Region:Asia

Author(s):Geetanshi

Product Code:KRAD3707

Pages:80

Published On:November 2025

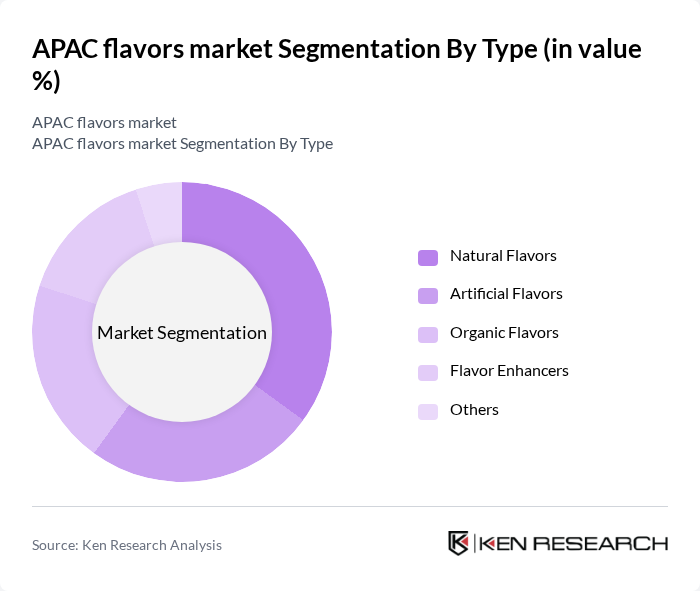

By Type:The market can be segmented into Natural Flavors, Artificial Flavors, Flavor Enhancers, and Others. Among these, Natural Flavors are gaining significant traction due to the increasing health consciousness among consumers and the demand for clean-label products. The shift towards natural ingredients is driven by consumer preferences for healthier options, leading to a growing market share for this sub-segment.

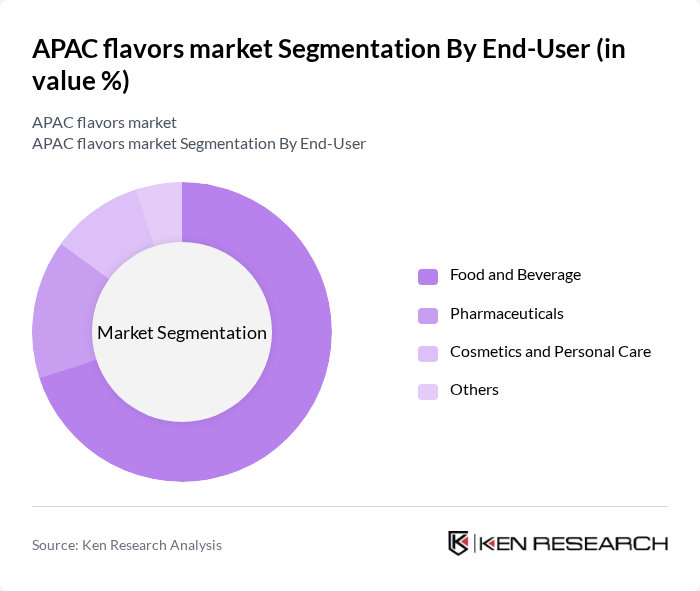

By End-User:The end-user segmentation includes the Food Industry, Beverage Industry, Confectionery, and Others. The Food Industry is the leading segment, driven by the increasing demand for flavored food products and the growing trend of culinary experimentation among consumers. This segment's dominance is attributed to the rising popularity of ready-to-eat meals and the expansion of the food service sector.

The APAC flavors market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan, Firmenich, IFF (International Flavors & Fragrances), Symrise, Takasago International Corporation, Sensient Technologies Corporation, Mane, Robertet, Bell Flavors & Fragrances, T. Hasegawa Co., Ltd., Wild Flavors, D.D. Williamson, Flavorchem Corporation, A.M.A. Flavors, Frutarom contribute to innovation, geographic expansion, and service delivery in this space.

The APAC flavors market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As the demand for clean label products continues to rise, manufacturers are expected to innovate with natural and plant-based flavors. Additionally, the increasing focus on sustainability will likely shape sourcing practices, encouraging companies to adopt environmentally friendly methods. Collaborations with food tech startups will further enhance product offerings, ensuring that the market remains competitive and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Flavors Artificial Flavors Flavor Enhancers Others |

| By End-User | Food Industry Beverage Industry Confectionery Others |

| By Application | Bakery Products Dairy Products Snacks Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Others |

| By Region | North Asia Southeast Asia South Asia Others |

| By Consumer Preference | Health-Conscious Consumers Trend-Driven Consumers Price-Sensitive Consumers Others |

| By Flavor Profile | Sweet Savory Spicy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Flavor Trends | 150 | Product Development Managers, Marketing Directors |

| Dairy Product Innovations | 100 | Flavor Technologists, R&D Managers |

| Baking Industry Insights | 80 | Bakery Owners, Ingredient Sourcing Managers |

| Consumer Preferences in Snacks | 120 | Brand Managers, Consumer Insights Analysts |

| Natural vs. Artificial Flavor Usage | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

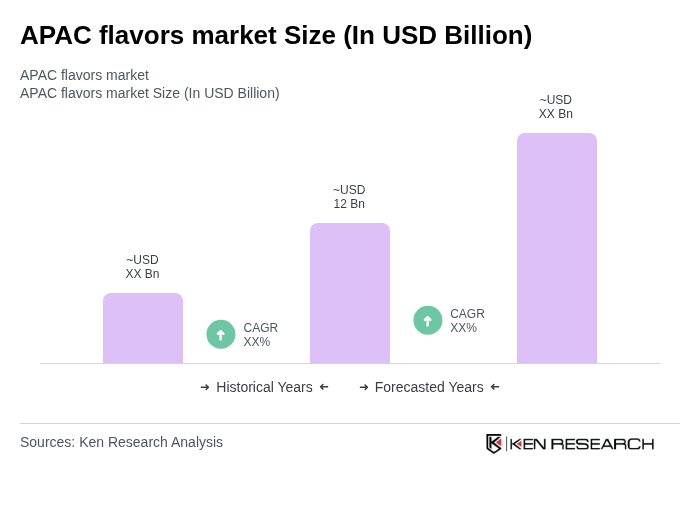

The APAC flavors market is valued at approximately USD 15 billion, driven by increasing consumer demand for innovative food and beverage products, as well as a preference for natural and organic flavors.