Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8294

Pages:88

Published On:November 2025

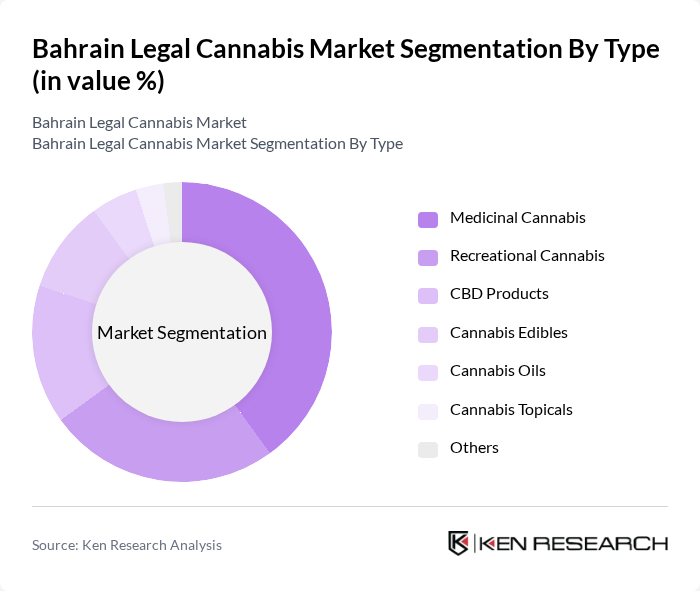

By Type:The market is segmented into various types, including Medicinal Cannabis, Recreational Cannabis, CBD Products, Cannabis Edibles, Cannabis Oils, Cannabis Topicals, and Others. Among these, Medicinal Cannabis is the leading segment, driven by increasing acceptance of cannabis for therapeutic use. The demand for CBD products is also rising, particularly among health-conscious consumers seeking natural remedies. Cannabis edibles and oils are gaining traction due to their ease of use and discreet consumption, while topicals are increasingly used for localized pain relief and skincare applications .

By End-User:The end-user segmentation includes Healthcare Providers, Retail Consumers, Research Institutions, Pharmaceutical Companies, and Others. Healthcare Providers dominate the market, as they are the primary users of medicinal cannabis for treating various health conditions. Retail Consumers are also significant, driven by the growing trend of self-medication and wellness. Research Institutions are increasingly involved in clinical trials and product development, while Pharmaceutical Companies are expanding their portfolios to include cannabis-based formulations .

The Bahrain Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as BMMI, Al Haramain, Gulf Medical Projects Company, Bahrain Cannabis Company, MedCann, Green Leaf Medical, Bahrain Medical Cannabis, Al Jazeera Pharmaceutical, Bahrain Drug Company, Gulf Pharmaceuticals, PharmaCann, Cannabiz, Herbalife, CannTrust, and Tilray contribute to innovation, geographic expansion, and service delivery in this space.

The future of the legal cannabis market in Bahrain appears promising, driven by increasing acceptance and government support for economic diversification. As regulations evolve, the market is likely to see a rise in investment and innovation, particularly in cannabis-based pharmaceuticals and wellness products. Additionally, the potential for cannabis tourism could attract international visitors, further stimulating economic growth. However, addressing regulatory uncertainties and societal stigma will be essential for realizing this potential and ensuring sustainable market development.

| Segment | Sub-Segments |

|---|---|

| By Type | Medicinal Cannabis Recreational Cannabis CBD Products Cannabis Edibles Cannabis Oils Cannabis Topicals Others |

| By End-User | Healthcare Providers Retail Consumers Research Institutions Pharmaceutical Companies Others |

| By Distribution Channel | Online Retail Physical Dispensaries Pharmacies Wholesale Distributors Others |

| By Product Form | Dried Flower Concentrates Tinctures Capsules Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences Others |

| By Regulatory Compliance | Licensed Producers Unlicensed Producers Importers Exporters Others |

| By Market Maturity | Emerging Market Growth Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Legal Experts on Cannabis Regulation | 45 | Lawyers, Policy Advisors, Regulatory Officials |

| Healthcare Professionals' Perspectives | 60 | Doctors, Pharmacists, Medical Researchers |

| Consumer Awareness and Attitudes | 100 | Potential Consumers, Patients, General Public |

| Industry Stakeholders and Investors | 40 | Investors, Business Owners, Industry Analysts |

| Retail and Distribution Insights | 55 | Retail Managers, Distributors, Supply Chain Experts |

The Bahrain Legal Cannabis Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing acceptance of cannabis for medicinal purposes and rising consumer awareness of its therapeutic benefits.