Kuwait Legal Cannabis Market Overview

- The Kuwait Legal Cannabis Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of the therapeutic benefits of cannabis, coupled with a gradual shift in public perception towards its legalization for medical use. The rising demand for cannabis-based products, particularly in the healthcare sector, has significantly contributed to the market's expansion. Recent trends indicate a growing interest in alternative therapies and wellness solutions, further accelerating market growth as consumers and healthcare providers seek natural and effective treatment options .

- Kuwait City is the dominant hub in the market, primarily due to its status as the capital and largest city, which facilitates access to healthcare facilities and retail outlets. Additionally, the presence of a growing number of wellness centers and pharmacies in urban areas has further solidified its position as a key player in the legal cannabis landscape. The concentration of medical infrastructure and regulatory oversight in Kuwait City has made it the focal point for both distribution and consumption of legal cannabis products .

- In 2023, the Kuwaiti government implemented a regulatory framework allowing the use of cannabis for medical purposes, which includes strict guidelines for cultivation, distribution, and sale. This regulation, known as the Medical Cannabis Regulation, 2023, issued by the Ministry of Health, sets clear standards for licensing, product quality, and patient eligibility. The framework aims to ensure product safety and efficacy while promoting responsible use among patients, thereby fostering a controlled environment for the burgeoning cannabis market .

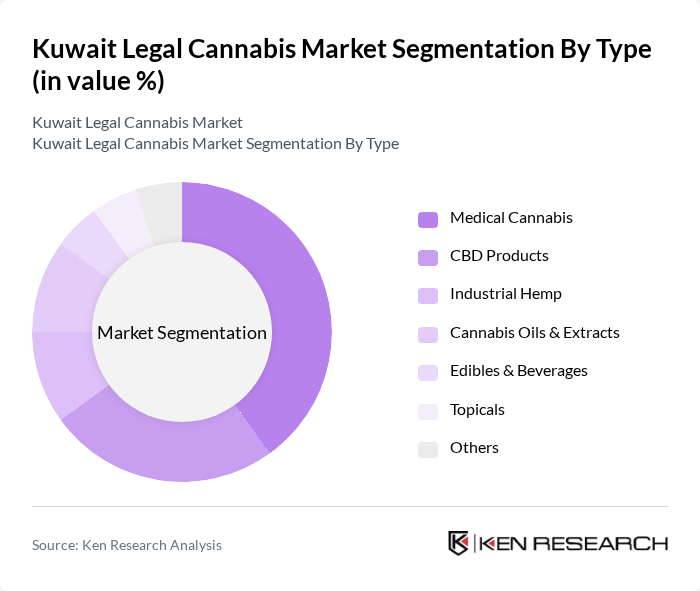

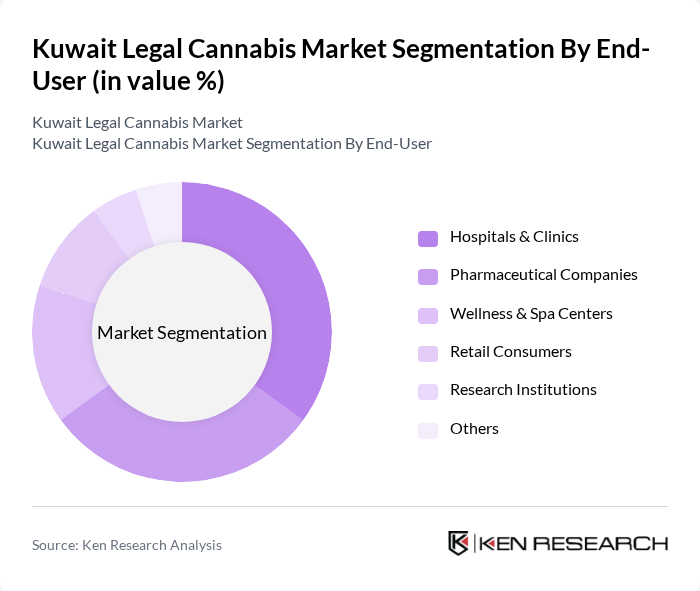

Kuwait Legal Cannabis Market Segmentation

By Type:The market is segmented into various types, including Medical Cannabis, CBD Products, Industrial Hemp, Cannabis Oils & Extracts, Edibles & Beverages, Topicals, and Others. Among these, Medical Cannabis is currently the leading segment due to its increasing acceptance in the healthcare sector for treating various ailments. The demand for CBD Products is also on the rise, driven by consumer interest in natural wellness solutions. The other segments, while growing, are still in the early stages of market penetration.

By End-User:The end-user segmentation includes Hospitals & Clinics, Pharmaceutical Companies, Wellness & Spa Centers, Retail Consumers, Research Institutions, and Others. Hospitals & Clinics are the primary consumers of medical cannabis, as they integrate these products into treatment plans for patients. Pharmaceutical Companies are also significant players, focusing on developing cannabis-based medications. The growing trend of wellness and spa centers incorporating CBD products into their offerings is further expanding the market.

Kuwait Legal Cannabis Market Competitive Landscape

The Kuwait Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tilray Brands, Inc., Aurora Cannabis Inc., Canopy Growth Corporation, Cronos Group Inc., HEXO Corp., Aphria Inc., GW Pharmaceuticals plc, Al-Fahad Group, Kuwait Pharma, MedCan Gulf, Pure Health Kuwait, Green Leaf International, CBD Life Sciences Kuwait, Gulf Cannabis Solutions, Future Cannabis Innovations contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Legal Cannabis Market Industry Analysis

Growth Drivers

- Increasing Acceptance of Medical Cannabis:The acceptance of medical cannabis in Kuwait is gaining momentum, driven by a growing body of evidence supporting its therapeutic benefits. In future, the Ministry of Health reported that over 1,500 patients were prescribed cannabis-based treatments, reflecting a 30% increase from the previous year. This shift is supported by a broader regional trend, with neighboring countries like Saudi Arabia also exploring medical cannabis, indicating a potential market expansion in the Gulf Cooperation Council (GCC) region.

- Potential for Economic Diversification:Kuwait's economy is heavily reliant on oil, contributing approximately 90% to its GDP. However, the government aims to diversify its economy, with the cannabis sector identified as a key growth area. The National Development Plan allocates $200 million for the development of alternative industries, including cannabis cultivation and processing, which could create thousands of jobs and stimulate local economies, thereby reducing dependency on oil revenues.

- Rising Demand for Alternative Therapies:The demand for alternative therapies in Kuwait is on the rise, particularly among the aging population. In future, the World Health Organization reported that approximately 4 to 5% of Kuwait's population is over 60, leading to increased interest in non-traditional treatments. This demographic shift is driving the market for cannabis-based products, as patients seek effective pain management and treatment options for chronic conditions, further legitimizing the cannabis industry in the region.

Market Challenges

- Regulatory Uncertainty:The regulatory landscape for cannabis in Kuwait remains ambiguous, posing significant challenges for potential investors. As of future, there are no clear guidelines for cannabis cultivation or distribution, leading to hesitance among businesses. The lack of a structured legal framework has resulted in only 5 licensed producers operating in the country, limiting market growth and creating barriers for new entrants seeking to capitalize on emerging opportunities.

- Cultural Stigmas:Cultural attitudes towards cannabis in Kuwait are predominantly conservative, with significant stigmas attached to its use. In future, a survey indicated that approximately 70% of the population still views cannabis negatively, which hampers public acceptance and market penetration. This cultural barrier complicates efforts to promote cannabis as a legitimate medical option, making it essential for stakeholders to engage in educational campaigns to shift perceptions and foster acceptance.

Kuwait Legal Cannabis Market Future Outlook

The future of the legal cannabis market in Kuwait appears promising, driven by increasing acceptance of medical cannabis and a push for economic diversification. As regulatory frameworks evolve, the market is likely to see enhanced investment opportunities and the emergence of innovative cannabis-based products. Additionally, collaboration with international firms could facilitate knowledge transfer and technology adoption, further strengthening the local industry. However, addressing cultural stigmas will be crucial for sustainable growth and market expansion in the coming years.

Market Opportunities

- Export Potential to Neighboring Countries:Kuwait's strategic location offers significant export potential for cannabis products to neighboring countries, particularly those with emerging markets. In future, the GCC region is projected to see a 40% increase in demand for medical cannabis, providing a lucrative opportunity for Kuwaiti producers to establish themselves as regional suppliers, thereby enhancing economic growth and international trade relations.

- Development of Cannabis-Based Products:The development of cannabis-based products presents a substantial market opportunity in Kuwait. With a growing interest in wellness and alternative therapies, the market for CBD-infused products is expected to expand. In future, the global CBD market is valued at $4.6 billion, indicating a trend that Kuwaiti businesses can leverage to create innovative health and wellness products tailored to local consumer preferences.