Region:Middle East

Author(s):Dev

Product Code:KRAD7629

Pages:83

Published On:December 2025

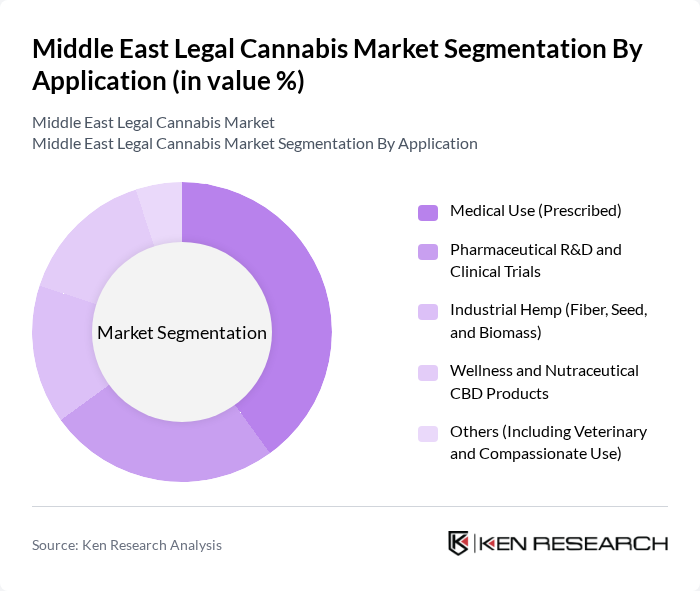

By Application:The application segment of the market includes various uses of cannabis, with medical use (prescribed) being the most significant, reflecting the dominance of regulated medical and pharmaceutical channels across the region. This sub-segment is driven by the increasing recognition of cannabis as a viable treatment option for various medical conditions, including chronic pain, epilepsy, multiple sclerosis, chemotherapy-induced nausea, and certain refractory neurological disorders. Pharmaceutical R&D and clinical trials are also gaining traction as companies and academic centers in Israel and selected Middle East markets invest in developing standardized cannabis-based therapies and drug-delivery formats. Industrial hemp is emerging as a sustainable resource for textiles, construction materials, food ingredients, and biomass feedstocks, particularly in countries that have legalized hemp cultivation for industrial and medical purposes such as Lebanon and parts of North Africa. Wellness and nutraceutical CBD products are becoming popular among health-conscious consumers through pharmacy, e-commerce, and specialty retail, especially where low-THC, hemp-derived CBD is permitted. The "Others" category includes veterinary applications, palliative and compassionate use programs, and institutional research supply, which are also contributing to market growth.

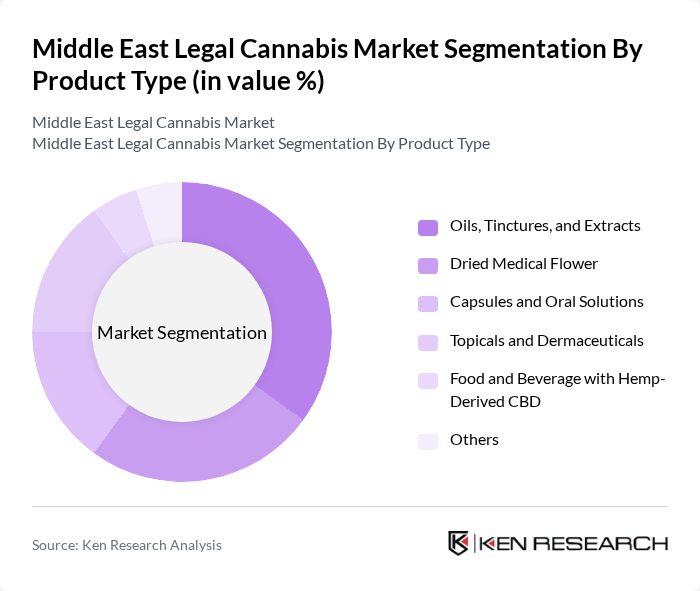

By Product Type:This segment encompasses various cannabis products, with oils, tinctures, and extracts leading the market due to their versatility, dose precision, and use in both medical prescriptions and wellness formulations. Dried medical flowers remain important for established patient programs, particularly in Israel, where inhaled and vaporized flower is widely prescribed under the national medical cannabis scheme. Capsules and oral solutions are gaining traction for their convenience, standardized dosing, and suitability for elderly and chronic-disease patients. Topicals and dermaceuticals are increasingly used for localized pain, inflammatory conditions, and dermatological applications, often formulated with hemp-derived CBD for over-the-counter use. The food and beverage sector is witnessing a rise in hemp-derived CBD products, including functional beverages, snacks, and fortified foods, in markets where such products are permitted and subject to food-safety and product-registration rules. The "Others" category includes various niche products such as transdermal patches, suppositories, and veterinary formulations that cater to specific patient and consumer needs.

The Middle East Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tikun Olam-Cannbit Pharmaceuticals Ltd. (Israel), Panaxia Labs Israel Ltd. (Israel), InterCure Ltd. (Canndoc) (Israel), BOL Pharma (Breath of Life Pharma) (Israel), IM Cannabis Corp. (Middle East Operations), Seach Medical Group (Israel), CANNDOC-Pharma Partnerships in the Gulf (Including UAE and Bahrain Distribution Partners), Pharm Yarok (Israel), Lebanese Regulated Cannabis Producers (Licensed Under Lebanon’s Medical and Industrial Cannabis Framework), Turkish Medical Cannabis and Industrial Hemp License Holders, UAE-Based CBD and Wellness Brands Operating Under Federal Regulations, Saudi Arabia-Regulated Importers of Medical Cannabis-Derived Pharmaceuticals, Qatar and Egypt Hospital-Linked Import and Distribution Consortia, Global Medical Cannabis Companies with Active Supply Agreements into Israel and the Wider Middle East, Regional Contract Research Organizations (CROs) Specializing in Cannabinoid Clinical Trials contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East legal cannabis market appears promising, driven by ongoing legislative reforms and increasing consumer awareness. As more countries consider legalization, the market is expected to expand significantly. Additionally, the integration of technology in cultivation and distribution will enhance efficiency and product quality. The rise of e-commerce platforms will facilitate access to cannabis products, catering to a broader audience and fostering a more informed consumer base, ultimately shaping a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Application | Medical Use (Prescribed) Pharmaceutical R&D and Clinical Trials Industrial Hemp (Fiber, Seed, and Biomass) Wellness and Nutraceutical CBD Products Others (Including Veterinary and Compassionate Use) |

| By Product Type | Oils, Tinctures, and Extracts Dried Medical Flower Capsules and Oral Solutions Topicals and Dermaceuticals Food and Beverage with Hemp-Derived CBD Others |

| By End-Use Sector | Hospitals and Specialty Clinics Licensed Pharmacies Pharmaceutical and Biotech Companies Research and Academic Institutions Wellness and Spa Chains Others |

| By Distribution Channel | Prescription-Based Hospital Pharmacies Retail and Chain Pharmacies Licensed Importers and Distributors Online Pharmacies and Telemedicine Platforms Others |

| By Cannabinoid Profile | CBD-Dominant Products THC-Dominant Products (Where Permitted) Balanced THC:CBD Products Broad-Spectrum and Isolate Formulations Others |

| By Country | Israel Lebanon Turkey United Arab Emirates Saudi Arabia Qatar Egypt Rest of Middle East |

| By Regulatory Framework | Established Medical Cannabis Programs Pilot or Limited-Scope Medical Use Industrial Hemp Only Import-Only Regimes Prohibition with Emerging Reform Discussions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Cannabis Usage | 120 | Healthcare Professionals, Pharmacists |

| Consumer Attitudes Towards Cannabis | 140 | Potential Consumers, Young Adults |

| Cannabis Industry Stakeholders | 80 | Producers, Distributors, Retailers |

| Regulatory Perspectives | 40 | Government Officials, Legal Experts |

| Market Entry Strategies | 60 | Business Development Managers, Investors |

The Middle East Legal Cannabis Market is valued at approximately USD 0.9 billion, driven by increasing acceptance of cannabis for medical use and expanding access to cannabis-based pharmaceuticals across selected jurisdictions in the region.