Region:Asia

Author(s):Dev

Product Code:KRAC3437

Pages:89

Published On:October 2025

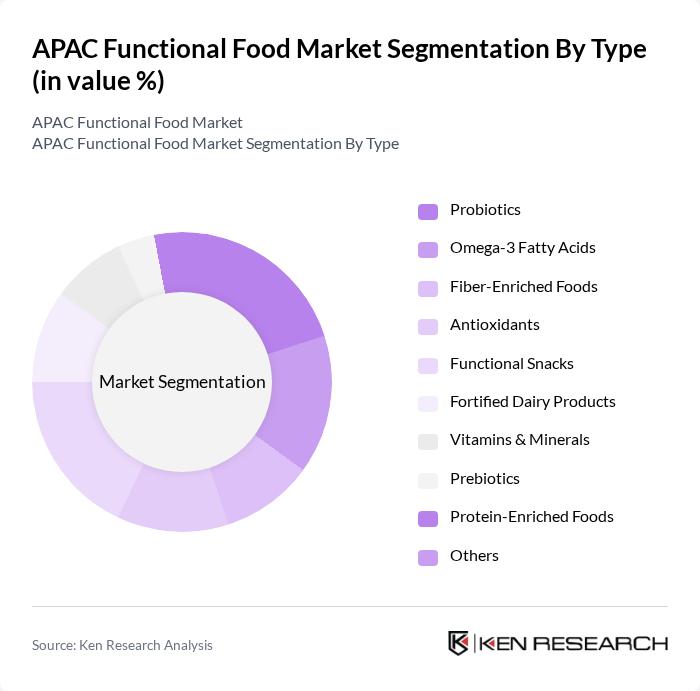

By Type:The functional food market can be segmented into various types, including Probiotics, Omega-3 Fatty Acids, Fiber-Enriched Foods, Antioxidants, Functional Snacks, Fortified Dairy Products, Vitamins & Minerals, Prebiotics, Protein-Enriched Foods, and Others. Each of these sub-segments addresses specific consumer health needs, such as digestive health, cardiovascular wellness, immune support, and energy enhancement, contributing to the overall growth of the market. Probiotics and fortified dairy products are particularly prominent due to their widespread use in APAC diets, while functional snacks and beverages are gaining traction among younger and urban populations .

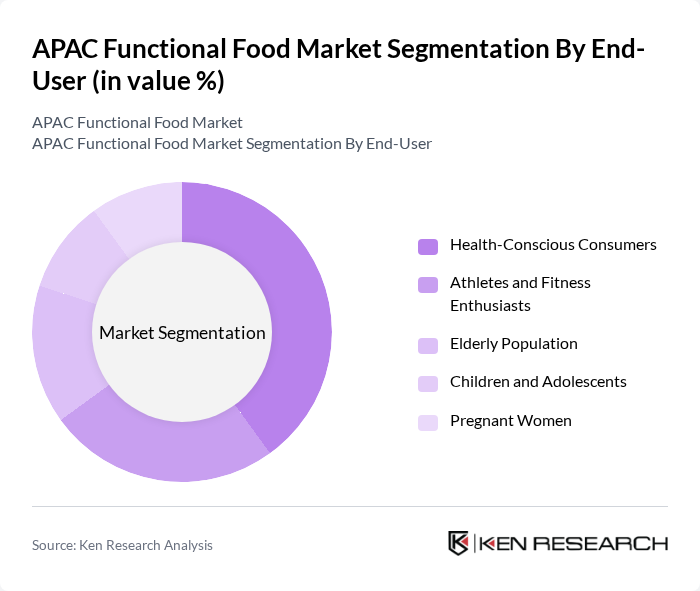

By End-User:The end-user segmentation includes Health-Conscious Consumers, Athletes and Fitness Enthusiasts, Elderly Population, Children and Adolescents, and Pregnant Women. Each group has distinct dietary needs and preferences, influencing their consumption patterns of functional foods. Health-conscious consumers and athletes are primary drivers of demand, while the elderly and children segments are increasingly targeted with products addressing immunity, bone health, and cognitive development .

The APAC Functional Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Herbalife Nutrition Ltd., Amway Corporation, Yakult Honsha Co., Ltd., GNC Holdings, Inc., The Coca-Cola Company, PepsiCo, Inc., Unilever PLC, GlaxoSmithKline PLC, DSM Nutritional Products, Reckitt Benckiser Group PLC, Kellogg Company, Mondelez International, Inc., Arla Foods Ingredients Group P/S, Kerry Group plc, Cargill, Incorporated, Blackmores Limited, and Meiji Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The APAC functional food market is poised for significant evolution, driven by increasing health awareness and technological advancements in product development. As consumers demand more personalized nutrition solutions, brands will likely focus on tailoring products to meet individual health needs. Additionally, the rise of digital marketing strategies will enhance consumer engagement, allowing brands to effectively communicate their value propositions. This dynamic environment presents opportunities for innovation and growth, positioning the market for robust expansion in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Probiotics Omega-3 Fatty Acids Fiber-Enriched Foods Antioxidants Functional Snacks Fortified Dairy Products Vitamins & Minerals Prebiotics Protein-Enriched Foods Others |

| By End-User | Health-Conscious Consumers Athletes and Fitness Enthusiasts Elderly Population Children and Adolescents Pregnant Women |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Pharmacies Convenience Stores |

| By Region | China Japan India Southeast Asia Oceania South Korea Rest of APAC |

| By Product Form | Powdered Supplements Ready-to-Drink Beverages Bars and Snacks Capsules/Tablets |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Functional Beverages | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Market Insights from Food Manufacturers | 60 | Product Development Managers, Marketing Executives |

| Retail Trends in Functional Foods | 50 | Store Managers, Category Buyers |

| Health Benefits Awareness among Consumers | 80 | General Consumers, Nutrition Advocates |

| Distribution Channels for Functional Foods | 40 | Supply Chain Managers, Logistics Coordinators |

The APAC Functional Food Market is valued at approximately USD 134 billion, reflecting significant growth driven by increasing health awareness, rising disposable incomes, and a shift towards preventive healthcare solutions among consumers in the region.