Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7269

Pages:93

Published On:December 2025

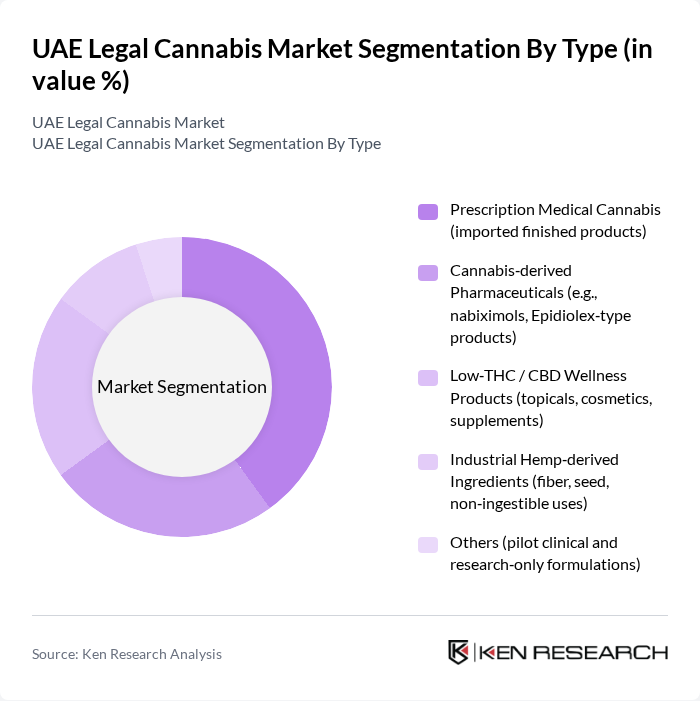

By Type:The market is segmented into various types of cannabis products, including prescription medical cannabis, cannabis-derived pharmaceuticals, low-THC/CBD wellness products, industrial hemp-derived ingredients, and others. Each of these subsegments caters to different consumer needs and preferences, with varying levels of regulatory compliance and market acceptance.

The leading subsegment in the UAE Legal Cannabis Market is Prescription Medical Cannabis, which accounts for a significant portion of the market share. This dominance is attributed to the increasing number of patients seeking alternative treatments for chronic conditions, as well as the growing acceptance of cannabis in the medical community. The regulatory framework supporting the prescription of cannabis products has further fueled this growth, making it a preferred choice among healthcare providers and patients alike.

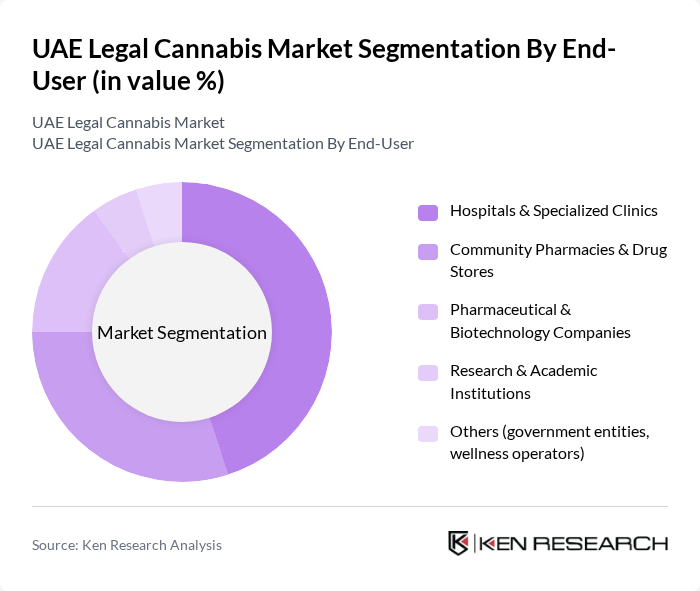

By End-User:The end-user segmentation includes hospitals and specialized clinics, community pharmacies and drug stores, pharmaceutical and biotechnology companies, research and academic institutions, and others. Each of these segments plays a crucial role in the distribution and utilization of cannabis products, reflecting the diverse applications of cannabis in healthcare and wellness.

Hospitals and specialized clinics are the leading end-users in the UAE Legal Cannabis Market, accounting for a substantial market share. This is primarily due to the increasing number of patients being treated for chronic conditions that require cannabis-based therapies. The integration of cannabis into hospital treatment protocols and the growing acceptance among healthcare professionals have significantly contributed to this segment's dominance.

The UAE Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as GW Pharmaceuticals / Jazz Pharmaceuticals plc, Tilray Brands, Inc., Aurora Cannabis Inc., Canopy Growth Corporation, Curaleaf Holdings, Inc., Emirates Healthcare Group, VPS Healthcare (Burjeel Holdings), Dubai Healthcare City Authority, PureHealth Holding PJSC, NewBridge Pharmaceuticals FZ?LLC, Julphar – Gulf Pharmaceutical Industries PSC, Neopharma LLC, Pharmax Pharmaceuticals FZ?LLC, LIFE Pharmacy Group, Aster Pharmacy (Aster DM Healthcare) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE legal cannabis market appears promising, driven by increasing investments in research and development, which reached AED 250 million in the future. As the market matures, the integration of technology in cultivation and distribution is expected to enhance efficiency and product quality. Additionally, the potential for international collaborations and partnerships with healthcare providers will likely expand market reach, paving the way for innovative product offerings and improved consumer acceptance in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medical Cannabis (imported finished products) Cannabis?derived Pharmaceuticals (e.g., nabiximols, Epidiolex?type products) Low?THC / CBD Wellness Products (topicals, cosmetics, supplements) Industrial Hemp?derived Ingredients (fiber, seed, non?ingestible uses) Others (pilot clinical and research?only formulations) |

| By End-User | Hospitals & Specialized Clinics Community Pharmacies & Drug Stores Pharmaceutical & Biotechnology Companies Research & Academic Institutions Others (government entities, wellness operators) |

| By Distribution Channel | Hospital Pharmacies Retail & Chain Pharmacies Cross?border / Named?patient Import Programs Direct Supply to Healthcare Institutions Others (special authorization channels) |

| By Product Form | Oral Solutions and Tinctures Capsules and Softgels Topical Creams and Ointments Oromucosal Sprays Others (inhalation and novel delivery formats, where permitted) |

| By Consumer Demographics | Patients by Indication (chronic pain, epilepsy, oncology?related, others) National vs Expat Patient Mix Insurance Coverage Status (covered vs self?pay) Severity & Stage of Disease Others |

| By Geographic Distribution | Dubai Abu Dhabi Sharjah & Northern Emirates Free Zones & Healthcare Cities |

| By Regulatory Compliance Level | MOHAP?Approved Prescription Products Free?zone / Special?permit Products Non?compliant / Illicit Products Others (under clinical trial or early?access schemes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Cannabis Usage | 100 | Healthcare Professionals, Pharmacists |

| Recreational Cannabis Interest | 140 | Potential Consumers, Young Adults |

| Regulatory Insights | 50 | Legal Experts, Policy Makers |

| Market Entry Strategies | 80 | Business Owners, Entrepreneurs in Cannabis Sector |

| Consumer Attitudes towards Cannabis | 120 | General Public, Focus Group Participants |

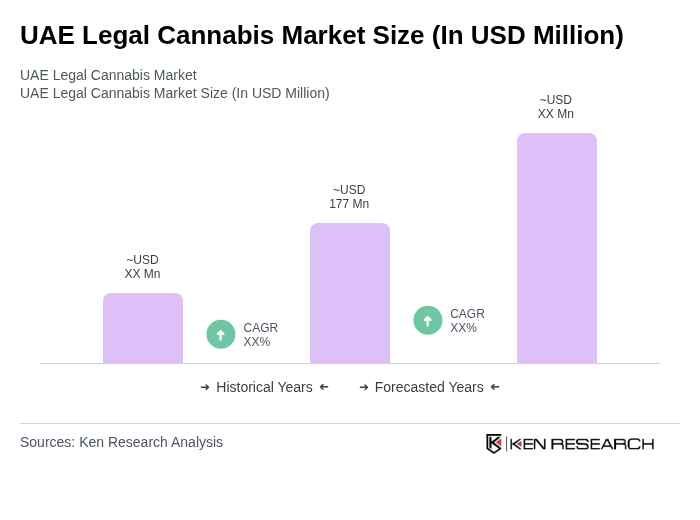

The UAE Legal Cannabis Market is valued at approximately USD 177 million, driven by increasing acceptance of cannabis for medical purposes and a rise in chronic health conditions requiring alternative treatments.