Region:Asia

Author(s):Geetanshi

Product Code:KRAD7233

Pages:87

Published On:December 2025

By Type:The market is segmented into various types of polyethylene films, including low-density polyethylene (LDPE), high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), and metallocene linear low-density polyethylene (mLLDPE). Each type has unique properties that cater to different applications in construction, with polyethylene generally accounting for the largest share of vapor barrier film materials due to its balance of cost, flexibility, and moisture barrier performance.

The low-density polyethylene (LDPE) segment is currently prominent in under-slab applications due to its excellent flexibility, conformability, and moisture barrier properties, which make it suitable for large surface coverage and ease of installation on construction sites. LDPE and LLDPE films are widely used in residential and commercial construction projects, where moisture control is critical to prevent slab moisture transmission, mold growth, and flooring failures. The increasing trend towards sustainable building practices and life-cycle performance has also led to a rise in demand for polyethylene films, as they can be produced with recycled content, are compatible with multilayer high-performance barrier structures, and offer a favorable cost-to-performance ratio. The versatility of LDPE and its blends with LLDPE or mLLDPE in producing puncture-resistant, high-strength vapor barriers further supports their leading position in under-slab moisture protection systems in APAC.

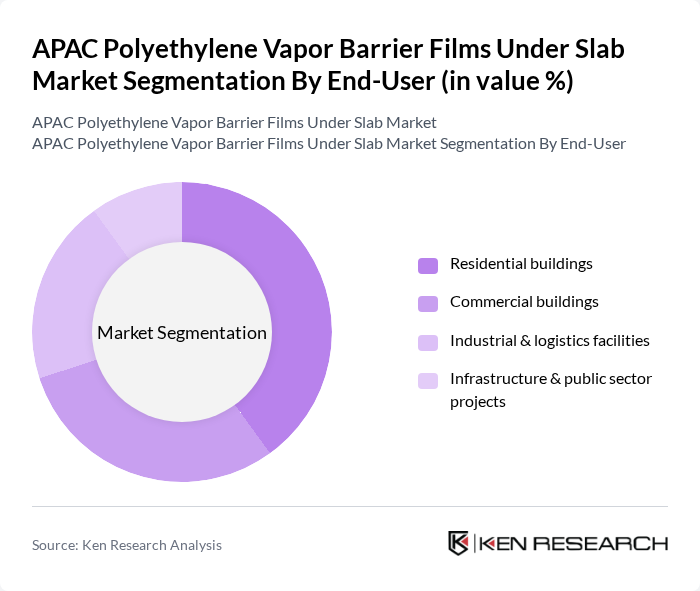

By End-User:The market is segmented based on end-users, including residential buildings, commercial buildings, industrial & logistics facilities, and infrastructure & public sector projects. Each segment has distinct requirements and applications for vapor barrier films, ranging from slab-on-grade residential floors to large industrial warehouses, cold storage, and transport infrastructure.

The residential buildings segment is a major end-user of polyethylene vapor barrier films, accounting for a significant portion of demand as new housing construction and multi-family developments expand across Asia Pacific. This prominence is attributed to the increasing construction of residential properties driven by urbanization, rising disposable incomes, and government-backed affordable housing programs in countries such as China, India, Indonesia, and Vietnam. Homeowners, developers, and builders are increasingly recognizing the importance of moisture control and vapor management in maintaining structural integrity, preventing floor failures and indoor air quality issues, and improving energy efficiency, leading to higher adoption of vapor barrier films in new residential constructions and major renovations. At the same time, commercial and industrial & logistics facilities are emerging as fast-growing end-user segments, supported by the expansion of e?commerce warehousing, data centers, and cold-chain infrastructure, all of which require robust under-slab moisture protection systems.

The APAC Polyethylene Vapor Barrier Films Under Slab Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stego Industries, LLC, Polyguard Products, Inc., Raven Industries, Inc. (Raven Engineered Films), GSE Environmental, Inc., Berry Global, Inc., Plasteco de México, S.A. de C.V. (Glostrup / Visqueen-equivalent supply into APAC), Tex-Trude LP, Gundle/SLT Environmental, Inc. (GSE), Insulrap™ (Insulrap Systems / regional licensees), NeoSeal Construction Products, Jindal Poly Films Ltd., Toray Industries, Inc., Mitsubishi Chemical Group Corporation, SKC Co., Ltd., LG Chem Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC polyethylene vapor barrier films market appears promising, driven by ongoing construction growth and a shift towards sustainable building practices. Innovations in film technology, such as enhanced durability and eco-friendly materials, are expected to gain traction. Additionally, the increasing integration of smart building technologies will likely create new applications for vapor barrier films, aligning with the region's commitment to energy efficiency and sustainability in construction.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-density polyethylene (LDPE) High-density polyethylene (HDPE) Linear low-density polyethylene (LLDPE) Metallocene linear low-density polyethylene (mLLDPE) |

| By End-User | Residential buildings Commercial buildings Industrial & logistics facilities Infrastructure & public sector projects |

| By Region | China India Japan South Korea ASEAN (Indonesia, Vietnam, Thailand, Malaysia, others) Rest of APAC (Australia, New Zealand, others) |

| By Application | Under-slab vapor barrier for new construction Under-slab vapor barrier for renovation & retrofit Under-slab vapor barrier in infrastructure & civil works Multi-layer systems with insulation or radon barriers |

| By Thickness | Below 10 mil –15 mil –20 mil Above 20 mil |

| By Performance Characteristics | Water vapor transmission rate (WVTR) performance Puncture and tear resistance Chemical and alkali resistance Environmental & sustainability attributes (recycled content, low VOC) |

| By Distribution Channel | Direct sales to contractors and developers Building material distributors & dealers Home improvement & retail chains Online and project-based procurement platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Contractors, Project Managers |

| Commercial Building Developments | 80 | Architects, Building Inspectors |

| Industrial Applications of Vapor Barriers | 70 | Facility Managers, Safety Officers |

| Polyethylene Film Manufacturing | 60 | Production Managers, Quality Control Specialists |

| Environmental Compliance in Construction | 90 | Regulatory Affairs Managers, Sustainability Consultants |

The APAC Polyethylene Vapor Barrier Films Under Slab Market is valued at approximately USD 4.8 billion, driven by increasing demand for moisture control in construction across rapidly urbanizing economies like China, India, and Southeast Asian countries.