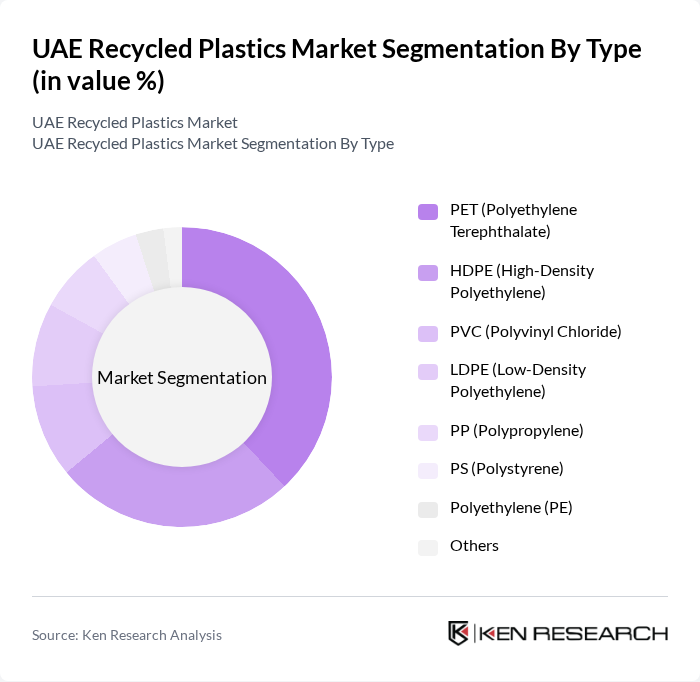

By Type:The market is segmented into various types of recycled plastics, including PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), PVC (Polyvinyl Chloride), LDPE (Low-Density Polyethylene), PP (Polypropylene), PS (Polystyrene), Polyethylene (PE), and Others. PET remains the most widely recycled plastic, driven by its extensive use in beverage bottles and high recycling rates. The ongoing shift toward sustainable packaging and increased consumer preference for eco-friendly materials continue to bolster PET recycling demand .

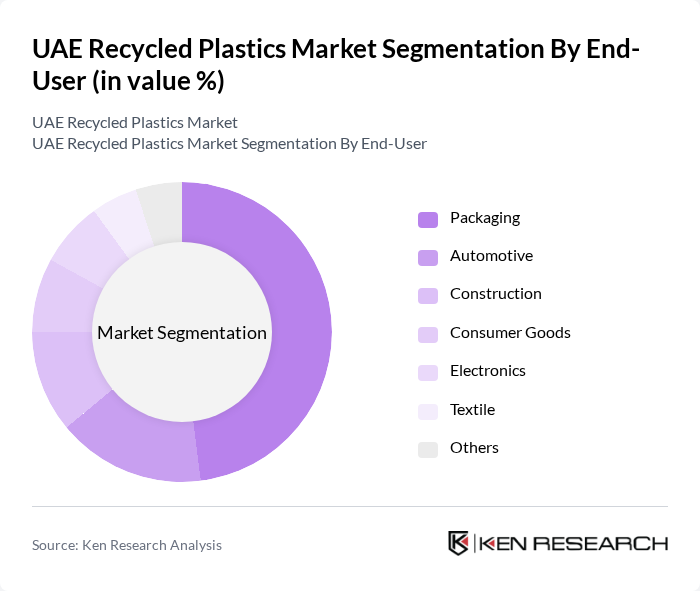

By End-User:The end-user segmentation includes Packaging, Automotive, Construction, Consumer Goods, Electronics, Textile, and Others. The packaging sector is the largest consumer of recycled plastics, propelled by the surging demand for eco-friendly packaging and regulatory pressures on single-use plastics. Companies are increasingly integrating recycled content to align with sustainability goals and consumer expectations, resulting in a marked rise in recycled plastics usage across packaging applications .

UAE Recycled Plastics Market Competitive Landscape

The UAE Recycled Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environmental Services, Dulsco, Emirates Recycling, EcoWASTE, Averda, Al Dhafra Recycling Industries, Bee'ah, Green Planet Recycling, Enviroserve, National Plastic Factory, Al Ain Plastic Factory, Al Qusais Plastic Factory, Gulf Plastic and Converting Industries, Emirates Plastics, Al Mufeed Recycling, Farz (Imdaad LLC), DGrade, Interpolymer, Rebound Plastic Exchange, RECAPP contribute to innovation, geographic expansion, and service delivery in this space.

UAE Recycled Plastics Market Industry Analysis

Growth Drivers

- Increasing Environmental Awareness:The UAE has seen a significant rise in environmental consciousness, with 50% of residents expressing concern over plastic waste, according to a survey by the Emirates Environmental Group. This awareness drives demand for recycled plastics, as consumers increasingly prefer products that minimize environmental impact. The UAE government aims to reduce plastic waste by 50% in future, further fueling the market for recycled materials. This growing awareness is pivotal in shaping consumer behavior towards sustainable products.

- Government Initiatives and Regulations:The UAE government has implemented various initiatives to promote recycling, including the National Waste Management Strategy, which aims to divert 75% of waste from landfills in future. Additionally, the introduction of regulations mandating the use of recycled materials in packaging has spurred growth in the recycled plastics market. The government allocated AED 1 billion for waste management projects, highlighting its commitment to enhancing recycling infrastructure and supporting sustainable practices across industries.

- Technological Advancements in Recycling Processes:Innovations in recycling technologies are enhancing the efficiency and effectiveness of plastic recycling in the UAE. For instance, advanced sorting technologies have improved the recovery rates of recyclable plastics by 30% in recent years. The introduction of chemical recycling methods allows for the processing of previously non-recyclable plastics, expanding the range of materials that can be recycled. This technological progress is crucial for meeting the increasing demand for high-quality recycled plastics in various sectors.

Market Challenges

- High Initial Investment Costs:Establishing recycling facilities in the UAE requires substantial capital investment, often exceeding AED 5 million for small to medium-sized operations. This financial barrier limits entry for new players and hinders the expansion of existing facilities. Additionally, the high costs associated with advanced recycling technologies can deter investment, making it challenging for companies to scale operations and meet the growing demand for recycled plastics in the market.

- Inconsistent Quality of Recycled Plastics:The quality of recycled plastics in the UAE often varies significantly, with some batches failing to meet industry standards. A report from the UAE Ministry of Climate Change and Environment indicated that 40% of recycled plastics did not meet the required specifications for certain applications. This inconsistency poses challenges for manufacturers who rely on high-quality materials, potentially leading to reduced consumer trust and limiting the market's growth potential.

UAE Recycled Plastics Market Future Outlook

The future of the UAE recycled plastics market appears promising, driven by increasing government support and technological advancements. As the nation strives to achieve its sustainability goals, investments in recycling infrastructure are expected to rise significantly. Furthermore, consumer preferences are shifting towards eco-friendly products, creating a favorable environment for recycled plastics. The collaboration between public and private sectors will likely enhance recycling capabilities, ensuring a steady supply of high-quality recycled materials to meet market demands.

Market Opportunities

- Expansion of Recycling Infrastructure:The UAE's commitment to enhancing recycling infrastructure presents a significant opportunity for growth. With plans to invest AED 2 billion in new recycling facilities in future, the market can expect improved processing capabilities and increased capacity for recycled plastics. This expansion will facilitate better collection and sorting processes, ultimately leading to higher quality recycled materials available for various industries.

- Collaboration with Private Sector:Partnerships between government entities and private companies can drive innovation in recycling technologies. By leveraging private sector expertise, the UAE can develop more efficient recycling processes and expand the range of materials processed. Such collaborations are expected to enhance the overall sustainability of the plastics industry, creating a robust market for recycled plastics and fostering economic growth in the region.