Region:Asia

Author(s):Geetanshi

Product Code:KRAD6024

Pages:85

Published On:December 2025

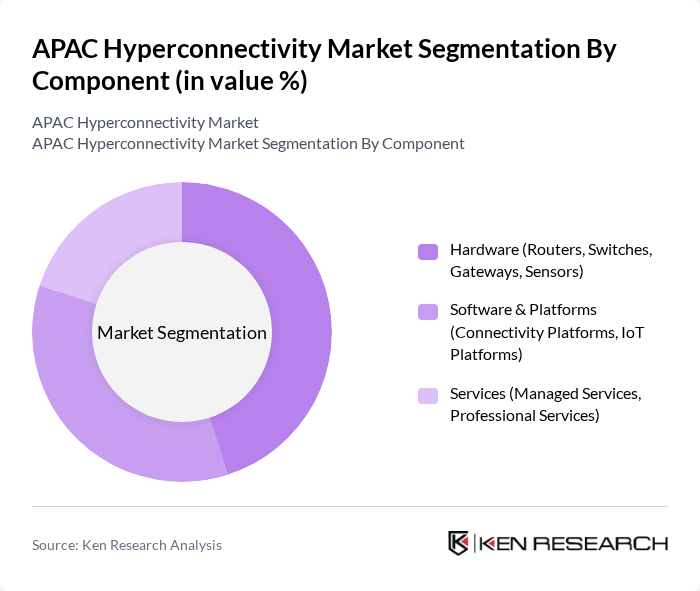

By Component:The components of the APAC Hyperconnectivity Market include Hardware, Software & Platforms, and Services. Among these, Software & Platforms, which encompasses connectivity platforms and IoT platforms, is currently the leading subsegment. The increasing demand for high-speed internet and the expansion of IoT devices drive the growth of software components. Hardware, including routers, switches, gateways, and sensors, is also gaining traction as enterprises seek robust infrastructure for connectivity needs. Services, comprising managed and professional services, are essential for supporting the deployment and maintenance of hyperconnectivity solutions.

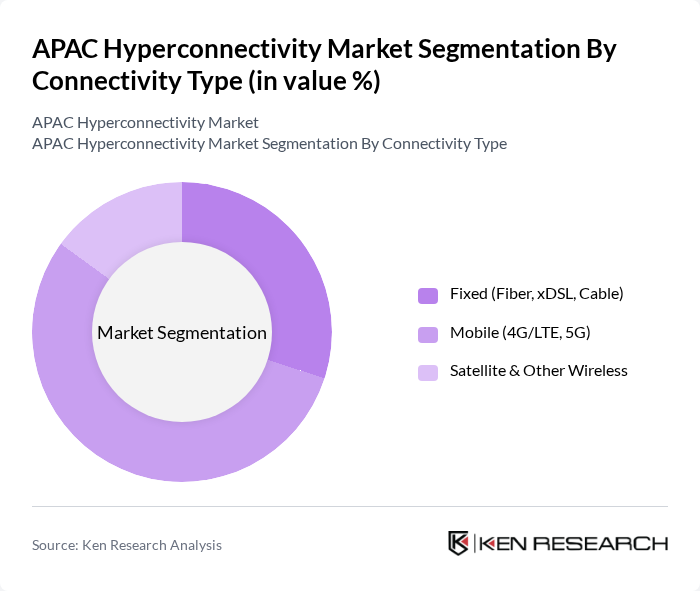

By Connectivity Type:The connectivity types in the APAC Hyperconnectivity Market include Fixed, Mobile, and Satellite & Other Wireless. Mobile connectivity, particularly through 4G/LTE and 5G technologies, is the dominant segment due to the rapid adoption of mobile devices and the increasing demand for high-speed internet access. Fixed connectivity, including fiber, xDSL, and cable, remains significant as it supports stable and high-capacity internet services. Satellite & Other Wireless connectivity is also gaining attention, especially in remote areas where traditional infrastructure is lacking.

The APAC Hyperconnectivity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., Ericsson, Nokia Corporation, Cisco Systems, Inc., Samsung Electronics Co., Ltd., ZTE Corporation, China Mobile Limited, NTT DOCOMO, Inc., SK Telecom Co., Ltd., Reliance Jio Infocomm Limited, Bharti Airtel Limited, SoftBank Corp., Alibaba Cloud (Alibaba Group Holding Limited), Amazon Web Services, Inc., Microsoft Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC hyperconnectivity market is poised for transformative growth, driven by technological advancements and increasing digital engagement. As governments prioritize digital infrastructure, the integration of AI and machine learning will enhance connectivity solutions. Additionally, the shift towards sustainable practices will shape future developments, with a focus on energy-efficient technologies. The collaboration between public and private sectors will be crucial in addressing challenges and leveraging opportunities, ensuring a robust hyperconnected ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Routers, Switches, Gateways, Sensors) Software & Platforms (Connectivity Platforms, IoT Platforms) Services (Managed Services, Professional Services) |

| By Connectivity Type | Fixed (Fiber, xDSL, Cable) Mobile (4G/LTE, 5G) Satellite & Other Wireless |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Application | Connected Infrastructure & Smart Cities Industrial & Enterprise (Industry 4.0, Smart Manufacturing) Connected Healthcare Connected Mobility & Transportation Retail, BFSI & Other Enterprise Applications |

| By Industry Vertical | IT & Telecommunications Manufacturing Healthcare Transportation & Logistics Government & Public Sector Retail & E-commerce Others |

| By Country | China Japan India South Korea Singapore Australia Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Infrastructure Providers | 120 | Network Engineers, Product Managers |

| Smart City Project Managers | 90 | Urban Planners, IT Directors |

| Healthcare Connectivity Solutions | 60 | Healthcare IT Managers, Chief Information Officers |

| Manufacturing IoT Implementations | 85 | Operations Managers, Technology Officers |

| Consumer Electronics Connectivity | 65 | Product Development Managers, Marketing Directors |

The APAC Hyperconnectivity Market is valued at approximately USD 270 billion, driven by the increasing demand for seamless connectivity, the proliferation of IoT devices, and the rapid expansion of 5G networks across the region.