Region:Asia

Author(s):Dev

Product Code:KRAC2734

Pages:88

Published On:October 2025

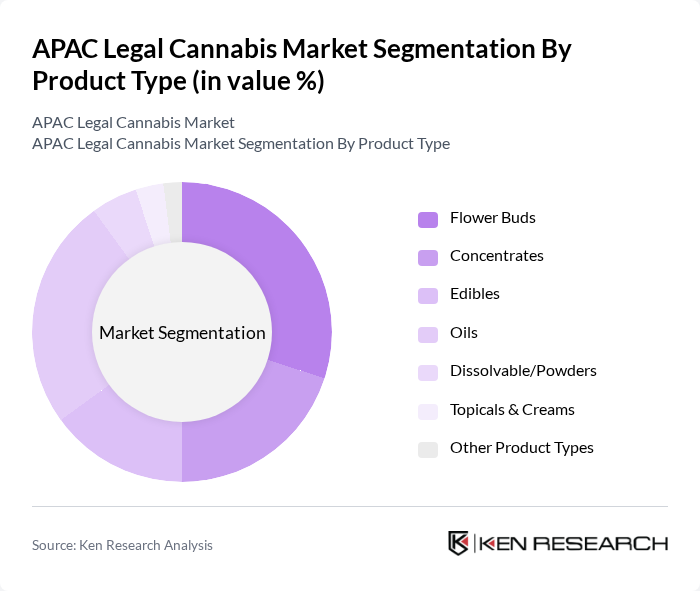

By Product Type:The product type segmentation includes various forms of cannabis products available in the market. The subsegments are Flower Buds, Concentrates, Edibles, Oils, Dissolvable/Powders, Topicals & Creams, and Other Product Types. Among these, Flower Buds and Oils are particularly popular due to their versatility and ease of use, catering to both medical and recreational consumers. The market is also seeing increased demand for edibles and topicals, driven by consumer preference for alternative delivery formats and wellness applications .

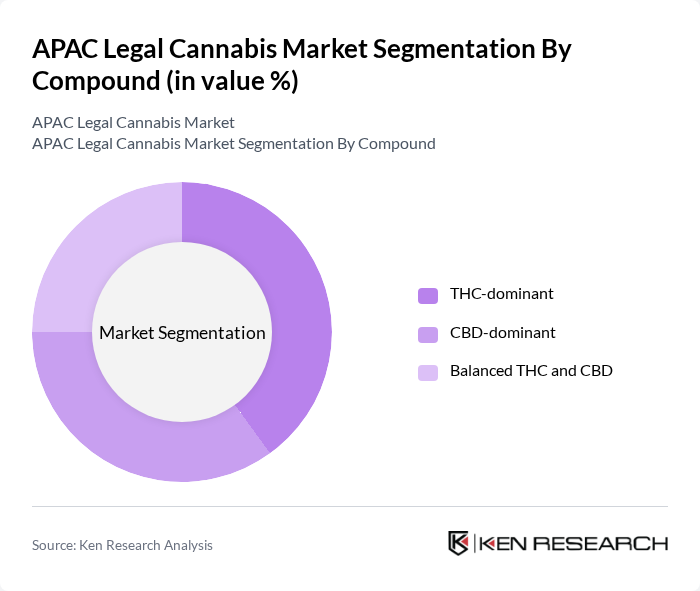

By Compound:The compound segmentation categorizes cannabis products based on their chemical composition. The subsegments include THC-dominant, CBD-dominant, and Balanced THC and CBD products. THC-dominant products are favored for their psychoactive effects, while CBD-dominant products are increasingly sought after for their therapeutic benefits without the high, appealing to a broader audience. Balanced THC and CBD products are gaining traction among consumers seeking both therapeutic and mild psychoactive effects .

The APAC Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Althea Group Holdings Limited (Australia), Cann Group Limited (Australia), Little Green Pharma Ltd (Australia), Medlab Clinical Ltd (Australia), Botanix Pharmaceuticals Ltd (Australia), Neurotech International Ltd (Australia), Avata Biosciences (Australia), Green House Thailand (Thailand), PTT Public Company Limited (Thailand), AeroFarms Asia-Pacific (Singapore), MMJ PhytoTech Limited (Australia), THC Global Group Limited (Australia), MedReleaf Australia, Cannatrek Ltd (Australia), Stemcell United Limited (Singapore) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC legal cannabis market is poised for transformative growth, driven by increasing consumer acceptance and evolving regulatory landscapes. As more countries adopt progressive cannabis policies, the market is expected to expand significantly. Innovations in product development, particularly in cannabis-infused goods, will cater to diverse consumer preferences. Additionally, partnerships with healthcare providers will enhance the credibility and accessibility of cannabis products, fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flower Buds Concentrates Edibles Oils Dissolvable/Powders Topicals & Creams Other Product Types |

| By Compound | THC-dominant CBD-dominant Balanced THC and CBD |

| By Crop Variety | Cannabis Indica Cannabis Sativa Others |

| By Application | Medical Use Recreational Use Industrial Use |

| By Distribution Channel | Physical Retail (Dispensaries, Pharmacies) Digital/Online Retail Direct Sales Others |

| By Region | China Australia Thailand Japan South Korea New Zealand |

| By Route of Administration | Inhalation Oral Topical |

| By Price Range | Budget Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cannabis Retail Market Insights | 150 | Dispensary Owners, Retail Managers |

| Consumer Behavior Analysis | 120 | Cannabis Users, Potential Consumers |

| Regulatory Impact Assessment | 100 | Policy Makers, Legal Experts |

| Cultivation Practices Survey | 80 | Cultivators, Agricultural Scientists |

| Distribution Channel Effectiveness | 100 | Supply Chain Managers, Logistics Coordinators |

The APAC Legal Cannabis Market is valued at approximately USD 17 billion, driven by increasing legalization for medical use in countries like Australia, Thailand, and South Korea, along with rising consumer awareness of cannabis's therapeutic benefits.